All published articles of this journal are available on ScienceDirect.

Research on Public-Private Partnership (PPP) Investment under Build - Operate - Transfer (BOT) and Build-Lease-Transfer (BLT) Contract Types in the High-Speed North-South Rail Project (HSR), the Hanoi - Vinh Line

Abstract

Introduction

The North-South high-speed rail development is a completely new field in Vietnam. Calculations show that Vietnam's high-speed rail system will attract a significant amount of investment, which is 4-5 times higher than developing highways, and the annual operation and maintenance costs are three times higher.

Methods

Public-Private Partnership (PPP) investment is effective and required to ease the strain on the state budget. This research aims to build a database for calculating the financial efficiency of the high-speed rail project (Hanoi -Vinh line), thereby establishing a mechanism for sharing benefits and risks between the state and investors through financial scenarios: applying Build - Operate - Transfer (BOT) contracts with state participation rates of 50% and 80%, respectively.

Results

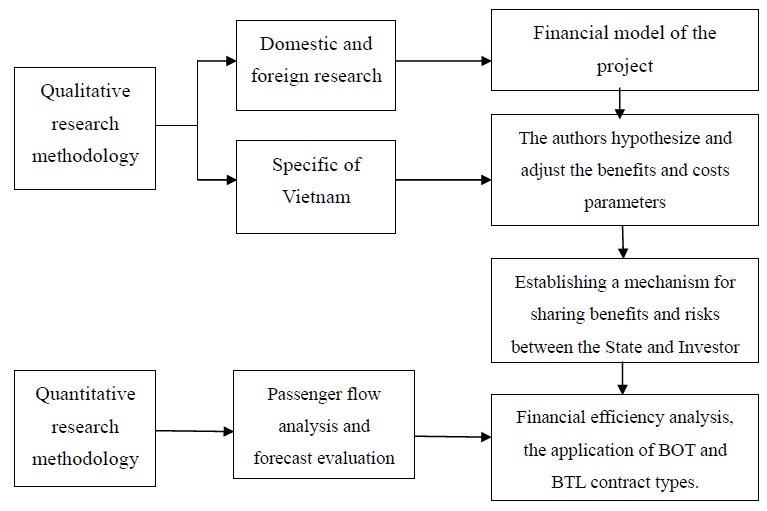

The qualitative research method is used to determine the indicators influencing the project's benefits and costs, assume and adjust economic, financial, and fare parameters based on Vietnam's actual conditions, and investigate and survey the affected areas to assess passenger transport demand.

Conclusion

Furthermore, the financial efficiency of the project is calculated, and various participation options for the parties involved are proposed to attract investors.

1. INTRODUCTION

For Vietnam, the official concept of “high-speed rail” is introduced in the Law on Rail Transport No. 06/2017/QH14. According to this law, high-speed rail is a type of national rail with a design speed of 200 km/h or higher, using a standard gauge of 1,435 mm, double track, and electrification [1]. According to the Planning of the Vietnam rail network for the period of 2021-2030 with a vision to 2050, the high-speed North-South Rail (HSR) is identified as one of the three strategic breakthroughs that require prioritized investment, referred to as the “backbone” linking the commercial activities of urban chains and economic zones across the country. It is also expected to reduce Vietnam's logistics costs from 20% to 6% of GDP by 2035 [2, 3]. In addition to railway transport, the demand for passenger and freight transportation is allocated among four modes: road, air, maritime, and waterway. To effectively exploit the transportation system, it is necessary to leverage and combine the strengths of each mode. Rail transport, along with air, road, maritime, and waterway transport, plays a crucial role in the development of every country, particularly in passenger transportation. However, currently, the railway sector in Vietnam is lagging behind [4-7].

The government of Vietnam aims to start constructing the Hanoi - Vinh and Nha Trang - Ho Chi Minh City routes in 2025. The Ministry of Planning and Investment and the Ministry of Transport have agreed on a plan to study the North-South high-speed rail with a design speed of 350 km/h and an operation speed of 180-225 km/h. However, one of the current critical issues is the financial resources to implement the project. Using all public investment capital is impossible since Vietnam's GDP in recent years has averaged 401 billion USD, and the public debt is 43.1% of the GDP [3]. Therefore, the Ministry of Transport has proposed investing in public-private partnerships (PPPs). This proposal is completely consistent with the Government's orientation in the transportation development strategy, which is to diversify investment sources, while state capital plays a dominant and decisive role, and external resources are crucial for breakthroughs [4]. However, there are currently no specific guidelines for implementing this form for the HSR project. At the same time, the implementation of PPP in Vietnam still has many shortcomings, not yet engaging the private sector.

Presenting investment possibilities that make the project effective and alluring to the parties concerned is one of the crucial duties to attract domestic and international private investors to get involved. This includes determining the proportion of state capital and private capital, as well as identifying which components the two indicated segments will cover. It is also necessary to define the sectors in which private entities can participate, and the incentives they will receive. Additionally, selecting the most effective project contract type is also crucial. According to the provisions of the Law on PPP Investment No. 64/2020/QH14, PPP contracts include BOT contracts (Build - Operate - Transfer), BTO contracts (Build - Transfer - Operate), BOO contracts (Build - Own - Operate), O&M contracts (Operate – Manage), BTL contracts (Build - Transfer - Lease), BLT contracts (Build - Lease - Transfer), and mixed contracts [4]. As of May 2021, Vietnam had mobilized 222 PPP projects for the transportation industry with an amount of 689.026 billion VND, among which the BOT contract form accounted for the majority - 95.5%, the BOO form accounted for 3.5%, and the BTL accounted for 1% [5, 6].

The paper aims to build a financial efficiency database for Hanoi – Vinh high-speed rail project, establishing a mechanism for sharing benefits and risks between the state and investor and working out financial measures, including the application of BOT and BTL contract types, hence proposing recommendations to attract private investors to participate in the project. The subsequent contents comprise an overview of related studies (domestic and foreign research), Research methodology, analysis of benefits and costs, financial efficiency analysis (State support at 50% of total investment under BOT contract, state support at 80% of total investment under BOT contract, state support at 50% of total investment under BTL contract, and conclusion.

