All published articles of this journal are available on ScienceDirect.

High-Speed Rail, Corporate Real Estate and Firm Location in the Central Business District: The Results from Two Surveys (2008; 2014) in Reims

Abstract

The arrival of High Speed Rail (HSR) often gives rise to a development of office and corporate real estate programs around the central station where firms are expected to locate. But the question is to know if HSR is, in itself, a location factor or if it induces an indirect effect by triggering a supply of business real estate, which then explains the location of firms. The aim of this paper is to identify the exact role of HSR in firms’ choice of location, and on real estate supply, at the time of opening of HSR services and during their development.

We analyzed the case of Reims, a city served since 2007 by the Eastern Europe High Speed Line. Its district near the central station has been transformed into a so-called business district. Two surveys interviewing firms were conducted in 2008 and 2014 respectively. The results of the first survey clearly show that use of HSR does not directly explain the location, but the image effect it generates real estate investments. Such programs quickly find real estate buyers and tenants, mainly local ones, but less from companies outside the city. The second survey makes it possible to identify whether the dynamics noticed in the short term, where strong expectations existed, are still relevant seven years later. Interviews with developers and investors make it possible to identify the reasons why they have invested in this district. This last survey shows the importance of local developers, local public stakeholders and of land availability, but also that HSR becomes, for some firms, a direct location factor.

1. INTRODUCTION

High-Speed Rail (HSR) arrival induces urban renewal and the creation of a business district around the station. It often gives rise to significant development of office and corporate real estate programs especially around the central station where, in many cases, business services firms choose to locate. But why do firms locate there and what is the role of HSR in this location choice? Does HSR have an impact, in itself, on firm location choice or does it have an impact on real estate decisions? Do firms use HSR services or just need new offices compliant with the current standards? What is the main location factor of these firms and why do developers and investors choose to build and invest in these areas? The aim of this paper is to identify the exact role of the High-Speed Rail Line and the HSR services in the location choice of firms and in the decisions of real estate stakeholders, on opening of the HSR services and subsequently.

From an empirical point of view we analyzed the case of Reims, a city located 150 kms from Paris and served since 2007 by the Eastern Europe High Speed Line. Its old infamous Clairmarais district near the central station has been transformed into a so-called business district. Two surveys have been conducted, the first in 2008 and the second in 2014.

This paper is organized as follows: in section 2, the literature concerning HSR services and firms’ location choice as well as the literature concerning HSR services and business real-estate will be presented. The case study of the Clairmarais district in Reims will be analyzed in section 3, whilst section 4 contains some concluding remarks.

2. FINDINGS FROM THE LITERATURE CONCERNING THE INTERACTIONS BETWEEN HSR, FIRMS’ LOCATION CHOICE AND BUSINESS REAL ESTATE

One of the effects most frequently expected from HSR is economic development. Ex-ante analyses suggest that HSR could increase the attractiveness of served areas [1-4]. More precisely, it is expected that HSR would attract new firms, especially in domains related to metropolitan activities such as business consultancy, research & development, etc., [2, 3, 5-11] and will induce relocation of some activities (offices) in cities which are served by HSR, particularly larger cities [9, 12-14] or in big intermediate cities [10]. But there is no global evidence [8] and the reality of these effects can be said to be debatable.

For some authors, HSR services play a role in the attractiveness of locations due to improved accessibility at intra-regional level [15]. But this effect exists at intra-regional level and not at the inter-regional level [15]. In other words, it only concerns firms already located in the same city or region before the arrival of HSR. There is no significant modification in the capacity to attract firms from other regions [16]. For others, HSR is rarely, in itself, a location factor [6, 9, 17, 18]: “the TGV [‘Train à Grande Vitesse’, the French high speed train] was only one factor considered by businesses in the decision to locate in a town or a city and no business relocated primarily because of the TGV service” [9, p. 24]. Certain authors consider that it depends on the type of station, whether peripheral or central [19]. Among peripheral ones, there is considerable heterogeneity due to promotional policies [20]. Finally Willigers and Wee point out that, in the case of the Netherlands, it depends on the kind of HSR services: if “international HST services can have a considerable impact on the attractiveness of an office location (…), domestic HST services are less important for location choices” [21, p. 9].

Other contributions in the literature point out that HSR service induces real estate operations and more generally leads to urban renewal around the central station, whose district previously appeared to be unsafe. Before the implementation of HSR services, the stations are renovated and then they become transportation hubs for different flows at different scales [22], even becoming urban hubs [23]. These actions are often a part of a larger project of urban renewal of the station area with the development of residential, commercial and office real estate projects. The old areas around the stations are replaced with business districts [22, 24-30]. Indeed by releasing land due to the reorganization of the station, HSR services can generate new opportunities in terms of business as residential or commercial real-estate developments [6, 9, 10, 12, 17, 18, 25, 26, 31-35]. The real-estate investors position themselves in stations of different HSR cities in France: in Tours and Le Mans where the Tours-based developer Art & Bat (groupe EPRIM) has invested, and in Reims (cf. infra). It is also the case in big cities such as Lyon, Nantes or Lille where, for instance, Regus has located business centres around HSR stations in 1997 and in 2008 in Lyon in the Part-Dieu district, in Lille near the Lille Europe new station, then in 2011 in Nantes in the Euronantes business centre.

