All published articles of this journal are available on ScienceDirect.

Strategic Development of ASEAN Logistics Infrastructure

Abstract

Introduction:

The Association of Southeast Asian Nations (ASEAN) recently launched its ASEAN Economic Community (AEC), which could potentially revolutionize the economic output in the region through free movement of goods, people, and capital across borders. At this stage, several trade barriers still exist which limit successes in AEC.

Literature Review:

This article assesses strategic opportunities, weaknesses, and threats to trade in the region, with a particular focus on logistics infrastructure. A review and analysis of the quality of land, air, and sea transportation networks is provided.

Recommendations and Conclusion:

Recommendations are made pertaining to customs and investment policies, security, safety, and infrastructure development. AEC is found capable of achieving its goals given that trade participants have adequate means by which they can deliver their goods.

1. INTRODUCTION

The Association of Southeast Asian Nations (ASEAN) is a group of ten countries in Southeast Asia. Its members include Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. The region boasts natural beauty, fertile lands, abundant natural resources, and diverse demography. There are three primarily primarily-Muslim countries: Brunei, Indonesia, and Malaysia; five primarily-Buddhist countries: Cambodia, Laos, Myanmar, Thailand, and Vietnam; one primarily-Christian country: Philippines; and one secular state: Singapore [1]. Formerly colonized by multiple European powers, the region’s legal systems include elements from all major legal traditions: English common law, civil law, Islamic law, communist law [2]. There are twelve official national languages among the ten ASEAN members with English as the official language of the ASEAN group itself and the language of international business in the region [3]. These many differences make cooperation and a sense of community indelibly important to the region’s security and prosperity.

Bearing in mind the value of togetherness, ASEAN recently launched its ASEAN Economic Community (AEC), which unites the region as a single market wherein people, products, and money can move between countries without restrictions [4]. Although the trade bloc does not intend to curtail customs and immigration to the extent of the European Union (EU), and there is no indication that a single currency will be introduced, AEC is seen as a “game changer” [5]. In order to promote ASEAN member states to higher status in the global economy, AEC aims to harmonize policies and facilitate equitable development. Numerous obstacles obviously exist which ASEAN members are currently working to reduce. Perhaps the most urgent matter to address in AEC is intra-regional connectivity, transportation and communications networks that serve as a conduit for the robust free trade the union hopes to generate. Blyde & Molina found logistics infrastructure positively impacts foreign direct investment (FDI) [6]. Currently, infrastructure quality in eight of ten ASEAN states: all but Singapore and Malaysia; lags behind global average, which drags down regional economic productivity.

This article examines strengths, weaknesses, opportunities, and threats that significantly impede growth and development within AEC. Poorly constructed and managed transportation networks are found to act as trade barriers. The regional logistics environment: land, air, and sea; is discussed in detail. Transportation safety and security are major concerns that require immediate attention. Disparate customs policies were found to increase time and cost in the import/export process. As part of the new open-border agenda, ASEAN members are urged to harmonize customs procedures, reduce documentation requirements, and allow for electronic processing of shipments. The research indicated that intergovernmental cooperation is desperately required to provide adequate security and safety compliance in shipping industries around the region. Infrastructure investment opportunities were found in abundance, but investment policies should be amended to attract foreign investors. Further recommendations include the establishment of a regional consumer credit rating bureau.

1.1. Definitions and Objectives

For the purposes of this study, the term “logistics” is defined as the commercial transport of goods and/or people; “logistics infrastructure” is defined as any physical means used for the commercial transport of goods and/or people (i.e. roads, railways, air traffic systems, maritime channels and ports). Logistics infrastructure can also include “soft infrastructure,” which is defined as services that facilitate the flow of goods and/or people; this can include government processing at customs or border facilities, or commercial operation of vehicles, or handling of goods and/or passengers.

The purposes of this study were to (1) identify core ASEAN and AEC values, objectives, and plans, especially those with regards to transportation, logistics, and connectivity, (2) assess strategic strengths, opportunities, weaknesses, and threats in logistical networks that affect progress toward broader AEC goals, (3) quantify infrastructure, safety, and security deficiencies in the regional logistics environment, (4) qualify policy deficiencies which impede economic growth and development, and (5) offer policy recommendations that may contribute toward achieving AEC’s objectives by improving, expanding, or otherwise enhancing logistics infrastructure.