2. LITERATURE REVIEWS

Numerous domestic and international studies have been conducted on PPP for transport infrastructure development, with different objectives and levels of implementation in both theoretical and practical aspects. These studies have identified factors influencing the success of PPP, including having a comprehensive and transparent legal framework, selecting capable partners, maximizing benefits for all parties involved, maintaining macroeconomic stability, implementing effective incentive policies, and distributing risks efficiently. However, the impact of these factors varies depending on the economic, political, and social characteristics of each country.

2.1. Studies in Vietnam

Studies on factors affecting the attraction of private investment in the form of PPP in transportation infrastructure have been conductedby many scientists. The doctoral dissertation [7] pointed out the elements that have a strong impact on the effectiveness of the public-private partnership pattern of transportation in Vietnam. Those are the commitment of the public sector, the investment environment, and the project characteristics. The articles [8, 9] point out three factors within the project that have a strong influence on engaging investors, including project location, profitability, and the quality of design documents. Besides, in understanding the reasons why the private sector has not fully engaged in PPP projects, all studies declare that Vietnam's institutional capacity is lagging behind, with the legal framework not being completed (project contracts are included). Other flaws pointed out are the restrictions in the project information, investors’ difficulties in mobilizing capital, inadequacies in the benefits of the project operation, slow payback, and investor selection not being transparent [10-12]. At the same time, the survey results of the doctoral thesis [10] show that the reasons for private individuals not wanting to participate in road PPP projects in Vietnam are low profits (making up 49.33%), inadequate legal framework (making up 30.61%), difficulties in finding partners (accounting for 6.67%), unreasonable risk sharing (making up 6.66%)... In general, studies suggest that political, legal, and economic obstacles are considered acute factors affecting PPP projects in the transportation sector [13].

Regarding the PPP contract types, according to a previous article [14], nowadays, the government has only thoroughly regulated the BOT contracts. The lack of PPP project contract patterns is the reason state agencies are hesitant when it comes to PPP projects. Report [15] shows that the cadres involved in negotiating, signing, and implementing PPP contracts are still confused in drafting contracts. The report has reviewed and evaluated BOT, BTL, and O&M contract patterns applied in the transpor- tation infrastructure sector, thereby recommending the addition of the details of the provisions of the contract pattern. In addition, the project [16] identifies the risks of investment in the form of BOT contracts in Vietnam, proposing several solutions to cope with the risks while minimizing losses in case of unwanted incidents.

The first step of the studies on high-speed rail and investment attraction for HSR in PPP form development includes (1) Research on global experience in investing in HSR system, analyzing, and selecting the appropriate exploitation types considering Vietnam's practical conditions, and drawing lessons on construction, invest- ment attraction, technology transfer, costs, and environmental impacts [17, 18]. (2) A previous research [3, 18] emphasizes the necessity of investing in HSR systems and the need for diverged investment. (3) Attracting investment through PPP, analyzing the benefits and costs for HSR projects in Vietnam from the perspective of investors and project enterprises, specifically focusing on Deo Ca Group in a master's thesis [2, 4].

There have been quite a few studies on PPP in Vietnam from various perspectives. However, there has been no research specifically focusing on PPP, especially in the forms of BOT (Build-Operate-Transfer) and BTL (Build-Transfer-Lease), for high-speed railway projects.

2.2. Aboard Studies on PPP in High-speed Rail Development

Observations from countries with developed rail infrastructure around the world indicate that public investment plays a predominant role, with a smaller proportion contributed by the private sector. For example, in Japan, Taiwan, and the UK, state capital accounts for over 80% of infrastructure costs, while the private sector contributes around 20% of operational equipment and means. Investor capital comes from owner's equity, commercial bank loans, corporate bond issuance, or other legitimate sources of capital mobilization [19, 20]. A previous study [5] examines two contract types: (i) The DBMF (Design – Build – Maintain - Finance) contract for the Southern high-speed rail line connecting the Netherlands and Belgium, analyzing two separate concession methods for investors: the 25-year concession for the operation of the superstructure (the upper part of the track) to the investors period, and the concession for transportation operation and commercial services on the train lines. (ii) The BOOT (Build-Own-Operate-Transfer) contract for the HS1 project in the UK, constructed by the London and Continental Railways Group. After completion, the investor is granted a 30-year concession for operation and maintenance, while the ownership of the infrastructure and land remains with the government. During the exploitation phase, the State has a policy to finance fares.

Some authors study the participation rate of the state in the PPP form in European countries, e.g., the Netherlands, Belgium, the UK, France, and Spain, and all indicate that the public sector accounts for over 50%. There are three types of PPP mechanisms for HSR projects in Europe, with varying degrees of private sector involvement. (i) Broad-based PPP: In Russia, the private sector participates in all categories. The exploitation and operation are concessions to the investor for 30 years, with payments made by the Government. The Government bears the revenue risk during exploitation. (ii) PPP for infrastructure only: The private sector participates in certain components, e.g., construction, electromechanical equipment, site clearance, and maintenance; typically the Olmedo - Ourense and Madrid - Badajoz lines in Spain. (iii) PPP for superstructure: electromechanical equipment, construction site, maintenance and operation [21, 22].

China has the largest HSR network in the world. A previous study [23] analyzed the development pattern of the high-speed rail from its development process, operation mechanism, and influences on sustainability. CHSR’s disruptive innovation pattern is an innovation that has three implementation subjects that including the government, enterprises, and research institutions. It relies on the interaction of three dominant factors, including a policy guide, capital support, and a guarantee of human resources.

In Taiwan, the entire construction and equipment were invested under a BOT contract. The investment process faced risks, and the Taiwanese Government had to rescue the investor multiple times through policies, e.g., reducing loan interest rates and increasing shareholding from the initial 20% to around 64%, as well as extending the operation and maintenance contract from 35 years to 70 years [2]. The comprehensive study indicates that alongside the selection of contract forms, the regulatory role of the State is also crucial in determining the success of the project.