In this dynamic, public stakeholders play a central role. Indeed, if the new real-estate supply around stations depends on developers’ strategies, they also depend on public strategies (see also [36]). The public stakeholders implement public policies to orient land availability to specific use, to renew the station district; they conduct actions to develop collective infrastructures, car park creation, and so on. These public policies linked to HSR services contribute to improving the district’s image. These stakeholders give a positive message to the developers concerning the future use of this district. This message encourages the developers to develop a new business real-estate supply around the train station. Many renewal and rebuilding projects are carried out. These areas are often transformed into business or commercial centres. This evolution can increase visits to these areas and their accessibility, but not only in terms of transportation [23].

Consequently the station can be analyzed as an urban object that gives rise to urban collective action [35] and HSR arrival as a tool for the urban project too [32, 37, 38].

3. THE CLAIRMARAIS CASE STUDY IN REIMS

3.1. The New High-Speed Rail Service in Reims

The East European High-Speed Rail service, which started in June 2007, modified the French and European transportation map and the accessibility of the cities that it serves. Reims possesses two rail stations a few kilometers apart. Champagne-Ardenne Station is the interconnection station which is located in Bezannes, a small village near Reims. It primarily serves domestic destinations in French provinces and enables three daily round trips (RT) to the Paris-Est station, as well as serving international HSR traffic, usually requiring prior connections (Fig. 1). The Reims central station only serves the Paris-Est station by HST.

The high-speed rail network in France.

Table 1 indicates the former week and weekend schedules to and from Reims, and the new ones, as well as the changes in journey times.

Modification of the journey times from both Reims stations to major cities in France since 2007.

| Before June 10th, 2007 | In 2009, after HSR arrival | Time-saving | |

|---|---|---|---|

| Paris Est | 1 hr35 | 45 min | 50 min |

| Gare Meuse | Not served | 30 min | New service |

| Gare Lorraine | Not served | 40 min | New service |

| Metz | 3 hrs10 (direct) | 47 min | 2 hrs 23 |

| Luxembourg | Not directly served | 1 hr 31 | New service |

| Strasbourg | 30 min + with a change in Epernay (15 min) + 2 hrs 30 = 3 hrs 15 | 1 hr 55 | 1 hr 20 |

| Marne-La-Vallée-Chessy | Not served | 30 min | New service |

| Roissy-Charles-de-Gaulle | Not served | 30 min | New service |

| Lille | 1 hr 35 + changing rail stations in Paris (45 min) + 1 hr 05 = 3 hrs 25 | 1 hr 25 | 2 hrs |

| Nantes | 1 hr 35 + changing rail stations in Paris (45 min) + 2 hrs 15 = 4 hrs 35 | 3 hrs 15 | 1 hr 20 |

| Rennes | 1 hr 35 + changing rail stations in Paris (45 min) + 2 hr 05= 4 hrs 25 | 3 hrs 15 | 1 hr 10 |

| Bordeaux | 1 hr 35 + changing rail stations in Paris (45 min) + 3 hrs 15 = 5 hrs 35 | 4 hrs 25 | 1 hr 10 |

| Le-Havre | 1 hr 35 + changing rail stations in Paris (45 min) + 2 hrs 30 = 4 hrs 50 | 4 hrs | 50 min |

The Reims central station is thus connected to Paris in 45 minutes with eight round trips per day during the week. Reims is also connected to other French cities (via the Champagne-Ardenne station) and benefits from better accessibility.

3.2. The Clairmarais District

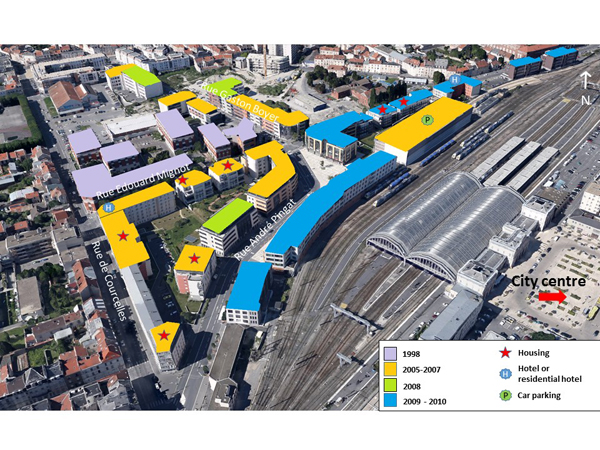

The Clairmarais district is located 5 minutes’ walk from the city centre just behind the central rail station of Reims (Fig. 2). Decrepit buildings, wastelands, industrial activities and housing occupied by low-income households could be found in this area in the past. Since the mid-1990’s, the public authorities have wanted to create a business district there. Some industrial buildings were renovated at the time for businesses. Consequently, in 1997, the Credit Mutuel Nord-Europe bank acquired 2.5 hectares of brownfield zone, originally built in 1920, and renovated it gradually as office buildings intended for tertiary sector firms (CAR, 2004). Over the period 1995-1998, about thirty companies moved into these five renovated buildings (totalling 20,000 square meters).