1.2. Procedure

Qualitative and quantitative data were retrieved electronically from governmental, intergovernmental, academic, trade and industry sources. Documents and statistical data were separated, and documents were classified by type (i.e. treaty, policy, academic journal, news article, etc.). Quantitative data were translated into tables and figures. Literature was holistically reviewed to compare AEC objectives and plans with existing conditions, to gain a sense of how successful plans have been. Logistics and transportation data were analyzed to determine strengths, weaknesses, opportunities, and threats to regional economies stemming from infrastructure. Recommendations were formed taking all available information into consideration.

2. LITERATURE REVIEW

The AEC officially opened on December 31, 2015. Under the singular umbrella of ASEAN, the region’s countries brand themselves as a unified single market in which goods, services, investment, capital, and skilled labor flow freely. Collectively, the AEC represents the world’s third largest consumer market, behind only China and India, with a population of over 622 million people. A single market and production base is one of the four pillars of AEC [4]. Although the AEC stops short of implementing binding directives comparable to those in the European Union, the free trade union is expected to ensure that ASEAN is globally-competitive, dynamic, and resilient.

AEC Economic Community Blueprint 2025 outlines general objectives for integration of multiple sectors with the intent of simplifying procedures, harmonizing regulations, and achieving sustainable development [7]. Blueprints for Political-Security and Socio-Cultural communities were also established under the Kuala Lumpur Declaration [8]. These agreements create a vision for ASEAN members to implement independently on the basis of good faith and pacta sunt servanda, which make performance of the treaty obligatory under Article 26 of the Vienna Convention on the Law of Treaties [9]. However, the Vienna Convention is not universally ratified within ASEAN, and the nature of dispute resolution in the region has led to some doubts over how successful AEC will ultimately be.

HSBC expressed concern that the ASEAN Secretariat has a small budget and limited powers to assist or coerce implementation of terms [10]. Although ASEAN agreements qualify as treaties under international law, the vagueness of some terms and the lack of dispute resolution or enforcement provisions in the documents reduce the likelihood that any specific action could be forced upon a member state by the Secretariat or other member states via a dispute resolution process [11, 12]. ASEAN has been criticized as having a weak central power. The U.S. Commercial Service determined, “The ASEAN Secretariat’s ability to implement agreed upon reforms at the national level remains weak” [13]. Thus, the extent to which the AEC’s mission is realized depends on the will of individual member nations. This structural difference between ASEAN and the EU does not necessarily mean that ASEAN will not succeed, but the question remains if all targets will be reached by 2025. In the meantime, ASEAN members need to focus on methodically, systematically making changes that improve their odds at satisfying requirements under AEC.

2.1. Connectivity

Growth rates in ASEAN are among some of the highest in the world, but millions of people in the region still suffer from poverty and lack of access to basic economics needs such as electricity, transportation, internet, and financial services. As a result, wealth inequality in the region is persistent. Infrastructure quality and poverty have been found to share an inverse correlation. Accordingly, ASEAN members have set out to spur change in the lives of individuals through investment in and development of basic infrastructure [14]. Ideally, the region will develop infrastructure such that they are linked together seamlessly as one community.

There are unique challenges presented in development of the Filipino and Indonesian archipelagos, whose infrastructure ratings have remained relatively low compared to those of other ASEAN members [14]. The obstacles that island nations face are not necessarily permanent; they merely need to adopt strategies that utilize the distinct strengths and opportunities available. For example, Indonesia and Philippines should naturally hold an advantage in maritime shipping and ports management for goods heading to Australia and the Americas. Similarly, the five GMS countries; Vietnam, Cambodia, Laos, Thailand, and Myanmar; hold a geographical advantage as land routes to mega markets in India and China. As ASEAN emerges further into the global economy, its own internal connectivity will strengthen the ability of individual nations and the group to provide efficient, effective, and timely transit of goods.

