All published articles of this journal are available on ScienceDirect.

Mixed High-Speed, Conventional and Metro Central Rail Stations as Places to Work: The Case Study of Naples

Abstract

According to the innovation in services theory any substitution or addition of characteristics to a service is considered as incremental innovation with the objective of improving the final client’s utility. Moreover by service relationship, it is meant the establishment of relationships between the client and the provider with the objective of producing the final product. In the light of this theory stations are here conceived as a set of services and the added characteristics as temporary offices designed inside and around High Speed Rail stations. Therefore, the traditional concept of a station as a node changes since stations can be also considered as workplaces. The objective of this contribution is to identify the characteristics of the clients renting temporary offices and the role of High Speed Rail and more generally transport in this respect. A survey was employed, interviewing clients renting flexible offices inside the Garibaldi station in Naples in Italy. Data were collected concerning the clients’ socioeconomic characteristics, the transport mode chosen to reach these offices and the services used.

1. INTRODUCTION

According to Bertolini and Spit [1] stations are no more considered as just nodes in a network but also as places within an area. The result of this statement is the redesign of the actual national-to-regional-to-local transport nodes in order to give them also a function of pedestrian ones. In general, this is not an easy task [2]. Central stations are renewed on the basis of the existing ones and in some cases new ones are built due to the willingness of public stakeholders [3, 4]. Around the stations, business parks or business centres have been built, renewing the surrounding district. With the introduction of High Speed Rail (HSR) services, urban renewal projects around the stations have been proposed as well. Indeed stations become transportation hubs for different flows at different scales [5], but also urban hubs [6]. In this respect, local administrations and institutions provide a positive message to the developers concerning the future use of the district encouraging them to propose a new real-estate supply, around the train station itself. Some cases can be found in France [3-7], but also in other countries ([8], for a review). In some cases, HSR systems have given birth to temporary offices inside the station, reinforcing the role of station as a place and moreover as a place to work. This is the aim of this paper, which is organised as follows. In section 2 the question of temporary offices inside and around HSR stations is explained. The case study of flexible offices inside the HSR station in Naples is dealt with in section 3. Section 4 reports some concluding remarks.

2. TEMPORARY OFFICES INSIDE AND AROUND HSR STATIONS

The development of temporary offices inside rail stations is going to change completely their image. Providers of these services are companies like Regus, Buroclub, Multiburo, but also smaller ones like the RPAD in Reims, in France. These temporary offices meet the growing demand of workers, sometimes mobile ones always looking for places to work without the costs of a full-time office and support the station as a place.

2.1. High Speed Rail Station as Places

The British entrepreneur Mark Dixon was inspired to start Regus during a business trip to Brussels, where he noticed how many businessmen were pushed to work in hotels, bars, etc. given to the lack of a more professional place. In 1989, he launched Regus with a single business centre in Brussels. Met with strong demand, Dixon quickly developed a global network of fully equipped, furnished workplaces for businessmen. Very recently, some of these types of offices have been established inside the stations in Italy and also in France.

In Italy, HSR nodes have become centres for services and urban renewal. The HSR stations in the major metropolitan nodes of Turin, Milan, Bologna, Florence, Rome and Naples have been renewed or built by well-known architects. Stations are considered as protagonists of significant urban redevelopment operations and the expression of a new architectural language, and conceived as spaces not only dedicated to railway activities, but also meeting and communication places. The restyling of Rome Termini and more recently of Milan Central stations are pilot projects of the new way of interpreting stations as city squares [7]. The renewal of Milan Central, centre of urban mobility and a real gateway to the city, also for future visitors to Expo 2015, marks a milestone in the expansion of regional and metropolitan transport and exploits the role of the station as a junction for the new High Speed/High Capacity lines. In Naples, the new HSR station, designed by Zaha Hadid, built in the municipality of Afragola, will be integrated with the major roads and regional railway lines. The four-level building will take up 20.000 m2 and Afragola will be a strategic node for local and international traffic and it will be a fundamental junction point for the Naples - Bari line [9].