Real estate operations in Clairmarais district.

The thinking of various private and public stakeholders (City of Reims, the French National Railway Company SNCF/Société Nationale des Chemins de Fer, the French Railway Infrastructure Manager RFF/Réseau Ferré de France1, banks and real-estate developers) concerning the transformation of this district has been sped up by HSR arrival expected for 2007. SNCF renovated the rail station and created direct access to this area; the city centre is on the opposite side of the station. SNCF released the land bordered by the street named Rue Edouard Mignot behind the rail station, which was occupied by its buildings, old rail lines and a high-rise car park. A new street (Rue André Pingat) was opened and offices as well as residential buildings were developed. An underground car park was also built on this land.

This first phase was extended to a new street (Rue Gaston Boyer) with 20,000 square meters of offices and nearly 150 dwellings. The buildings are located in a triangle made up of the streets Rue André Pingat, Rue Courcelles, Rue Mignot and Rue Gaston Boyer. The public authorities wanted to impose a mix of activities (housing and economic activities) in this district. This constraint led an important national developer to give up its projects in this area. It was thus a local developer who carried out the principal operation. Other developers created offices arranged as customised open-plan offices or traditional offices for sale or rent, as well as a hotel residence with 106 rooms plus dwellings.

In 2008, a second phase of 10,000 square metres of offices and a premium category hotel were delivered. The third phase, which corresponds to the constructions nearest to the station, amounts to approximately 30,000 square metres and nearly 150 dwellings, built in 2009-2010. The last phase, made up of the buildings which are further away from the rail station, was launched later. Lastly, 70,000 square meters of offices and 500 residential units were built during this period.

These new buildings contribute to solving the issue of a lack of offices compliant with current standards. Relocation within the city of firms and administrations that were lacking in space in their original buildings or housed in unsuited buildings took place here.

3.3. The Main Results From the Survey of the Firms

3.3.1. The Activities and Firms in the Clairmarais District

The image of Clairmarais district is now completely new. One hundred firms are located there and 43 firms responded to a quantitative and qualitative survey aimed at identifying the types of businesses located in the area, their location factors, the HSR impact on location choice and their current use of HSR. The survey was administered using a questionnaire, conducted by phone or mainly face to face. A similar survey was conducted in 2008 and allows comparative analysis of the results.

HSR is expected to induce arrivals of new firms, especially in metropolitan activities, business consultancy and research laboratories. However, established firms are mostly local. Among the firms located in the buildings constructed in the Clairmarais district (Table 2), many operate in financial and insurance activities (38.1%), scientific and technical activities (23.81%), administrative and support services (23.81%), or public administration, education, healthcare and social work (16.67%). These figures are totally different from what is observed throughout the city as a whole and what was observed in 2008.

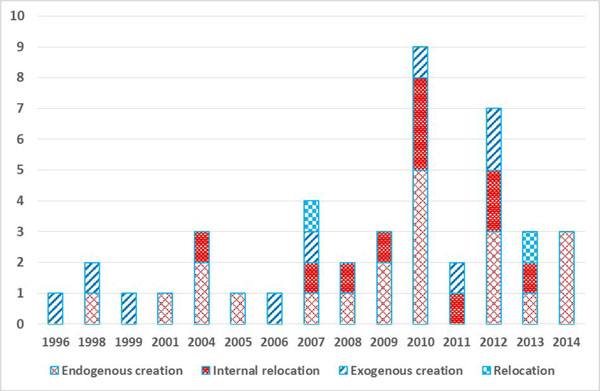

At the time of the first survey, almost a quarter of the investigated firms had moved into the district before 2006 (Fig. 3 and Table 3).

Activity sectors in Reims (2012) and Clairmarais (survey 2014 and 2008).

| Activity sectors (No. of firms) | Reims (2012) |

Clairmarais district (survey 2014) |

Clairmarais district (survey 2008) |

|---|---|---|---|

| Agriculture, Industry and Manufacturing | 6.04% | 0.00% | 3.13% |

| Construction | 9.36% | 0.00% | 9.38% |

| Trade; repair of cars and motorcycles | 23.63% | 7.14% | 3.13% |

| Transport and storage | 2.72% | 4.76% | 3.13% |

| Hotels and restaurants | 5.76% | 2.38% | 3.13% |

| Information and communication | 2.86% | 4.76% | 6.25% |

| Financial and insurance activities | 6.10% | 38.10% | 9.38% |

| Real estate activities | 5.09% | 2.38% | 9.38% |

| Scientific and technical activities; administrative and supportservices | 15.89% | 23.81% | 28.13% |

| Public administration, teaching, healthcare and social work | 14.97% | 16.67% | 18.75% |

| Other types of business | 7.56% | 0.00% | 6.25% |

| Total | 100.00% | 100.00% | 100.00% |

Attractiveness existed before HSR arrival. However, a significant number of new firms relocated to this district after this change. The relocation can result from an endogenous or exogenous creation in the urban area, or from a relocation of local activities or exogenous ones.