ASEAN connectivity can be split into physical, institutional, and people-to-people dimensions. Physical connectivity encompasses transportation, information communications technology, and energy. Institutional connectivity refers to harmonization of regulations, cooperation and communication on trade and economic issues, and investment liberalization and facilitation. People-to-people connectivity covers tourism, education, and culture [15]. None of these three areas of connectivity can be established or maintained without progress in the other two areas, and advancements in one area lead to progress in each of the other areas. Success in each of these synergistic elements of broader connectivity requires pursuit of macroeconomic growth that can only be achieved through the revolutionary AEC vision. Notwithstanding the potential economic turnaround that AEC represents for the region’s roughly 200 million living below the $2 per day poverty threshold [16], there exist structural and institutional barriers that even the most clearly-worded treaty cannot remove. For AEC to be the paradigm shift that economists hope, a metamorphosis must occur in Southeast Asia that rivals China’s economic miracle.

2.2. Trade Barriers

Souza et al. found foreign ownership regulations created significant barriers to free and open trade in ASEAN, where only Brunei and Singapore permitted complete foreign ownership and control [17]. Equity participation and licensing are among the issues foreign investors consistently face throughout ASEAN [18]. In Thailand for example, foreign land ownership is prohibited under the 1954 Land Code while in the Philippines it is constitutionally proscribed [19]. Further limitations are placed upon specific sectors, such as transportation. Regulations in Indonesia, Philippines, Thailand, and Vietnam preclude majority foreign ownership in air, surface, and maritime shipping companies [20], which undoubtedly restrains investment. Thangavelu found construction and engineering services were the most restrictive industries in every ASEAN member state [21].

Removal of intra-ASEAN tariffs alone does not provide remedy for the complex matrix of threats and weaknesses in the region. Nontariff barriers, including inadequate infrastructure, pose more significant risks to SMEs, which are the backbone of intra-ASEAN trade. In a study of 126 countries, Djankov et al. found that each day in transit reduced overall trade volumes by slightly more than 1.0% [22]. Hummels found that a one-day border delay increases costs by about 0.8% around the world. In developing economies, retail prices must be kept low enough for consumers on modest budgets to afford products [23]. Even the most miniscule pruning of profit margins can pose existential threats to businesses.

3. QUANTITATIVE ANALYSIS OF HARD AND SOFT INFRASTRUCTURE

Recent studies of global trade suggest that a mere 1% decrease in costs could result in a minimum income increase of US$40 billion, nearly two-thirds of which would occur in developing countries [24]. Intra-ASEAN connectivity and trade are key drivers of overall growth in the single market system [25]. An effective, efficient logistics service industry is fundamental to the region’s continuing productivity. As such, the Secretariat recommended focus on non-tariff barriers that impede movement of goods, services, vehicles, and people across borders within the group. Among the specific elements of a plan to improve ASEAN connectivity, the group has adopted visions to improve shipping and transportation via land, air, and sea. By improving road and rail networks, airports, and shipping infrastructure alongside harmonization of customs codes and procedures, ASEAN members hope that growth in intra-regional trade will keep pace with ASEAN-China and ASEAN-India trade growth.

Table 1 shows the quality of logistics infrastructure in six ASEAN members is poor. Singapore and Malaysia offer globally-competitive infrastructure; Thailand’s airports are likewise competitive, although it has room to improve land and sea infrastructure, particularly rail. The remaining five members cannot offer competitive means of transit, and therefore cannot take full advantage of opportunities in shipping economies.

| Roads | Rail | Ports | Air | |

|---|---|---|---|---|

| KH | 94 | 100 | 83 | 100 |

| ID | 80 | 43 | 82 | 66 |

| LAO | 83 | n/a | 130 | 94 |

| MY | 15 | 13 | 16 | 21 |

| MR | 136 | 96 | 123 | 132 |

| PH | 97 | 84 | 103 | 98 |

| SG | 3 | 8 | 2 | 1 |

| TH | 51 | 78 | 52 | 38 |

| VN | 93 | 48 | 76 | 75 |

The World Economic Forum ranked logistics infrastructure quality of ASEAN members relative to that in a sample of 140 countries [26]. With the exceptions of Singapore and Malaysia, ASEAN members’ infrastructure consistently ranked in the bottom half of the sample. Further analysis revealed that transportation and shipping infrastructures in ASEAN economies ranked lower than overall competitiveness, thus indicating that infrastructure is a strategic economic weakness in the group. WEF infrastructure evaluations were not contradicted by other indices, such as the World Bank’s Logistics Performance Index, wherein only Malaysia and Singapore ranked in the top quartile of 160 surveyed nations; Philippines, Cambodia, Myanmar, and Laos ranked in the bottom half while the remainder of ASEAN sat in the second quartile [27]. Most concerning is the fact that, between 2014 and 2016, all ASEAN members except for Myanmar fell in logistics infrastructure rankings on the World Bank index.