3. METHODS

3.1. Research Methodology

High-speed rail with an operational speed of above 200km/h is a brand-new field, and no similar projects have been approved, started, or constructed in Vietnam up till now. Consequently, the authors adopt a qualitative research methodology to collect data for thestudy, mostly from overseas studies and scientific publications in respected international journals from the UK, France, USA, and Spain, and the scientific research results on high-speed rail from TU-Dresden University, along with Bahntechnik Research Institute (Germany), and Tongji University, Beijing Institute of Technology (China). Simultaneously, the authors also refer to the report requesting investment policies for the North-South high-speed rail project of the Ministry of Transport to determine the speed, costs, and benefits of the HSR project in Vietnam. This forms the foundation for developing a method to calculate the metrics affecting the project’s financial effectiveness.

Research steps.

Based on the metrics affecting the project's benefits and costs, the article relies on the specific realities of Vietnam to hypothesize and adjust the economic, financial, and fare parameters, forming the basis for calculating the project’s financial effectiveness. Following that, the mechanisms for sharing benefits and risks between the State and investors are established through financial scenarios: applying the BOT contract with the State's participation rates of 50% and 80% and the BTL contract with the State's participation rate of 50% for Hanoi - Vinh line, which is approved for planning by the Prime Minister in Decision No. 1769/2021/QD-TTg on rail network planning for the period 2021 to 2030, with a vision to 2050 [24, 25]. Additionally, to review and evaluate passenger flows and revenue distribution in Hanoi - Vinh section, the authors use a 4-step predictive analysis model with the support of PTV-VISUM software (which is applied in analyzing and forecasting traffic demand of countries around the world) based on the collected survey data on the level of sharing of transport modes (road, air, existing rail, and sea); and analyze 12 impact regions, which affect attracting passengers. The forecasting model has been adjusted compared to the pre-feasibility study report by the Ministry of Transport. The research methodology is illustrated in Fig. (1).

4. RESULTS

4.1. Analysis of Benefits and Costs of the Hanoi – Vinh Line

4.1.1. Financial Model of the Project

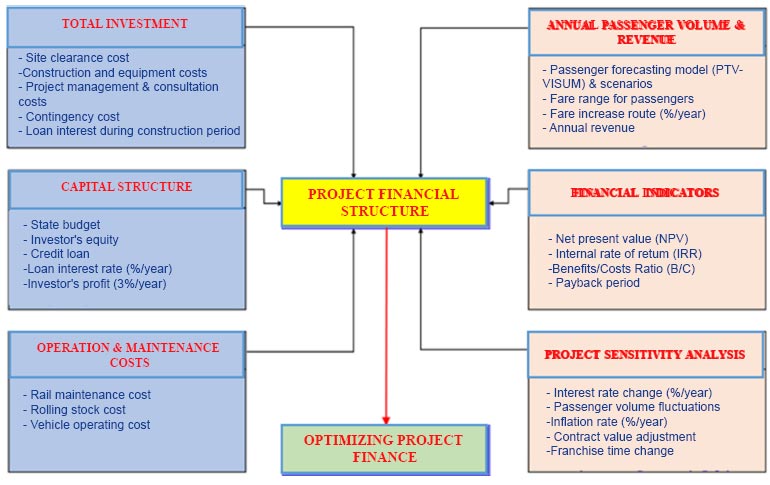

The financial model of the project is created in the project preparation phase and continuously developed, improved, and updated. For rail infrastructure investment enterprises to make the right decisions in choosing the timing and investment roadmap, identifying the model along with influential factors plays a crucial role. Within the framework of the article, the financial model of the HSR project is limited to direct revenue sources from fares and passenger flows (not considering business services in the station area); simultaneously, it represents the related influencing factors according to the block diagram in Fig. (2).

4.2. Data for Benefit Analysis of Hanoi - Vinh Line

4.2.1. Passenger Flow Forecast Model

To forecast the passenger flow, the authors use a 4-step forecast method, with the support of PTV-VISUM software, specifically as follows:

Financial model of the project [6].

4.2.1.1. Step 1 - Trip Generation

Calculate the number of passengers generated from the impact area to the station area.

The authors analyze 12 impact areas that attract a concentration of passengers on Hanoi - Vinh line with a length of L=703.5km and a total of 6 stations along the line. These are the stations: Ngoc Hoi, Phu Ly, Nam Dinh, Ninh Binh, Thanh Hoa, Vinh. The impact areas for analyzing passenger transport demand are within the radius R=30km - 25km - 20km - 15km - 5km and R=500m - 5.0km.

The results show that: (i) Most of the generated passengers come from major cities, urban areas, industrial zones, hospitals, and tourism development areas within the project's impact radius. (ii) The demand for high-speed rail from passengers in the period of 2030-2050 has enough potential for growth as long as the system provides competitive fares and high-quality transport services.

4.2.1.2. Step 2 - Trip Distribution

Calculate the trip itineraries to be distributed among rail stations in the region.