The results of the analysis conducted in 2008 and in 2014.

| Type of location | Survey in 2014 | Survey in 2008 | ||||||

|---|---|---|---|---|---|---|---|---|

| Before 2006 | After 2006 | Total | % | Before 2006 | After 2006 | Total | % | |

| Exogenous creation | 3 | 6 | 9 | 21.43% | 3 | 3 | 6 | 18.7% |

| Relocation | 0 | 2 | 2 | 4.76% | 3 | 1 | 4 | 12.5% |

| External sub-total | 3 | 8 | 11 | 26.19% | 6 | 4 | 10 | 31.2 % |

| Internal Relocation | 1 | 10 | 11 | 26.19% | 8 | 11 | 19 | 59.4% |

| Endogenous creation | 5 | 15 | 20 | 47.62% | 1 | 2 | 3 | 9.4% |

| Internal Sub-total | 6 | 25 | 31 | 73.81% | 9 | 13 | 22 | 68.8 % |

| Total | 9 | 33 | 42 | 15 | 17 | 32 | ||

| % | 21.43% | 78.57% | 100.00% | 46.9 % | 53.1 % | 100% | ||

In the Clairmarais district, it is mainly firms from Reims (73.81%) that decided to relocate there (26.19%) or which were created (47.62%) by local stakeholders.

Exogenous creations and relocations resulting from decisions of stakeholders outside the urban area of Reims, account respectively only for 21.43%, and 4.76%, i.e. only 26.19 % of the overall establishments. In comparison with the previous survey, the significance of endogenous creations compared to relocations should be noted.

Type and date of relocation.

3.3.2. Location Factors Self-Reported by Firms

The study of factors listed by the firms in 2014 to explain their location shows the importance of office availability (20.24%), HSR (11.90%), the image of the district (10.71%) and proximity of clients (10.71%) (Table 4a). However, the importance of these criteria in the choice of location of firms is very different.

The survey clearly shows that office availability is very important. It allowed many firms, of which nearly 75% are of local origin, to find offices corresponding to current standards. These buildings are more pleasant and adapted to their activity in terms of equipment or size. The location of firms inside the city in this district thus coincides either with their growth in activity and previous buildings that were too cramped or more often with a new activity.

Proximity of clients appears more important in 2014 than in 2008 (Tables 4a and 4b). In the case of services like banking services where clients are local, a central location confers a major asset in maintaining the existing market or widening it. At present, the Clairmarais district’s image is different from the image it had before the arrival of HSR and urban planning changes. The firms consider that this image can improve their reputation and business.

The results of the analysis conducted in 2014.

| Location factors | Numb. | Frequency (%) |

|---|---|---|

| Offices availability | 17 | 20.24% |

| HSR | 10 | 11.90% |

| Image of the district | 9 | 10.71% |

| Proximity of clients | 9 | 10.71% |

| Proximity of the city centre | 7 | 8.33% |

| Proximity of the highway | 5 | 5.95% |

| Rail station | 5 | 5.95% |

| Rent cost | 5 | 5.95% |

| Accessibility | 4 | 4.76% |

| Public transport | 3 | 3.57% |

| Car park | 3 | 3.57% |

| Proximity of services | 2 | 2.38% |

| Image of Reims | 1 | 1.19% |

| Existing activity | 1 | 1.19% |

| Employment area | 1 | 1.19% |

| Proximity of head offices | 1 | 1.19% |

| Vicinity of home | 1 | 1.19% |

| Total | 84 | 100.00% |

Location factors self-reported by firms in 2008.

| Location factors | Numb. (%) |

|---|---|

| Office availability | 23,3% |

| Proximity of the city centre | 20,5% |

| Proximity of the highway | 17,8% |

| Proximity of the station | 15,1% |

| Proximity of clients | 6,8% |

| Accessibility | 5,5% |

| HSR | 2,7% |

| Business district | 2,7% |

| Rent costs | 1,4% |

| Student availability for jobs | 1,4% |

| Car parking | 1,4% |

| Growing and renewed district | 1,4% |

| Total | 100,0% |

The location factors linked to accessibility (proximity of the city centre, highway and rail station) were also underlined by firms. Most of them do not consider global accessibility, but specific accessibility to an infrastructure or a place which appears essential for their activities.

If searching for new buildings remains the prime location factor (Tables 4a and 4b), the others are more varied than beforehand. Lastly, in comparison with the 2008 study, HSR became the second most quoted factor in 2014.