For cross-border trade to flourish, road and rail networks in the mainland GMS region need to be robust while seaports in the Filipino and Indonesian archipelagos must be expansive. UNDP considered transportation infrastructure as an essential factor in human development, particularly in rural areas [28]. A simple lack of paved roads in areas of Myanmar, Philippines, Cambodia, and Vietnam seriously limits the extent to which farming villages can participate in national economies, the aggregate effects of which can stall macroeconomic growth and development.

In a similar way, import and export delays block many SMEs from trade opportunities. Whereas SMEs create almost three-quarters of total ASEAN employment and just over two-fifths of GDP, they account for only about one-fifth of direct exports in ASEAN [29]. In contrast, SMEs accounted for about 70 percent of Japanese employment in 2015, contributing to half of the GDP and more than half of total exports. In the United States, SMEs contributed to roughly half of all employment in 2015, generating 46 percent of the GDP and over one-third of exports [30]. Although there are a host of other factors that constrain SME involvement in export economies, border procedures and delays remain a significant threat to businesses that cannot afford to carry costs for a week or longer while in wait at the border.

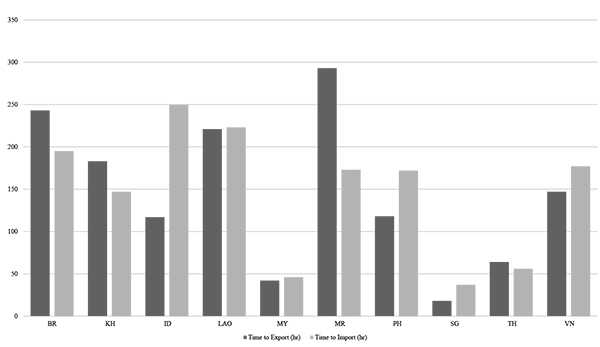

Fig. (1) shows a wide range of import/export times across ASEAN. Aside from Singapore, Malaysia, and Thailand, the group fails to offer timely services. Throughout the region, importers and exporters usually wait more for five or more days to complete their processes, which undoubtedly carries economic costs. If all ASEAN members could reduce cross-border times to less than 48 hours, like Malaysia and Singapore, the region would likely witness a dramatic rise in trade volumes and corresponding reduction in costs. Accomplishing such an ambitious goal would require implementation of electronic platforms for customs declarations and fees, and expansive transportation infrastructure development and enhancements. Progress toward reaching targets has begun as nine of ten ASEAN members have ratified the WTO Agreement on Trade Facilitation, which mandates, inter alia, border agency cooperation, a “single window” for traders to submit documents or data for transfer of goods, and electronic payment options [32].

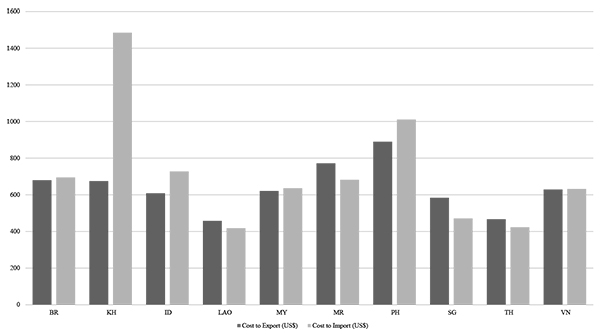

Fig. (2) shows import and export costs are usually between 400USD and 800USD, with exceptions in Cambodia and Philippines. Import and export costs should be virtually equivalent in a major trade union like ASEAN, although recent reports suggest disparity throughout the region where import costs are typically higher. The most notable difference is in Cambodia where domestic land transport is a tremendous financial burden. Producers, distributors, and consumers should all benefit from lower costs with single window and online documentary compliance platforms, uniform customs declaration rules, and expedited customs clearance within the single market system. Ideally, import and export costs in every AEC country should fall below $500 per unit.