In France, central stations have also been renewed and in some cases new ones have been built outside the city centre. For example, on the South East axis, for the stations that only benefit from a couple of daily stops, the renewal has been minimal, whereas in some bigger cities, with very good services, the central station has been completely renewed (Dijon, Chambéry) or a new station has been built (Lyon Part-Dieu) [4]. Concerning the South West Line, the new Novaxis business center has been built near the HSR station [3, 10-12]. Concerning the North HS Line, a new TGV station and a business centre, EuraLille, has been conceived near the existing rail station [13]. More recently, in the case of the East European High-Speed Line, new stations have been built near the city (Champagne-Ardenne station) or outside (Meuse TGV, Lorraine TGV), and in bigger cities like Reims, Metz and Strasbourg, the central stations have been renewed to make them “new places” in the city.

The role of a HSR system in fostering the location of firms has been studied by several authors [3, 11, 12-14].

Bazin et al. [3] have highlighted the new perspective that local stakeholders have given to a HSR service. The image effect, in terms of dynamism and modernity, can foster local real estate operations [15].

As reported in the literature, land-use impacts brought by rail systems induce urban physical transformations such as land development or renewal interventions [16] and activity pattern changes, such as residents and jobs reallocation. Most of the studies present in the literature, concentrating on urban rail transit systems, have found some level of land use change, resulting from transit improvements and an activity clustering effect close to urban rail stations. The economic transformations related to HSR systems consist of microeconomic impacts, such as property and rent value changes for different land uses, and macroeconomic effects such as urban economic competition variation, potential development increase, etc. [17, 18].

2.2. Temporary Offices as Innovation in Services

Temporary office spaces can be conceived as innovation in services inside and around the station from the point of view of developers [19]. These new work-spaces change the image of the station, turning it into a place to work. Stations become formal third places [20, 21] or third spaces [22] for mobile workers (see 2.3).

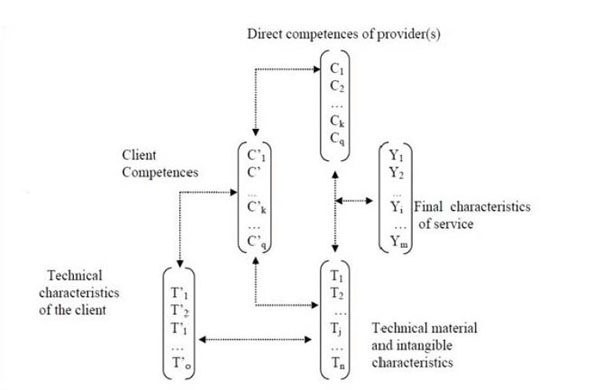

Indeed making reference to the analysis of Gallouj and Weinstein [23], improved by De Vries [24], a service can be represented by vectors of technical characteristics and the interface between the competences of clients and providers (see Fig. 1).

According to this definition, renting an office can be analyzed as a service that can be defined by several characteristics. The technical characteristics for the office are represented by the surface, the equipment, etc.; for the building, they can be the location, the heating, etc. and for the neighborhood, they can be the architectural style, the accessibility, etc. The final characteristics of the service related to the office are comfort, internet connection, etc. and of the building are security, comfort, etc. Accessibility to public transport, parking facilities, accessibility to shops and services can be considered depending on the neighborhood.

The service is co-produced by a provider and the client, who uses the service, taking part at the definition of it.

Temporary office rent can be described as incremental innovation regarding the service characteristics1, i.e. innovations adding one or several new service characteristics, improving the client utility. For example, this new service proposes flexibility, some technical and administrative supports (e.g. telephone, wifi, printing, secretary services, etc.) which are chosen by the client. But using relational service innovation analysis [25, 26], temporary office rent can be analyzed as a service relationship, since it corresponds to the establishment of relations between clients, providers, public authorities, competitors, station managers and rail operators [19-27]. But the question is to know the reasons why temporary offices are developed and why they are specifically developed in HSR stations.

2.3. The Development of Temporary Offices Inside HSR Stations

For a long time, real estate buildings were a part of the location process. Firms were building their own spaces. However services activities needed very standardized offices. Consequently, the building could be realized by another company selling business real estate on a specific market where different agents were demanding offices [3]. This demand can be linked to the need to locate an activity but also to the willingness to invest in the financial market. This possibility was growing during the nineties when private English and American funds were investing in the real estate market [28]. Moreover, the slow growth since the eighties of last century has induced firms to reorganize their business and to outsource many functions as management of their real estate property and finally to rent or leasing their real estate [29, 30]. Real estate becomes exogenous to the firm [3].