The territory of Vietnam has a narrow width. The transport system stretches along the “backbone” axis from north to south. Based on the statistical data on the number of passengers of the three main transport modes in 2022, namely, the current rail, road, and air transport (Table 1), with a forecasted growth rate for the period of 2020-2030 of 8% per year [19], the authors review the passenger flow model and transport corridor network along the North-South axis.

| Data in 2022 | Hanoi – Vinh |

|---|---|

| Current rail transport (passengers/day) | 1,774 |

| Air transport (passengers/day) | 730 |

| Passenger car/ coach transport (passengers/day) | 4,010 |

| Total (passengers/day) | 6,514 |

4.2.1.3. Step 3 - Model Split

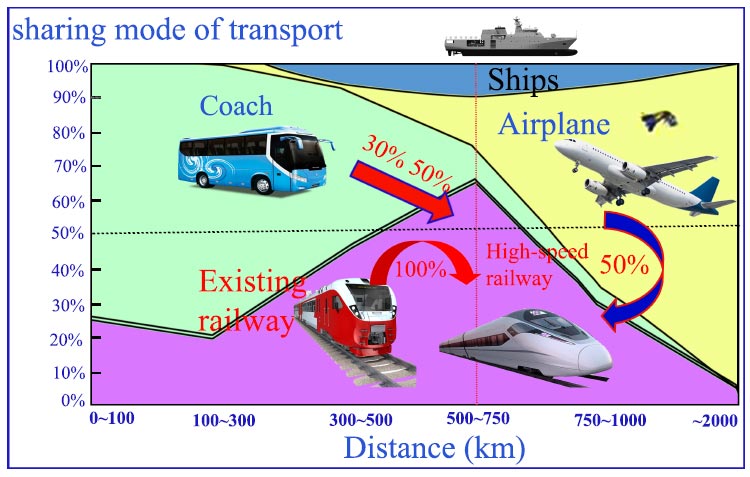

Split the transport modes between road, rail, and air transport on the studied line. The results are shown in Fig. (3).

4.2.1.4. Step 4 - Traffic Assignment

Identify the network system to be applied, distributed, and connected for each type of transport. The forecast result of the Hanoi - Vinh passenger flow is demonstrated in Table 2.

Passenger transport mode splitting model for the North-South high-speed rail line [4].

| Time | Hanoi – Vinh (passengers/day) |

|---|---|

| 2030 | 6,926 |

| 2035 | 10,271 |

| 2040 | 15,803 |

| 2045 | 25,451 |

4.3. Annual Revenue

In accordance with the financial model of the project analyzed above, the revenue is determined based on the total number of annual passengers and fares. The basis for determining high-speed rail fares includes:

+ The level of competition among vehicles: Travel distance - Travel time - Passenger volume.

+ Average GDP, per capita income, and each country's related policies and regulations.

+ The financial plan and payback period of the project.

+ Forecast of passenger volume on each route.

+ The base fare is determined in 2030 when the project is put into operation and adjusted every 05 years to increase by 15% per time.

+ Estimated time of ticket issuance: From 01/01/2030.

+ The fare range determined for each journey segment, on the principle that HSR fare will be about 1.5 times higher than regular rail fare; at the same time, it is about 50% - 60% of airfare or the cost of hiring a private car.

+ Comparing with fares in China: (i) according to the Beijing Institute of Technology, the average fare of Chinese rail in 2017 was 1,074 dong/km per passenger, equivalent to 302,291 dong/passenger when traveling on a line of 281km. (ii) Research by Tongji University (China) and other countries shows that for journeys ranging from 300km to 900km, high-speed rail fare is cheaper than airfare (high-speed rail fare fluctuates around 70% compared to airfare). However, when the journey exceeds 1,000km, high-speed rail fare is sometimes higher than airfare (Table 3) [23, 26].

4.4. Data for Cost Analysis of Hanoi – Vinh Line

Data on construction and operation costs are referenced and compared from studies worldwide and projects using trains with similar speeds and technology.

4.4.1. Total Investment in Rail Infrastructure Development

The total cost for the project preparation and construction is referred to as the Total Investment, which includes the costs of Project preparation, site clearance, work construction, rail construction, core technical equipment system, regular stations and some major stations, depot, and warehouses, project management, consultation, loan interest during construction, and contingency cost. To select a suitable investment rate for the project, the authors analyze and compare the high-speed rail investment rate with other countries in the world and in the region.

| Year | Itinerary (Hanoi - Vinh) | ||

|---|---|---|---|

| Passenger/Day | Fare (VND/person) | Revenue (Billion VND/ year) | |

| 2030 | 6,926 | 700,000 | 1,770 |

| 2035 | 10,271 | 805,000 | 3,018 |

| 2040 | 15,803 | 925,750 | 5,340 |

| 2045 | 25,451 | 1,064,613 | 9,890 |

| Country |

Construction Cost per Kilometer according to 2017 Price (Million Euros) |

Index CPI 2022 / CPI 2017 |

Construction Cost per Kilometer according to the 2022 Price |

|

|---|---|---|---|---|

| (Million Euros) | (Million VND) | |||

| France | 5.5 – 22.0 | 1.01 | 5.58 – 22.31 | 133,347 – 533,390 |

| Germany | 17.7 - 34.1 | 1.03 | 18.34 – 35.33 | 438,512 – 844,817 |

| Japan | 20.6 – 31.9 | 1.01 | 20.82 – 32.24 | 497,770 – 770,818 |

| Spain | 9.7 – 24.9 | 0.96 | 9.31 – 23.90 | 222,638 – 571,515 |

| China (trains with speed of 200-250 km/h) | - | 16.01 – 17.60 | 382,831 – 420,851 | |

| Laos | - | 5.9 – 10.0 | 141,081 – 239,120 | |

| Thailand | - | 6.5 – 12.0 | 155,428 – 286,944 | |

Table 4 demonstrates that the investment rate in HSR in Germany and Japan is high due to several reasons: (i) HSR lines are built through densely populated areas, resulting in significant site clearance costs, (ii) rail lines have many viaducts and mountain tunnels. In Japan, 30% of the total length of the HSR system runs through tunnels; in areas with a high earthquake rate, protection and reinforcement of talus slopes, construction of wind barriers, and erection of avalanche barrier systems have been used.The arrangement of tunnels to limit the impact of earthquakes is prioritized and technical guaranteed. This also increases the investment rate in Japan's HSR.