Significant progress in reducing administrative overhead and time to delivery throughout ASEAN hinges on an overhaul of customs regulatory systems in each member state. Table 2 shows the number of documents required for import and export in each ASEAN state. Singapore’s requirement of three documents both to import and export is the only example of a globally-competitive procedure, though it should be noted that France managed to cut documentation compliance down to two pieces [30]. Most members require five or more documents for either procedure, which causes delay, frustration, and economic losses. For ASEAN to claim AEC is a truly integrated single market, document requirements should be equal in every country and for both import and export. If ASEAN members were to reduce the burdens of border and documentary compliance for importers and exporters to three pieces which could be filed electronically, AEC governments would simultaneously support businesses and preserve government resources for more intensive undertakings.

| Export | Import | |

|---|---|---|

| BR | 5 | 5 |

| KH | 8 | 9 |

| ID | 4 | 8 |

| LAO | 10 | 10 |

| MY | 4 | 4 |

| MR | 8 | 8 |

| PH | 6 | 7 |

| SG | 3 | 3 |

| TH | 5 | 5 |

| VN | 5 | 8 |

3.1. Land

Streamlining customs procedures only guarantees swift border crossings; delays and complications relating to transit within domestic territories remain an obstacle to strong, efficacious commerce. Domestic transportation times and costs are frequently higher in countries with less-developed road and rail networks. In Cambodia and Philippines, government or joint investment in transportation infrastructure is likely to result in decreased import and export costs. That savings would be passed on to businesses and consumers rather than wasted. The resulting economic value added would likely be greater than the nominal value of the costs saved. In order to full capitalize on trade potential, each of ASEAN’s ten member states must ensure ample, safe, and sustainable transportation networks.

Although two and three-wheel vehicle accidents account for more than half of regional traffic fatalities, road safety significantly impacts business productivity. A combination of lack of commercial highways and SME domination in regional commerce results in relatively low utilization of heavy trucks for road shipments. Instead, vans and pickup trucks are commonly used for transport [16, 34, 35]. Including buses that act as human-logistics transport vehicles, business vehicle fatalities sum to thousands per year. WHO estimated an ASEAN-wide GDP loss of about 2.28 percent due exclusively to road crashes [35].

Fig. (3) provides aggregated traffic fatalities for ASEAN. Thailand’s numbers are disproportionately high with regards to its population, with nearly three out of four deaths relating to motorcycles. Indonesia’s higher annual traffic fatalities may reflect its larger population, but 35 percent of those fatalities related to bus accidents, suggesting unsafe conditions in commercial road travel. Modest law enforcement efforts would prevent thousands of deaths, but to really solve the problem, land transport infrastructure also needs to be upgraded and expanded.

Traffic congestion is ubiquitous in ASEAN cities due in large part to urbanization and growth in middle class car ownership outpacing road construction, but transnational and international highway networks are also to blame. Highway border links are few and far between in the GMS, which forces traffic through cities on their its to other destinations. Cambodia shares only one highway border crossing with Vietnam, one with Laos, and two with Thailand. All highway traffic en route from Vietnam to Thailand or beyond through Cambodia must pass through Phnom Penh. Likewise, all ASEAN highway traffic going to or coming from Malaysia and Singapore passes through the Bangkok area. In 2008, less than 5% of ASEAN highways were access-controlled with four or more lanes [34]. Various projects have commenced and completed since 2008, but the lack of throughways in the region continues to make long distance road travel inefficient and inconvenient.

One possible solution that has garnered much media attention in recent years has been the addition of a high-speed rail line connecting Kunming, China with Singapore. Though the north-south line would not alleviate traffic woes for the entire region, it would undoubtedly relieve some or much of the passenger car congestion in and around Bangkok. Unfortunately, the rail project has stalled due to concerns over Thailand’s and Laos’ ability to absorb the colossal loans required to finance the line [36]. Several urban mass-rapid transit (MRT) lines are currently under construction in Thailand, Singapore, Malaysia, Vietnam, Philippines, and Indonesia, which will reduce travel time through cities and, perhaps more importantly, support the “innovation culture” needed to advance the region’s lofty economic agenda [37, 38].