But the outsourcing process is nowadays more important. Offices can be rented for a short time! Temporary offices have been developed to meet the growing demand of workers looking for places to work without the costs of a full-time office. In this respect temporary offices are a way to save money.

More recently temporary offices have been developed inside rail stations and particularly in HSR stations.

For instance, in March 2007, Regus signed a partnership with Thalys, according to which businessmen, moving between Paris, Brussels, Amsterdam and Cologne and being members of Cybelys Gold program from Thalys, can have access to the 950 places of Regus in 70 countries all around the world. Regus clients can access the Thalys Lounge located in the Brussels-Midi station. In France, in 2011, it is quite different: Regus has been chosen by Gares & Connexions - the subsidiary of SNCF- to develop projects of business centres inside TGV stations to make waiting rooms connected working spaces2 [19]. The objective is to develop a network of modern and innovating working spaces inside stations to meet the needs of mobile workers (CP Gares & Connexions - Regus) and to reduce waste of time.

In Italy too, Regus has developed its activities3. The Regus Gold Card gives unlimited access to all Regus facilities, all over the world. But more recently, Regus has signed a partnership with Trenitalia, the Italian State railways company. Thanks to the partnership between Trenitalia, and Regus, since 2012, holders of Gold and Platinum Cartafreccia can have access to the 11 FrecciaClubs of the main Italian stations (number expected to grow in the coming years), even in the nine Regus centers. The agreement allows those, who frequently travel on Trenitalia HS trains “Frecciarossa” and “Frecciargento”, to enjoy unlimited access to Regus business lounges, as members of the Businessworld. But even more recently in September 2013 Regus developed flexible workplaces inside the High Speed Rail station Garibaldi in Naples. Thanks to the development of business centres inside the HSR station, the rail station itself gets new functionality: a working space for mobile workers. The location inside the station adds news characteristics to the office rent: flexibility and modularity of the rent, in many locations, connected to the HSR network. By locating flexible working places inside or around HSR stations, these developers contribute to the creation of a specific model that associates third places and HSR and probably mobile workers.

Temporary offices rent could allow mobile workers to benefit from the time spent in stations and/or to decrease the total travel time since they do not have to make additional trips from the station to meet the clients. The meeting can be organized inside the station or around it!

In this case temporary offices could also be built to meet the growing demand of mobile workers who need more flexibility in work organization.

2.4. Who are Mobile Workers?

New information technologies, changing work force demographics, rising customer expectations, transnational companies, and cost pressures are forcing companies to reconsider ideas of what the workplace is. New strategies such as telecommuting, teleworking centers, non-territorial offices, and team space are creating the “virtual workplace".

Two factors promote acceptance of teleworking or telecommuting: employee flexibility in work space, time, and productivity and employer profit margins and cost savings. Savings in time and effort mean money earned or saved on each side. Workers are drawn to the flexibility afforded by working at home or from mobile locations.

New technologies are making such flexibility increasingly possible. Groups of workers for whom travel represents an extensive part of their job descriptions may use internet for collaborative and community-building activities as well as for training, market review and product tracking [31].

These extended work options are appealing to many workers and are becoming more state of the art. Drawbacks appear to be the lack of one-on-one communication and team building that occurs through daily contact with co-workers.

A mobile workforce appeals to employers as it can save money typically spent on office space, computer equipment, travel time and conflict resolution.

The new mobile work arrangements creating the virtual workplace - telecommuting, telework centers - are changing the way companies and workers do business with each other and with their respective clients [32, 33]. Key elements to consider in these arrangements are flexibility in work time, space, and performance; cost-effective production of goods and services; worker satisfaction and learning through social interactions with others, and strategies for facilitating brainstorming, team work, problem-solving and collaboration. The main categories involved are executives; people involved in sales as well as many company directors [34, 35].