The HSR investment rate in Spain and France is lower than in Germany because the HSR design in these countries is only for passenger trains. Moreover, in France, the investment rate in rail construction is minimized by allowing the design standards to apply higher gradients, i.e., using a 35% gradient (instead of the previous 15% gradient) to limit the construction of viaducts and tunnels [27]. HSR in Laos has a low investment rate since it currently applies Chinese technology and operates passenger trains at a maximum speed of 200 km/h and freight trains at 120 km/h and the site clearance cost is also minimized. In 2020, Thailand planned to research the HSR investment project for passenger transport. In Phase 1, the investment is for Bangkok to Nakhon Ratchasima line with a length of 253km and design speed V=250km/h, with a total cost of 1.67 billion USD. It means that the expected investment rate ranges from VND 155 billion/km to VND 286 billion/km depending on the terrain conditions of each section [27]. When train speed increases, the construction cost also increases, and the ratio of cost components to total investment can be found in the studies [25, 28, 29].

In Vietnam, this is the first HSR project. The rail line will traverse almost all provinces along the length of the country. Based on the above analysis and comparison, the authors calculate the total investment for the Hanoi - Vinh line at the speed design speed of 350 km/h.

Site clearance cost: The Hanoi - Vinh route, with a length of 703.5km passes through 6 stations: Ngoc Hoi, Phu Ly, Nam Dinh, Ninh Binh, Thanh Hoa, and Vinh. According to a previous study [6], this cost accounts for 3 - 5% of the total investment.

Equipment cost: Accounts for 20-22% of the total investment due to Vietnam's lack of technology mastery. Moreover, rolling stock cost: According to UIC's 2015 publication, the rolling stock cost for a 350-seat train averages from 30-35 million Euros/train [30]. On April 6, 2022, ALSTOM signed an agreement with the Swedish National Rail Operator (SJ) to supply 25 Zefiro Express high-speed electric trains with a speed of V=250km/h. The contract for the first order was worth around 650 million Euros, averaging 26 million Euros/train with a capacity of 363 seats [31].

| Project Category |

Design Speed 350 km/h |

Design Speed 250 km/h |

Design Speed 200 km/h |

|---|---|---|---|

| Line length | 355 km | 1,503 km | 806 km |

| Construction duration | 2008-2012 | 2008-2017 | 2008-2017 |

| Train type | Passenger transport | Passenger transport | Cargo and passenger transport |

| Site clearance, land acquisition and resettlement | 4.0% | 4.0% - 8.0% | 6.0% - 9.0% |

| Construction work | 48.0% | 50.0% - 54.0% | 44.0% -51.0% |

| (+) Rail background | 6.0% | 7.0% - 12.0% | 13.0% -15.0% |

| (+) River bridge and viaduct | 41.0% | 13.0% - 25.0% | 25.0% -27.0% |

| (+) Rail tunnel | 18.0% -32.0% | 16.0% - 29.0% | 2.0% - 13.0% |

| Rail | 9.0% | 9.0% - 11.0% | 6.0% - 7.0% |

| Signal and communication | 4.0% | 3.0% | 4.0% |

| Electromechanical equipment | 5.0% | 4.0% - 5.0% | 4.0% - 5.0% |

| Rolling stock | 15.0% | 3.0% - 4.0% | 5.0% - 7.0% |

| Construction of station and Depot | 2.0% | 2.0% - 4.0% | 3.0% - 5.0% |

| Other expenses | 13.0% | 14.0% - 25.0% | 16.0% -28.0% |

| No. | Category | Value (Billion VND) |

|---|---|---|

| 1 | Site clearance cost | 14,691 |

| 2 | Construction and equipment cost | 210,863 |

| 3 | Project management, consultation costs, and other costs (Loan interest) | 26,358 |

| 4 | Contingency cost | 23.508 |

| Total investment | 275,420 | |

Rolling stock cost for Hanoi - Vinh line: With the expected number of passengers in Section 4.2 by 2030, for Hanoi - Vinh line, 28 10-car trains with a maximum capacity of 740 seats/train will be purchased with an average investment value of 30 million Euros/train equivalent to 717 billion VND/train.

Construction cost: A previous report [19] calculated the construction costs for train speeds of 200-300km/h. Table 5 demonstrates that as train speed increases, construction costs also rise. The construction price index for 2023 compared to 2022 is 102%. Based on this, the author group calculates the total construction cost to be 204.935 trillion Vietnamese dongs.

Project management, consultation costs, and other costs make up approximately 10-12% of the total investment, based on the percentage ratio [19].

There are two types of contingency costs: those for unforeseen quantities and those for price escalation. Provisionally calculated at 8-10% of the combined costs mentioned above. Summarized below in Table 6.

4.5. Rail Infrastructure Maintenance Cost

According to UIC's 2018 calculations, the annual maintenance cost for each kilometer of HSR averages 2.16 billion VND/km/year [29]. However, UIC's published results are often higher than the actual maintenance cost in some countries. Typically, based on the figures from ADIF-Alta Velocidad (Spain), when operating over 3,661 km of HSR, the maintenance cost ranges from 25,000 to 30,000 Euros/km/year (equivalent to ~650 - 750 million VND/km/year) [30]. This maintenance cost is also in line with the studies of Jean-Pierre Loubinoux & Ignacio Barrón de Angoiti et al. in 2013 for some European countries' rail lines [30]. For the current Vietnamese conditions, the technology has not yet been mastered. Four-season weather conditions and temperature changes during the day fluctuate, strongly affecting the thermal expansion of steel materials. Therefore, the authors based on the average rail maintenance result from 1.0 - 1.5 billion VND/year.

4.6. Vehicle Operating Cost

Vehicle operating costs include the costs of management, rail conversion, train operation, power consumption, train maintenance, and equipment maintenance, determined in units of the total annual passenger kilometer [26]. Several models are applied to determine the Vehicle Operating Cost (VOC), with a primary focus on determining fuel consumption cost, power consumption cost, and equipment depreciation cost. These models include the “Mechanistic-Empirical Model” and the HDM-4 software, the ARFCOM fuel consumption model developed in Australia in 1988, regression equation models developed based on statistical data, continuous and discontinuous flow models combined with experimental mechanics, and average velocity approach methods. According to a previous study [32], electric fuel consumption during HSR train operation accounts for a minimum of approximately 60% of the total vehicle operating cost [33, 34]. The research also indicated that the electricity consumption on rail lines in some countries, such as Belgium and France, is significant when the operating speed is increased from 150 km/h to 240 km/h.