Ingenuity and endurance will be required to patch up the 4,000 kilometers of missing or out of commission links in Cambodia, Laos, Malaysia, Myanmar, Thailand, and Vietnam. There are currently no active train lines in Laos or Cambodia and no connections between Thailand and Myanmar, leaving the entire GMS utterly unconnected by rail in an era when total connectivity is the vision [38]. Given its central location, Thailand could serve as a hub for land transportation, but not without spokes extending into Laos, Myanmar, Malaysia, and Cambodia [39]. If ASEAN intends to execute its connectivity aspirations by 2025, each country has to work independently toward the group’s goals, and that has yet to happen. In the absence of high speed international rail lines, there is no competition for the air travel industry, which has its own unique set of weaknesses and threats to overcome.

3.2. Air

The ASEAN single aviation market, or “open skies agreement,” which was fully ratified in early 2016, allows any designated airlines in the region to operate both passenger and cargo services to and from anywhere in the region without capacity or schedule limitations [40, 41]. The precise level of GDP growth that air services liberalization will bring is yet unknown, but it is expected to contribute billions of dollars annually [42]. Open skies is a milestone in ASEAN’s collective connectivity master plan at a time when intra-ASEAN travel is becoming more popular and global arrivals to developing nations surpass those to high income countries [43].

Air services facilitate movement of human and investment capital into and around the region. Tourism alone accounts for more than 10% of GDP in Cambodia, Laos, Malaysia, Philippines, and Thailand. International tourist arrivals to ASEAN exceeded 105 million by 2014, nearly half of which were intra-ASEAN arrivals. Through 2030, ASEAN arrivals are expected to grow at a rate greater than elsewhere in the Asia-Pacific region, and nearly one and one-half times greater than global rates. By 2025, GDP contribution of tourism in ASEAN is expected to increase to 12-15% [44]. Hence, airport infrastructure, competitive service markets, liberal transportation policies, and safety are major concerns for the health of regional economies.

Sharp increases in air traffic within the region coupled with lack of state-of-the-art air traffic flow management systems and procedures may be partly to blame for recent fatal accidents that occurred in Malaysia and Indonesia [45]. Thailand, which received over 28 million foreign tourists in 2015, had its air safety rating downgraded by the United States Federal Aviation Administration (FAA), signaling to experts that the region’s infrastructure may not be equipped to handle the immense growth in the aviation sector [46-48]. After the 2014 AirAsia flight 8501 crash in Indonesia, pilots complained of outdated equipment and delayed responses from air traffic controllers on congested routes, which cause captains to unilaterally change course to avoid weather [49]. Notwithstanding international scrutiny following Malaysian Airlines flight 370 and AirAsia flight 8501 accidents, ASEAN does not seem any less safe than Europe or North America by looking at statistics over several years [50].

Fig. (4) shows international arrivals in the ASEAN group as a whole, and in Malaysia, Singapore, and Thailand individually. Strong and increasing inflows of international visitors throughout ASEAN is a testament to the safety and reliability of its air services. However, as previously mentioned, several ASEAN members rank 80th or worse for quality of airport infrastructure, which is bad news for a region that counts on tourism for more than 10% of GDP. In the process of improving overall quality of air services, ASEAN members will have to invest in the same training and technologies that the FAA and other organizations recommend. AEC connectivity relies upon more than bare-minimum functionality and as such, the group has committed to a pan-Asia seamless air traffic management plan [52]. Now that the groundwork has been laid, ASEAN members need to focus on harmonized implementation; this final stage has been the most difficult step for the group, which relies upon consensus building rather than penalties for noncompliance with agreements.

3.3. Sea

Industrial economies rely upon maritime transport services to deliver raw materials like iron, oil, and grain. Billions of tons of cargo pass through ports and travel across seas each year. Globally, seaborne cargo transport accounts about 80% of international trade, including over half of the world’s oil supply [34]. More than fifteen million barrels of oil pass through the Strait of Malacca every day; only the Strait of Hormuz carries more oil [53]. More than eighty thousand bulk carrier ships; one third of global shipping traffic; transited the Straits of Malacca, making Singapore, Malaysia, and Indonesia key participants in the global economy by virtue of geographic location alone [54].