3.3.3. The Hierarchy of Location Factors Self-Reported by Firms

During both surveys, the firms could spontaneously classify the 3 factors that contributed to their location in this district by decreasing order of importance (Tables 5a and 5b). The analysis of prime location factors quoted by stakeholders shows the importance of client proximity (21.21 %), office availability (15.15 %), then HSR (12.12 %). As a second factor, the firms quote office availability (21.43 %), the image of the district (17.86 %) and the proximity of the city centre (14.30 %). Finally as a third factor, the firms still favour office availability (21.05 %), HSR (21.05 %), client proximity (10.53%), highway proximity (10.53%) and the existence of car parks (10.54%).

Consequently, if office availability is always the first location factor, it seems less important in 2014 than in the previous study, whereas proximity of clients is more important. Two elements can explain this point: firstly, it can be due to the functional mix of the district, which allows broadening of the market. Secondly, it can be due to the willingness to explore the Parisian market. Once again, HSR plays a more important role in 2014 than in 2008. It seems that it is overall accessibility which is important, as previously quoted [23].

Client proximity (as a 1st factor) corresponds to a standard profile of firms, which also locate due to

- Seeking available offices (28.60%),

- Benefiting from the image of the district (28.60%) and rail station proximity (14.30%).

Hierarchy of location factors self-reported by firms in 2014.

| Location factors | 1st Frequency (%) |

2nd Frequency (%) |

3rd Frequency (%) |

|---|---|---|---|

| Client proximity | 21.21% | 10.53% | |

| Office availability | 15.15% | 21.43% | 21.05% |

| HSR | 12.12% | 3.57% | 21.05% |

| Image of district | 9.09% | 17.86% | 5.26% |

| Rent costs | 9.09% | 3.57% | 5.26% |

| Highway proximity | 6.06% | 3.57% | 10.53% |

| City centre proximity | 6.06% | 14.30% | 5.26% |

| Rail station | 6.06% | 7.14% | 5.26% |

| Service proximity | 6.06% | - | - |

| Public transport | - | 7.14% | - |

| Proximity of head offices | 3.03% | - | - |

| Image of Reims | 3.03% | - | - |

| Existing activity | 3.03% | - | - |

| Accessibility | - | 10.71% | 5.26% |

| Employment area | - | 3.57% | - |

| Car park | - | 3.57% | 10.54% |

| Vicinity of home | - | 3.57% | - |

| Total | 100.00% | 100.00% | 100.00% |

Hierarchy of location factors self-reported by firms in 2008.

| Location factors | 1st Frequency (%) |

2nd Frequency (%) |

3rd Frequency (%) |

|---|---|---|---|

| Office availability | 40.0% | 8.0% | 20.8% |

| City centre proximity | 24.0% | 28.0% | 8.,3% |

| Station proximity | 12.0% | 12.0% | 20.8% |

| Client proximity | 12.0% | 4.0% | 4.2% |

| Business district | 8.0% | - | - |

| Accessibility | 4.0% | 8.0% | 4.2% |

| Highway proximity | 24.0% | 29.,2% | |

| Rent costs | - | 4.0% | - |

| Available students for jobs | - | 4.0% | - |

| Growing and renewed District | - | 4.0% | - |

| HSR | - | 4.0% | 4.2% |

| Parking | - | - | 8.3% |

| Total | 100.0% | 100.0% | 100.0% |

Cross-referring the first two location factors evoked by firms provides a wealth of information (Tables 6a and 6b).

First and second location factors self-reported by firms in 2014.

| 2nd location factor 1st location factor | None | offices availability | Image of district | City centre proximity | Accessibility | Public transport | Rail station | Car park | Enployment area | HSR | Rent costs | Vicinity of home | Highway proximity | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client proximity | 28.6% | 28.6% | 28.6% | 14.3% | 100.0% | |||||||||

| Available offices | 40.0% | 20.0% | 20.0% | 20.0% | 100.0% | |||||||||

| HSR | 25.0% | 50.0% | 25.0% | 100.0% | ||||||||||

| Image of district | 33.3% | 33.3% | 33.3% | 100.0% | ||||||||||

| Rent costs | 66.7% | 33.3% | 100.0% | |||||||||||

| Highway proximity | 50.0% | 50.0% | 100.0% | |||||||||||

| Rail station | 50.0% | 50.0% | 100.0% | |||||||||||

| City centre proximity | 50.0% | 50.0% | 100.0% | |||||||||||

| Service proximity | 50.0% | 50.0% | 100.0% | |||||||||||

| Existing activity | 100.0% | 100.0% | ||||||||||||

| Image of Reims | 100.0% | 100.0% | ||||||||||||

| Head office proximity | 100.0% | 100.0% | ||||||||||||

| Total | 15.2% | 18.2% | 15.2% | 12.1% | 9.1% | 6.1% | 6.1% | 3.0% | 3.0% | 3.0% | 3.0% | 3.0% | 3.0% | 100.0% |

More than a quarter of these firms do not give any other location factor.

On the other hand, firms forming another profile only search for offices as their first location factor and no other factor (40%); the others quote accessibility in general (20%) and public transport proximity (20%). One indicates the importance of the employment area as the second factor. Finally, firms in the third profile favour HSR (as a 1st factor) and city centre proximity (50%), available offices (25%) and highway proximity (25%).