However, the value of vehicle operating cost per passenger km will decrease (approximately 0.004 USD/passenger-km) as the number of passengers using HSR increases and the vehicles achieve maximum transport capacity efficiency. The synthesis of research results in Table 7 shows that the new generation ICE-3 (Germany), TGV Duplex (France), and Chuo Shinkansen (Japan) high-speed electric trains have low average power consumption, ranging from 22 kWh/km to 27 kWh/km.

Therefore, for the Hanoi - Vinh rail line with the distance L = 281.4 km and an estimated number of passengers in 2030, when the line is put into operation being 5,057,075 passengers/year, the total passenger kilometer will be 1,423,060,905 passengers-km in 2030. The average operating cost will be 0.009 USD/passenger-km in 2030, equivalent to 219.2 VND/passenger-km. The total operating cost for the Hanoi - Vinh line will be 311.8 billion VND/year in 2030.

5. DISCUSSION

5.1. Scenarios for Financial Efficiency Analysis

The above calculations show that the investment cost of HSR is significant. The total investment for the Hanoi - Vinh line is 275,420 billion VND, while the State budget allocated for transport development investment in the period of 2021-2025 is 252,694.5 billion VND. Commercial banks in Vietnam lend investment loans in the transport sector for no more than 30 years [34]. Furthermore, the analysis of the HSR system development experience in the world shows that the public sector plays a major role in providing over 50% of the total construction investment. Therefore, the authors study the financial management mechanisms for the investment project through two forms of contracts: BOT and BTL.

According to the regulations of the Law on PPP Investment, the State's capital rate in PPP projects should not exceed 50% of the total investment (except for some specific projects, if approved by the National Assembly, the allowable State capital ratio exceeds 50%). The State's capital does not count towards the payback plan and investor profits, and the profit margin is set at 11.0% [4]. However, considering the specific nature of the HSR project, as the first HSR project requiring large investment capital and a long recovery time, the state's contribution rate of 50% is not sufficient to attract investors. Two scenarios are proposed:

5.1.1. Scenario 1

State capital accounts for 50% and 80% of the total investment (under BOT contracts) and proposes special mechanisms approved by the National Assembly.

5.1.2. Scenario 2

State capital accounts for 50% of the total investment (under BTL contract).

The project financial performance calculations are as follows:

| Type of Vehicle | High-speed Rail Lines in Operation | Average Electric Power Consumption |

|---|---|---|

| Transrapid train | Hamburg – Berlin (330 km/h) | 26 (kWh / km) |

| Chuo Shinkansen train | Leipzig – Dresden (330 km/h) | 27 (kWh / km) |

| Chuo Shinkansen train | Tokyo - Nagoya – Osaka (500 km/h) |

85 (kWh / km) |

| ICE-3 | Hamburg – Berlin (330 km/h) | 23 (kWh / km) |

| TGV Duplex | Rhine – Rhone (320 km/h) | 22 (kWh / km) |

| No. | Year | After-tax Revenue | Initial Investment Cost | Net Cash Flow | Discounted Value | Net Present Value (NPV) |

Total Benefit | Total Discount-ed Benefit | Total Cost | Total Discounted Cost |

B/C Ratio |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | - | - | 137,710 | (137,710) | (137,710) | - | - | - | 137,710 | 137,710 | - |

| 1 | 2030 | 1,713 | - | 1,713 | (135,997) | (135,997) | 2,623 | 2,370 | 342 | 309 | 0.017 |

| 2 | 2031 | 1,866 | - | 1,866 | 1,524 | (134,638) | 2,220 | 1,812 | 354 | 289 | 0.030 |

| 3 | 2032 | 2,031 | - | 2,031 | 1,499 | (133,139) | 2,396 | 1,768 | 366 | 270 | 0.043 |

| 4 | 2033 | 2,209 | - | 2,209 | 1,473 | (131,666) | 2,588 | 1,725 | 378 | 252 | 0.055 |

| 5 | 2034 | 2,403 | - | 2,403 | 1,448 | (130,218) | 2,794 | 1,684 | 391 | 236 | 0.067 |

| 6 | 2035 | 3,090 | - | 3,090 | 1,6,83 | (128,536) | 3,494 | 1,903 | 404 | 220 | 0.081 |

| 7 | 2036 | 3,383 | - | 3,383 | 1,665 | (126,871) | 3,801 | 1,870 | 418 | 206 | 0.094 |

| 8 | 2037 | 3,703 | - | 3,703 | 1,646 | (125,225) | 4,134 | 1,838 | 432 | 192 | 0.107 |

| 9 | 2038 | 4,051 | - | 4,051 | 1,628 | (123,597) | 4,497 | 1,807 | 446 | 179 | 0.120 |

| 10 | 2039 | 4,431 | - | 4,431 | 1,609 | (121,988) | 4,892 | 1,776 | 462 | 168 | 0.133 |

| ... | ... | ... | - | ... | ... | ... | ... | ... | ... | ... | ... |

| 60 | 2089 | 955,611 | - | 955,611 | 2,190 | (2,778) | 1,144,476 | 2,623 | 188.864 | 433 | 0.984 |

| 61 | 2090 | 1,162,011 | - | 1,162,011 | 2,406 | (372) | 1,421,254 | 2,943 | 259.243 | 537 | 1.001 |

| 62 | 2091 | 1,232,401 | - | 1,232,401 | 2,306 | 1,934 | 1,534,757 | 2,872 | 302.356 | 566 | 1.017 |

| No. | Year | After-tax Revenue | Initial Investment Cost | Net Cash Flow | Discounted Value | Net Present Value (NPV) |