The reasons behind the increasing demand for mobility can be found in the globalisation of companies, the expansion of multi-facility companies, the introduction of multi-site team working, the growing reliance on outsourcing and partnerships with other companies. These trends have effectively contributed to an overall increase in the need for companies to communicate with geographically remote interlocutors (customers, suppliers, etc.) [19, 36, 37].

A survey carried out in France [38] reports that 13% of French workers are mobile and 21% are "partially" mobile (regular workplace + irregular workplace= 15% and home + regular workplace + irregular workplace= 6%) [7]. In Italy, the phone survey by Corso et al. [32] reports that 46% of the firms have mobile workers, representing, in general, less than 5% of the workforce. Data have provided the need of new and temporary workplaces, named third places [20, 21]. They are hybrid spaces for private and professional practices, such as internet cafes, hotels, airports, rail stations, etc. However they can also be spaces dedicated to temporary occupation by professionals: tele-centres, co-working spaces and temporary offices for rent (e.g. an hour, a day, etc.), offering given services (e.g. meeting rooms, printers, etc.).

But two kinds of workers outside the firm can be distinguished: firstly, telecommuters and secondly mobile workers to long distance. Temporary offices are meant for workers, trying to decrease commuting distances, without working at home. But secondly, they are meant for mobile professionals, trying to increase the productivity of business travel by working in good conditions, while waiting for an appointment or a train, a plane, etc. and/or by reducing the overall distance travelled by organizing meetings inside or near airports and rail stations, i.e. in highly accessible locations and often central in the case of rail stations.

Finally in all the three cases (saving money, telecommuting and mobile workers at long distance), the accessibility is a very important determinant but in the first two cases, it is the accessibility for short or medium distance trips. In the third one, the accessibility is higher and can include long distance trip. It is only in this case that HSR could play a role.

The case study of Naples, described in the following section, will give some information concerning the occupation of temporary office space.

3. THE CASE STUDY OF THE REGUS OFFICE INSIDE THE HSR STATION OF NAPLES

3.1. Naples Central Station: A Transport Node and a Central Place

Napoli Centrale (Naples Central Station) is the main railway station in the city of Naples and in the southern Italy and the sixth largest station in Italy in terms of passenger flow with an annual ridership of 50 millions. On the Regus website, it is quoted that around 137,000 people pass through the railway station every day and that Naples Central is a big railway node with nearly 400 trains a day, linking to the entire national railways system (website of Regus Naples)4.

The station is located next to Garibaldi square to the east of the old city. It is the first rail terminal for Naples and it serves Trenitalia national railways. It has an underground section known as Stazione di Napoli Piazza Garibaldi (Naples Garibaldi Square station), which is served by the metro line 2.

The station has 25 tracks. It is connected to Rome by HS trains on the Rome-Naples HS railway line as well as slower trains on the original Rome-Cassino-Naples line and the Rome-Formia-Naples Direttissima opened in 1927. It is connected to Salerno and southern Italy by the traditional Naples-Salerno line and the recently opened Naples-Salerno HS line used by long distance trains.

The services provided inside the station are the tourism office; the baggage consignment; a bar and a pub; a place for currency exchange and some shops as well. Two clubs are present dedicated to NTV and Trenitalia passengers. NTV is the new private rail operator competing with the state company Trenitalia.

The HSR station of Naples hosts also the temporary office space of Regus since September 2013. The Regus business centre is placed on the sixth floor of a 16-storey modernized building located directly inside the Naples Central station railway station. The workspaces offer clear views of the square and the area's historic buildings. The business centre is strategically located in the heart of the city's most important business and cultural centre, close to the financial district (see Fig. 2) [39].

3.2. Using Temporary Offices: The Results of the Revealed Preference Survey

A Revealed Preference survey was employed between January and October 2014. The questionnaire, submitted to Regus clients, was made of 21 questions concerning the socioeconomic characteristics of the clients, the transport mode chosen and the services used.

The Regus offices inside the HSR station in Naples. Source: www.regus.co.uk/locations/ business-centre/naples-garibaldi.

The total number of questionnaires collected was 172, and their information was used to start an exploratory study exercise. Tables 1, 2 and 3 report some results.