Cross-referring of the first factor of location and the type of location is also interesting (Table 6b).

In the case of an intra-city relocation, firms are seeking client proximity (30%), available offices (30%) and lower rent costs (20%). In the case of endogenous creation, location factors are more varied even if the prime factors quoted are client proximity (17.65%) and HSR (17.65%). With regard to relocations, the firms seek city centre proximity (50%) and client proximity (50%). For exogenous creations, the reasons are very diverse: image of the district, rent costs, service proximity and HSR.

First location factors self-reported by firms and type of location in 2014.

| Location factor | Internal relocation | Endogenous creation | Exogenous creation | Relocation | Total |

|---|---|---|---|---|---|

| Highway proximity | 11.76% | 6.06% | |||

| City centre proximity | 5.88% | 50.00% | 6.06% | ||

| Rail station | 10.00% | 5.88% | 6.06% | ||

| Image of district | 11.76% | 25.00% | 9.09% | ||

| Available offices | 30.00% | 11.76% | 15.15% | ||

| Rent costs | 20.00% | 25.00% | 9.09% | ||

| Client proximity | 30.00% | 17.65% | 50.00% | 21.21% | |

| Service proximity | 5.88% | 25.00% | 6.06% | ||

| Head office proximity | 10.00% | 3.03% | |||

| Image of Reims | 5.88% | 3.03% | |||

| Existing activity | 5.88% | 3.03% | |||

| HSR | 17.65% | 25.00% | 12.12% | ||

| Total | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

The analysis of HSR use for work-related travel confirms that directors and managers travel regularly2 (Table 7). Over half of the directors and managers of firms which use HSR, use it once to several times per week, compared with only 35.71% for the employees. Half of the firms declare that the employees use it less than once a month in the year. However, 54.76% of the firms never use the HSR for their work-related travel.

The analysis of location factors and firms’ profiles shows a certain evolution since the first survey. In 2008, only two firms among 26 evoked HSR in their location choice, but they are much more plentiful in 2014. Moreover, the statistics confirm this use for work-related travel (Table 7). The evolution in the type of firms and sample-related bias in the studies in 2008 or in 2014 could perhaps partly explain these differences in the location factors. Thus, 65% of firms located in the district in 2007 were still located there in 2014.

However, another more efficient explanation can be advanced. Before the period of building in Reims which accompanied the arrival of the HSR, offices were lacking. Between 2006 and 2010, only the Clairmarais district could provide new buildings. With the extension of the Clairmarais district but also of the Bezannes area near the Champagne-Ardenne station and also of the Croix-Blandin area, choice becomes possible and firms less often chose the Clairmarais district for its office availability than for other needs. In addition, firms have completely integrated the advantages of HSR for their work-related travel, whereas it was not the case in 2008. HSR is thus a location factor but it is only the third location factor behind client proximity and office availability.

Frequency of work-related travel in 2014.

| Frequency of work-related travel | Director | Manager | Employee |

|---|---|---|---|

| 5/week | 2 | 0 | 1 |

| 3/week | 2 | 1 | 1 |

| 2/week | 3 | 1 | 0 |

| 1/week | 3 | 0 | 3 |

| Once to several times per week | 55.56% | 50.00% | 35.71% |

| 3/month | 0 | 0 | 1 |

| 2/month | 1 | 1 | 0 |

| 1/month | 2 | 1 | 1 |

| 15/year | 1 | 0 | 0 |

| Once to several times per month | 22.22% | 50.00% | 14.29% |

| 10/year | 0 | 0 | 1 |

| 5/year | 2 | 0 | 0 |

| 4/year | 1 | 0 | 0 |

| 3/year | 1 | 0 | 2 |

| 2/year | 0 | 0 | 1 |

| 1/year | 0 | 0 | 1 |

| Occasionally | 0 | 0 | 2 |

| Other rhythms | 22.22% | 0.00% | 50.00% |

| Total | 18 | 4 | 14 |

3.4. The Main Results of the Survey on Developers

In Reims, five real estate developers invested in the Claimarais district just before the arrival of HSR and just afterwards. A qualitative survey based on data collected from interviews was conducted with them and two others that invested in other districts of the city (Table 8). Three main results can be put forward:

First, local developers and investors joined with an external developer to build offices in this district.

The first operations were carried out as early as in 2004, when the HSR line was planned. This district had already begun to be occupied by some local companies, which indicated local demand for higher-standard tertiary sector premises, whether new or renovated.

The first important creations of tertiary sector offices (30.000 m²) in this district, just behind the station, were the result of an association between:

-A local developer from a small local family company whose activity was established in Reims.

-A national developer established in 10 French cities who began to invest in residential real estate in Reims in 2000 (a repositioning strategy without any link to HSR).

-A local bank subsidiary specialized in real estate investments.

This association of investors (one of them of strictly local origin, the two others positioned in the greater North-East of France) was an answer to the will of the city to develop a tertiary zone around the HSR central station.