Total Benefit | Total Discounted Benefit | Total Cost | Total Discounted Cost |

B/C Ratio |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | - | - | 52,466 | (52,466) | (52,466) | - | - | - | 52,466 | 52.466 | - |

| 1 | 2030 | 1,713 | - | 1,713 | (50,735) | (50,735) | 2,270 | 2,043 | 342 | 308 | 0,039 |

| 2 | 2031 | 1,866 | - | 1,866 | 1,512 | (49,412) | 2,220 | 1,799 | 354 | 287 | 0,072 |

| 3 | 2032 | 2,031 | - | 2,031 | 1,482 | (47,930) | 2,396 | 1,748 | 366 | 267 | 0,105 |

| 4 | 2033 | 2,209 | - | 2,209 | 1,451 | (46,479) | 2,588 | 1,700 | 378 | 248 | 0,136 |

| 5 | 2034 | 2,403 | - | 2,403 | 1,421 | (45,058) | 2,794 | 1,652 | 391 | 231 | 0,166 |

| 6 | 2035 | 3,090 | - | 3,090 | 1,645 | (43,413) | 3,494 | 1,860 | 404 | 215 | 0,200 |

| 7 | 2036 | 3,383 | - | 3,383 | 1,621 | (41,792) | 3,801 | 1,821 | 418 | 200 | 0,233 |

| 8 | 2037 | 3,703 | - | 3,703 | 1,597 | (40,194) | 4,134 | 1,784 | 432 | 186 | 0,265 |

| 9 | 2038 | 4,051 | - | 4,051 | 1,573 | (38,621) | 4,497 | 1,747 | 446 | 173 | 0,296 |

| 10 | 2039 | 4,431 | - | 4,431 | 1,549 | (37,072) | 4,892 | 1,711 | 462 | 161 | 0,326 |

| ... | ... | ... | - | ... | ... | ... | ... | ... | ... | ... | ... |

| 28 | 2057 | 35,394 | - | 35,394 | 1,867 | (2,870) | 42,361 | 2,234 | 6,967 | 367 | 0,953 |

| 29 | 2058 | 37,442 | - | 37,442 | 1,778 | (1,092) | 45,742 | 2,172 | 8,300 | 394 | 0,984 |

| 30 | 2059 | 39,584 | - | 39,584 | 1,692 | 599,51 | 49,393 | 2,111 | 9,809 | 419 | 1,014 |

| Investment period: 2022-2030; Hanoi - Vinh line length (L=281,4km) | |

|---|---|

| Total investment: 275,420 (billion VND) | |

| Vehicle operating cost in the first year of operation: 311.8 (billion VND /year) | |

| Rail maintenance cost: 301.4 (billion VND /year) | |

| Train procurement cost in 2030-2035: 20,076 billion VND for 28 trains | |

| Revenue in the first year of exploitation: 2,284 (billion VND /year) | |

| Capital structure | |

|

Scenario 1: State capital accounts for 50% of total investment (according to the Law on PPP Investment No.64/2020/QH14) |

Scenario 2: State capital accounts for 80% of total investment (proposing a specific mechanism of the National Assembly) |

| Mobilized capital of investors accounts for 50% of total investment |

Mobilized capital of investors accounts for 20% of total investment |

| Result - Financial plan | |

| Payback period: > 50 years (61 years 02 months) Unfeasible scenario |

Payback period: ~ 30 years, (29 years 08 months) IRR = 11.16% / year > 11% NPV = 599.51 billion VND B/C > 1.0 |

| No. | Year | - | Beginning Balance | - | - | Principal Payment | - | Loan Interest/profit generated by the Investor | Total Cost of Repair & Operation | Revenue Subject to CIT | Loss Transfer | CIT | Total Amount Paid by the State during the Operation Period | Total Benefits Discounted | Total Cost Discounted | B/C Ratio | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Owner's Equity | Loan Capital | Foreign Loan Capital | Total | Total | Owner's Equity | Loan Capital | Foreign Loan Capital | Owner's Equity | Loan Capital | Foreign Loan Capital | ||||||||||

| - | 21,850 | 36,203 | 87,613 | 145,666 | - | - | - | - | - | - | - | - | - | - | - | - | - | 145,666 | - | |

| 1 | 2035 | 21,850 | 36,203 | 87,613 | 145,666 | 6,056 | 908 | 1,505 | 3,643 | 2,513 | 3,801 | 1 | 342 | 3,715 | 3,715 | - | 12,714 | 11,844 | 319 | 0.081 |

| 2 | 2036 | 20,941 | 34,698 | 83,970 | 139,610 | 2,110 | 316 | 524 | 1,269 | 2,408 | 3,643 | 4,199 | 354 | 3,861 | 3,861 | - | 12,714 | 11,034 | 307 | 0.156 |

| 3 | 2037 | 20,625 | 34,174 | 82,701 | 137,500 | 2,253 | 338 | 560 | 1,355 | 2,372 | 3,588 | 4,135 | 366 | 3,904 | 3,904 | - | 12,714 | 10,279 | 296 | 0.226 |

| 4 | 2038 | 20,287 | 33,614 | 81,347 | 135,247 | 2,406 | 361 | 598 | 1,447 | 2,333 | 3,529 | 4,067 | 378 | 3,951 | 3,951 | - | 12,714 | 9,576 | 285 | 0.291 |

| 5 | 2039 | 19,926 | 33,016 | 79,900 | 132,842 | 2,570 | 385 | 639 | 1,546 | 2,292 | 3,467 | 3,995 | 391 | 4,001 | 4,001 | - | 12,714 | 8,921 | 274 | 0.351 |

| 6 | 2040 | 19,541 | 32,377 | 78,354 | 130,272 | 2,745 | 412 | 682 | 1,651 | 2,247 | 3,400 | 3,918 | 404 | 4,054 | 4,054 | - | 12,714 | 8,311 | 264 | 0.407 |

| 7 | 2041 | 19,129 | 31,695 | 76,703 | 127,527 | 2,933 | 440 | 729 | 1,764 | 2,200 | 3,328 | 3,835 | 418 | 4,112 | 4,112 | - | 12,714 | 7,743 | 254 | 0.459 |