In Table 1 the socioeconomic characteristics of the clients are highlighted. It is possible to deduce that the majority of the clients are from Naples and/or Province (82%); there is a majority of men aged between twenty-five and thirty-five; most of the customers are freelance or managers with a monthly income between 500-1500€. Freelance clients are more represented w.r.t. the Italian population (23%) and the Naples one (see the Italian census www.istat.it).

Socioeconomic characteristics of the clients.

| City | % |

|---|---|

| Naples and Provences | 82 |

| Other Italian Cities | 18 |

| Gender | |

| Male | 63 |

| Female | 37 |

| Age | |

| 25-35 | 64 |

| 35-50 | 21 |

| 50 > | 15 |

| Level of Education | |

| High School | 57 |

| University | 43 |

| Professional Status | |

| Freelance | 44 |

| Manager/Employee | 46 |

| Retired | 4 |

| Student | 7 |

| Monthly income | |

| 500-1500 | 54 |

| 1500-2500 | 21 |

| 2500-3500 | 10 |

| 3500-4500 | 3 |

| >4500 | 12 |

Consequently, temporary offices are not necessarily used in relation to HSR services. Moreover, the monthly income is quite low. Indeed in Naples freelance are not necessarily rich.

Regus’s service type.

| Type of Room | % |

|---|---|

| Meeting Room | 29 |

| Office | 63 |

| Both | 8 |

| Type of Service | |

| Printer | 16 |

| Internet | 34 |

| Secretary | 29 |

| Phone | 21 |

| Who pays for the service | |

| Myself | 79 |

| My company | 21 |

In Table 2 the data about the type of services, chosen by Regus customers, are reported. Offices are chosen by 63% of the clients; secretary and internet (e.g., wifi connection) are the most required services. The rent has been mainly paid by the client himself/herself (79%). The rent per day depends on the surface. But for an office it is 69 Euro for the whole day and 30 Euro per hour.

In Table 3 the transport modes chosen by the clients to reach the Regus offices inside the Naples HSR station are reported.

Transport mode chosen by clients.

| Transport Mode | % |

|---|---|

| Car | 32 |

| Bus | 11 |

| Intercity Train/ Metro | 36 |

| Plain | 4 |

| HS: NTV | 3 |

| Trenitalia | 13 |

| Ferry | 1 |

| Motivation for choosing HSR | |

| Accessibility | 27 |

| Reduce travel time | 39 |

| Safety | 6 |

| Comfort | 15 |

| Frequency of Service | 12 |

| Motivation for not choosing HSR | |

| Living in Naples | 45 |

| Travel costs | 21 |

| Too many transfers | 11 |

| Inconvenient | 24 |

| Travel time |

Not a high percentage of clients have chosen the HSR alternative (only 16%) but this behavior can be justified by the recent opening of the service, which is not yet deeply advertised and therefore known by the people. This transport alternative has not been chosen by those living in the city of Naples, 45%, and by those who have found it expensive (21%).

It is very interesting to highlight from the sample that 37% of clients has chosen the Regus office because it is located inside the HSR station. From the data, it is also possible to understand that around 40% of the clients are positively affected by the presence of the Regus office, being inside the station. But as already stated, this station is also the traditional rail station, served also by metro lines. Moreover 49% have chosen Regus due to the provided services. In Naples the total floorspace dedicated to offices is equal to 126,000 m3 (www.ilsole24ore.com), 32% is owned and the remaining 68% is available for renting. According to some experts the rent of an office of 20 m2 in the city centre near Garibaldi square is between 300 and 400 Euros per month (http://www.tecnocasa.it ; www.property-italy.immobiliare.it).

In Table 4 the motivations of choosing Regus temporary offices by the clients travelling by HSR are reported. 37% of the total has chosen the Regus office because it is located inside the HSR station. From the data, it is possible to understand that around 40% of the clients are positively affected by the presence of the Regus office, being inside the station. But as highlighted before, this station is also the traditional rail station, served also by metro lines.

Reasons for choosing HSR and Regus offices.

| % | |

|---|---|

| Regus offices chosen because they were inside the HSR station in Naples |

37 |

| HSR was chosen because the regus office services were cheaper | 3 |

| HSR was chosen because of the provided services | 12 |

| Regus office were chosen because of the provided services | 49 |

The percentage of HSR users renting Regus offices, whose hometown is outside Naples and province, is shown together with the monthly income of the clients (see Table 5). This analysis shows that HSR clients have also low income!