The first operation found a buyer for two thirds of the real estate (for the regional head office of the French railway company which tried to regroup its activities) and the third part (initially without buyer) was sold very quickly. These investors also wanted, albeit in a more marginal way, to build apartment hotels (two hotels) and parking lots, since the will of the city was, at this time, to mix offices and housing in this district. This last one was classified as such (in the urban location plan or PLU) in order to avoid having housing only.

Other developers were interested in the district, but abandoned the project for two main reasons. On the one hand, the reason was the purchase prices of the land, which represented a risky operation for them. This was due to their poor knowledge of local demand. In particular, the risk was great for one of them, whose strategy was to build without buyers and therefore needed to sell quickly. On the other hand, others only wished to build residential real estate. At this time, external developers did not believe in the capacity of a city such as Reims to fill tertiary sector offices. Some of them invested for the first time in the city centre of Reims (a major one invested massively in 2008 near to the hyper-centre and in 2010 within the hyper-centre) in residential real estate.

Consequently, seven years after the arrival of HSR, it is possible to observe a set of stakeholders with unequal knowledge of the market and with different investment strategies.

Secondly, as quoted before, the essentially endogenous demand can be satisfied by the supply of significant land reserves in this district. According to developers and investors interviewed, there was a very significant demand for relocation of business activities previously located in the city centre. These offices were too cramped and confronted with car parking difficulties. We can then qualify what happened as a “HSR effect” only insofar as the city waited for the arrival of HSR to offer a coherent set of land reserves in this district. As in many cities, the city itself thus wanted to create an HSR effect. This considerable demand also resulted from evolution in legislation, relative to binding obligations concerning accessibility for disabled people to offices, as well as new insulation standards.

The need to have access to new technologies also contributed to the demand for new premises, which allow pooling of equipment, meeting and conference rooms. Being located in this district could also allow firms to visit clients located in Paris more easily and to better absorb the growth of anticipated activity. Consequently, the district attracts more exogenous activities (estimated at approximately a third) than other office areas in the city. The High Speed Train station in Bezannes, for example, is more characterized by endogenous relocation, according to the interviews with the developers.

Besides, the demand for relocation of Parisian activities never emerged.

Thirdly, the role of urban governance appears to have been essential in explaining the building dynamic in this district. The city’s policy seems to have been a determining factor in the tertiary destination of this district. It obliged developers and investors to build mixed surfaces (office and residential real estate). This immediately excluded investors only interested in residential investments, as was the case with the major national investors. In this way, the city's urban planning service facilitated the creation of this district in terms of land use. The city’s strong desire was combined with a large scale communication operation. Reims has created (with the “Reims-Epernay” chamber of commerce and industry) an economic development agency to promote the city to outside firms. This agency, called “Invest in Reims”, is (according to interviews) seen as a real facilitator in welcoming external business managers and as a genuine ambassador of the city at trade fairs.

Other communication operations, aimed at the Parisian public for instance, contributed to modifying the image of the city, previously considered as rather very quiet and conservative. The arrival in this district of an investor boasting the experience of Euralille (the business district at the central HSR station in Lille), reassured the city stakeholders in their will to obtain a quite similar dynamic, despite a very different context in terms of city size. This strategy, which intends to reproduce the dynamic of bigger cities, has been decisive in the current destination of this district. The junction of the historic façade of the HSR station with the hyper-city centre and the arrival of the tramway three years after HSR also contributed to this policy in Reims.

HSR then became an additional location factor, associated with other transportation systems existing near to this district (highways, regional express trains, the tramway four years later, buses and taxis).

The image effect associated with HSR seems, at the beginning, to have been important only for local stakeholders. It is the city authorities, while drawing on examples of past experiences and through imitation, which believed in the future of the station district. The city decided to develop a tertiary and residential offer in this district. Local developers and investors also believed in the choices of the city. However, this dynamism has led some outside developers to choose Reims in the case where they had a new strategy of investing in medium-sized cities. In this case, HSR influences city managers and local developers that then influence outside ones. The investors also consider that HSR has tempered the effects of the crisis. Indeed, in this district, the marketing operations have worked relatively well in spite of the economic climate. This can appear as contradictory in a context where banks are quite nervous and where fiscal policy restricts the possibilities of revitalizing this type of activity.

Investors and the possible role of HSR in location choices in the Clairmarais district.

| Investigated investors | Geographic scale | Date of investment in Reims | Building in this district | Nature of buildings | Specificity | Cited factors relative to the choices of Reims for activities | Importance of HSR in the choice of Reims for developing their activity (and of the Clairmarais district if they built in it). |

|---|---|---|---|---|---|---|---|

| Montroyal | Local / regional | 1990 |

Yes |

Offices Housing |

Developer | Local roots | A HSR district able to develop - HSR allows the firms of Reims to find more markets in Paris. |

| Brooks | Local | 1993 | Yes | Housing | Developer | Local roots | In this period, they considered that it was an HSR district able to develop, but that HSR is very expensive and the economic crisis occurred. |