| 8 | 2042 | 18,689 | 30,966 | 74,939 | 124,594 | 2,717 | 407 | 675 | 1,634 | 2,149 | 3,251 | 3,747 | 432 | 4,175 | 4,175 | 417 | 12,714 | 7,377 | 482 | 0.507 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 28 | 2062 | 4,127 | 6,837 | 16,546 | 27,510 | 8,594 | 1,289 | 2,136 | 5,169 | 475 | 718 | 827 | 840 | 6,301 | 6,301 | 1,260 | 12,714 | 2,047 | 289 | 0.997 |

| 29 | 2063 | 2,837 | 4,701 | 11,377 | 18,916 | 9,158 | 1,374 | 2,276 | 5,508 | 326 | 494 | 569 | 868 | 6,496 | 6,496 | 1,299 | 12,714 | 1,917 | 278 | 1.007 |

| 30 | 2064 | 1,464 | 2,425 | 5,869 | 9,759 | 9,759 | 1,464 | 2,425 | 5,869 | 168 | 255 | 293 | 897 | 6,706 | 6,706 | 1,341 | 12,714 | 1,796 | 267 | 1.017 |

5.2. Investment Plan for Hanoi - Vinh Rail Line under BOT Contract

The Build-Operate-Transfer (BOT) contract is a contract signed between the competent State authority and the investor to authorize the investor rights to construct, trade, and operate the project and infrastructure system for a specified period. At the end of the contract term, the investor transfers the project and infrastructure system to the state. In the transportation sector, this type of contract is often chosen due to its lower risk compared to (BTO) and (BOO) contracts. After the construction is completed, the investor has full control over the business operation and exploitation of the project to recover the capital and profit. Tables 8 and 9 show the financial efficiency for the case of State budget support at 50% for Hanoi - Vinh line under the BOT contract:

The corresponding capital structure for the two financial scenarios is presented in detail in Table 10. Under BOT contract, if the State supports 50% of the total investment, the payback period exceeds 50 years, which makes it difficult to attract investors. In order to make the project feasible and achieve a payback period within 30 years, the State needs to support 80% of the total investment (proposing a specific mechanism of the National Assembly).

| Hanoi – Vinh |

|---|

| State capital accounts for 50% of total investment (according to the Law on PPP Investment No. 64/2020/QH14) |

| Mobilized capital of investors accounts for 50% of total investment |

| Result - Financial plan |

| Case: The concession period for exploitation and operation is 30 years |

| NPV = 1,795 billion VND; B/C =1.017 |

5.3. Investment Plan for Hanoi - Vinh Rail Line under BTL Contract

The Build-Transfer-Lease (BTL) contract is a contract signed between the competent State agency and the investor, which grants the investor the right to construct facilities and infrastructure systems. After the project completion, it will be transferred to the State agency, while the investor is allowed to provide services based on the operation and exploitation of the work for a certain period; at the same time, the State agency hires the services and pays for the investor and project enterprise [4]. The contract has a low business risk advantage as the service rental fee is paid from public service revenue, budget capital, or a combination of both. Under this plan, the maximum mobilized state capital is 50% of the total investment value and fully complies with the provisions of the Law on PPP Investment. After the project's completion, the right to exploit and operate will be transferred to the investor for a period of 30 years with the State's payment; at the same time, the State will share the risk with the investor regarding the revenue deficit during the exploitation process according to the Law on PPP Investment. Tables 11 and 12 show the financial efficiency - State support at 50% of the total investment under the BTL contract for the Hanoi – Vinh rail line.

Comparing the two types of contracts (BOT and BTL), each has its advantages and benefits, providing enterprises with flexibility in choosing their investment forms. Investment projects under these two contracts are those that the State encourages investment in through incentives and support measures such as tax incentives, incentives for land use rights, and numerous investment guarantee measures to facilitate the project implementation process.

CONCLUSION

The high-speed rail project brings significant environmental, economic, and social effects and is considered a breakthrough in the transport infrastructure system. However, the investment for construction and operation requires a vast amount of resources, and the capital recovery period is lengthy, potentially leaving a long-term “burden” on the state budget. Therefore, the investment decision needs to analyze and carefully evaluate political, economic, and social factors, along with technical and technological requirements, benefits, costs, and investment efficiency. Based on the analysis of previous studies (both domestic and international) adjusted to Vietnam's conditions, this paper has constructed a project financial model, calculating benefit-cost ratios. This includes determining revenue sources from ticket prices and passenger flow forecasting models, developing calculation methods to determine the total investment, and estimating vehicle management and operation costs.

Furthermore, the financial efficiency is analyzed and evaluated (through the financial indicators NPV, IRR, B/C) under a public-private partnership. Two types of contracts, which are BOT (with the State's participation rate of 50% and 80% of total investment) and BTL (with the State's participation rate of 50% of total investment) are proposed. The calculation shows that the State must participate at a rate of 80% under the BOT contract and 50% under the BTL contract for the project to be feasible and the payback period to be extended for 30 years. These are important bases for helping investors make the right decisions in choosing the timing and investment route.

The novel contributions of this research: The authors have constructed a database to calculate the financial feasibility of the high-speed railway project Hanoi - Vinh (an entirely new field in Vietnam) using qualitative research methods to identify the factors influencing the project's benefits and costs. They assumed and adjusted economic, financial, and ticket price parameters based on Vietnam's actual conditions, surveyed areas affected to assess passenger transportation demand, determined the total investment, and identified vehicle management and operation costs. From this, they established mechanisms for sharing benefits and risks between the government and investors through financial scenarios: applying BOT contracts with government participation rates of 50% and 80% and BTL contracts with a government participation rate of 50%. This serves as a scientific basis for the government to reference when attracting private investors to participate in the project.

The next research direction of the author group is to collaborate with international experts in the field of high-speed railways of the Federal Republic of Germany, France, and Japan to adjust the parameters related to the benefits and costs of operating and maintaining equipment to suit each type of ship technology. Hence, we continue to improve the determination оf investment benefits and costs for the HSR project in Vietnam.