The number of Regus clients spending more than a night in the city of Naples is also reported. It is interesting to note that 50% of the Regus clients, choosing HSR, spent 2 nights in Naples. It seems that they don’t come in Napoli just for a meeting.

Income and time spent in Naples by clients choosing HSR.

| Income of HSR clients | % |

|---|---|

| 500-1500 | 44 |

| 1500-2500 | 33 |

| 2500-3500 | 15 |

| 3500-4500 | 0 |

| No Income : Student | 7 |

| Time spent in Naples | |

| 2 Nights | 50 |

| 6-12-Hours | 18 |

| Other : Departing from Naples | 32 |

CONCLUSION AND FURTHER PERSPECTIVES

The advances in computer technology and telecommunications have provided an opportunity to change the location of activities in which people participate. Indeed, nowadays work is becoming more and more mobile. Thanks to the introduction of new charming technologies like smartphones, tablets, etc. new models of lifestyle are proposed to workers and mainly to the mobile workers. The latter are professionals who spend part of their time working in different places. They usually do not own head-offices.

This new phenomenon is supported by Regus which, with a global network spanning in 500 cities and in 85 countries, is the world’s largest provider of innovative workspace solutions. It enables customers to grow revenues, reduce costs, increase profitability, providing comfortable working environments, wherever people are. Indeed “everywhere you want to be” is the slogan promoted by Regus! Flexible offices, placed in city centres, business parks, retail centres, but also inside airports, HSR stations and service stations. Transport terminals become places to work and this is the real revolution. Fully furnished flexible offices are proposed with administrative support, free internet access, catering options at hourly pricing. Access to business lounges and cafés are provided as well to mobile professionals.

Although it can be considered a paradox, a more flexible work, outside the office, can allow improving the quality of life. “Living” in different ambiences can represent a “breath of fresh air”.

For many managers it is clear that letting their employees stay at home all day represent not a good idea. Many workers think that it is hard to concentrate on their work when distractions like housework, daytime television, etc., surround them.

Therefore for policymakers, combining the advantages of staying at home with the benefits of going to work (i.e. nice working environment and meeting colleagues) can be a solution.

The new concept provides commuters with an alternative. In the Netherlands, instead of making the stressful and time-consuming journey into Amsterdam every morning, workers can go to a place closer to home, doing nearly all of the things they would normally do at their place of work [40].

Within this new trend, transport terminals have been chosen as perfect places where to locate these temporary offices, being strategic nodes for meetings. Indeed very interesting is the case of the HSR station of Naples in Italy, proposed in this paper, which hosts the Regus business centre on the sixth floor of a 16-storey modern building.

An important outcome of this RP survey concerns the fact that these services have been used by local workers with low monthly income. Specifically 82% of the sample comes from Naples and its province. But what is surprising is that offices are more rented by workers than by companies, probably due to the fact that freelance are numerous! Linked to the first point, only 16% choose HSR. In this case, temporary offices, placed inside the station, are used by local workers and not only by mobile workers on long distance, thus confirming the new trend of working inside a third place near his home.

Another outcome of the RP survey has been that 37% of the clients (reaching these offices by HSR) have chosen temporary offices because of their location being inside the HSR station. Indeed this HSR station is a classical rail station, also served by metro lines. The global accessibility seems to have an impact in this context.

Lastly, in Naples, temporary offices are chosen due to the provided services. In this case, temporary offices are also chosen by workers and companies in order to save money.

Further perspectives will consider the collection of other interviews, increasing the accuracy of the results obtained. The same analysis can be extended to other Regus offices in Italy, such as in Milan, Rome and Turin. Naples has represented a test site for this kind of analysis. Other HSR stations in other countries can also provide interesting insights. Lastly, future perspectives will deal with the real challenge that still remains, i.e. to understand whether temporary offices placed inside transport terminals can modify workers’ trip behavior, changing the trip itself.

CONFLICT OF INTEREST

The authors confirm that this article content has no conflict of interest.

ACKNOWLEDGEMENTS

The authors would like to thanks the Labex Urban Futures of Paris Est University for having allowed their cooperation.