| Nord-Est aménagement promotion | Regional | 1999 | Yes |

Offices Housing Hotels |

Co-promoter (subsidiary of a bank) | Local roots | Easier marketing of real property in HSR districts - A HSR is an additional selling factor for external buyers - Markets are boosted thanks to the proximity of Paris. |

| Nacarat | International National Local |

2000 | Yes | Offices Apartment hotel Parking lots Student residence |

Developer (who experienced «Euralille») |

They are positioned in the 20 biggest cities in France + 2 at international level. | They had already invested in HSR districts and they perceived a possible dynamic for tertiary activities. |

| Pingat |

National Local |

2004 | Yes | Housing |

Architect, Developer |

Local roots | A HSR district able to develop. |

| Bouygues |

International National Local |

2007 | No | Housing (other districts, including the HSR station of Bezannes) | Developer | Desire to cover the territory - It is the more dynamic city in the department. | HSR is an additional location factor among others (they invested in the district of the Bezannes HSR station). |

| Lazard Group |

International National Local |

2008 | No | Offices (other districts, including the HSR station of Bezannes) | Investor (building without buyer) | Strategy of investment in medium-sized cities - dynamism perceived at trade fairs | Important role for a city of this size, but they withdrew from the HSR district in Bezannes because of the crisis, which made their investments very risky ones (without buyers). |

4. CONCLUSION AND FURTHER PERSPECTIVES

In the first survey, we underlined a paradox: firms relocated to business districts near the HSR Clairmarais station, but HSR was not an important location factor and, moreover, firms did not use HSR. We suggested that the important element in the location process was not the location factors of firms but the real estate supply.

We have shown that these firms had decided to relocate to this district mainly according to land availability. Since the behavior of real estate stakeholders (developers and investors) was not analyzed, we concluded that the important question was to know what role HSR plays in the real estate supply.

Our hypothesis was that HSR services are a tool for producing information on cities served, which decreases the perceived risks by investors and induces a modern image of the city and station district. In this process, we assumed that the role of local public stakeholders was central.

In this second survey our aim was to test a possible evolution of the location factors and to identify if the newly established firms were local ones or external ones, as well as the reasons why developers invest in this area.

This second survey allowed us to test this evolution and to check the validity of our previous hypothesis. The results were sometimes quite similar but also sometimes quite different concerning firms’ location factors.

Firstly, the firms were always mainly of local origin. This business district does not attract many external firms.

Secondly, we noted significant differences in the kinds of activities. Financial and insurance activities are now the most important sector in the district.

Thirdly, HSR is a more important location factor in 2014 than in 2008. Indeed, in 2008 there was a limited supply of new office premises elsewhere in the city. The companies had no real choices in terms of location. Nowadays, there is much more choice (several districts have built office premises: Croix Blandin, Bezannes, etc.); Clairmarais is a more central but also a more expensive district. Consequently, firms which have located there really need a central location and HSR for their travel.

Fourthly, client proximity is more important in 2014. This can be explained by the functional mix of the district that induces a local demand (for financial and insurance products) but also by the fact that HSR also allows a greater proximity to Parisian clients.

Concerning real estate stakeholders, since 2007, the city has attracted national investors that have built, but mainly in other districts. Before 2007, only one outside developer had built in this city, more specifically in the hyper-centre as early as in 2000. In 2004, this developer joined with two other local developers to invest also in this district. This can be analyzed as a signal that leads other outside investors to decide to invest. However, it is important to note that investments by outside developers also correspond to their general willingness to invest in medium-sized cities.

The perceived dynamism of the city is another reason. It is due to pro-active communication by the economic development agency “Invest in Reims” and also to the fact that when looking for mid-sized cities in which to invest, the presence of the HSR is reassuring.

Finally, it must also be underlined that the city authorities played a genuinely important role in the tertiary functional destination of this district.

Our previous hypothesis seems to be only partially validated. If there is an image effect, it is a local one for private and public local stakeholders. Developers and investors with local roots and the city’s willingness were critical to the district’s dynamism. They produce an image effect that can attract national developers and investors. The local authorities wanted to create a HSR effect in this district and this wish was partially transformed into fact seven years later. If the causality between HSR and firms’ location was only indirect in 2008, it is now both direct and indirect.

Lastly, it would also be interesting to study the Bezannes district, where the other HSR station is located, where a later but genuine dynamic is beginning to appear, where what is considered as the biggest private hospital in Europe is going to be located and where national investors were the first ones to invest, whilst they were more cautious in the Clairmarais district.

NOTES

1 RFF has been transformed in SNCF Réseau in 2014.

2 In 2008, there was no specific question concerning this point but during the interviews, many firms indicate that they do not use HSR.

CONFLICT OF INTEREST

The authors confirm that this article content has no conflict of interest.

ACKNOWLEDGEMENTS

The authors would like to thanks the students of Reims University (from the Management Logistics and Transport department of the IUT) who conducted the survey concerning firms’ location factors, as well as developers and investors who accepted to be interviewed. The authors appreciate the previous economic support of the Regional Council of Champagne-Ardenne and the current economic support of PREDIT (French program of research, experimentation and innovation in land transport).