Given the importance of trans-ASEAN maritime shipping to both regional and global economies, safety and security are of crucial importance. In matters of such seriousness and complexity as ASEAN maritime logistics, the region’s countries are best served by joining major international treaties, which establish a basis for unified objectives and procedures. Every ASEAN member except Cambodia has ratified the United Nations Convention on the Law of the Sea [55]; a fundamental instrument that all ASEAN members should ratify as part of their pursuit of connectivity. Considering the substantial volume of oil that passes through the Straits of Malacca, all ASEAN states, except perhaps landlocked Laos, should join the International Convention on Oil Pollution Preparedness, Response and Co-operation [56]. Despite the obvious importance of the treaty, however, Malaysia was the first to join only after the 175,000-barrel spill in 1997; Singapore, Thailand, and Philippines followed [57, 58]. All nine ASEAN members that have coastlines are contracting parties of the three key International Maritime Organization conventions on safety, pollution prevention, and standards of training [59].

The relatively developed and unified maritime legal framework in ASEAN ensures states have similar visions regarding standards and practice, but as noticed in other areas of ASEAN cooperation and connectivity, treaty membership does not guarantee compliance or optimal implementation. Piracy and accidents are still a serious concern in ASEAN waters. In 2015, more than half of all piracy incidents reported in Asia occurred in the Straits of Malacca and Singapore [60]. Incidents involving Somali pirates have attracted the most media attention in recent years, but the number of attacks in the Somali region started on a steep decline following 2011-12. Since 2013, Indonesia pirates have been the most active worldwide insomuch that about 60% of incidents in 2014-15 were in Southeast Asia. In 2015 alone, there were 214 hostages taken at sea in Indonesia, Malaysia, and Malacca Straits [61].

On the matter of piracy, ASEAN Economic Community clearly cannot function satisfactorily without simultaneous emergence of the ASEAN Political-Security Community. Economic losses and insurance costs choke the profitability of ASEAN shipping companies without increased naval involvement in securing the waters around Singapore, Borneo, Sumatra, and Java. Ideally, most directly affected countries; Malaysia, Singapore, Indonesia, Thailand, and Vietnam; will be able to resolve the scourge of local piracy, but it may be in the best interest of economics to bring in third parties such as the United States, China, and Australia, whose interests are threatened by ongoing incidents. As an alternative or supplemental measure, governments or the insurance industry could incentivize ship owners to employ additional security personnel onboard [62]. Private security firms have succeeded in abating Somali piracy with floating armories [63], although such a strategy could be difficult to manage due to the relative absence of international waters in and around the Straits of Malacca compared to the Horn of Africa region. Regardless of the method, ASEAN members need to act swiftly and resolutely to combat terror on the seas.

While security forces are working toward eliminating piracy, private firms and individuals need to take steps to reduce the number of accidents at sea. Allianz found that the South China Sea, Philippines, and Indonesian region had the most accidents of any region in the ten years prior [64]. According to Allianz, the EU recently criticized the training standards of Filipino seafarers; who account for 40% of all seafarers worldwide. Overreliance on electronic navigation equipment was a key safety concern in the South China Sea, where cargo ships frequently encounter small fishing boats with poorly trained crews. Port calls, shifting sandbars, and submerged rocks and reefs pose significant threats in the congested shipping lanes in ASEAN. These conditions have been particularly challenging for Cambodia, which lost more than 9% of its registered fleet between 1997 and 2011 [65, 66].

Cargo ship losses are of concern for the region’s economy, but more distressing is the loss of thousands of lives in ferry accidents in Philippines and Indonesia between 2000 and 2014. Greater than two-thirds of these passenger ferry accidents were attributable to human error, including passenger error such as a case in Indonesia where passengers climbed atop the roof of the vessel to get a stronger cellular signal [67]. In view of ongoing loss of life and property in ASEAN, international cooperation on standards is required. As part of its connectivity plan, ASEAN members need to implement and enforce rules on seaworthiness of ships, safety equipment, crew training, bookkeeping, communications, reporting, compliance and monitoring. Risks of loss of life and property significantly impacts AEC growth and stability. ASEAN governments are obliged to create an environment that nurtures free trade, which cannot flourish while its participants are under mortal threat.

4. DISCUSSION

The literature review showed the two most common concerns regarding ASEAN’s potential as a globally competitive free trade union were the trade barriers and inadequate power of the ASEAN Secretariat. The latter issue was by design of the union. A review of the ASEAN Charter [68] and Declaration [69], and the Treaty of Maastricht [70] shows ASEAN was never intended to be an EU-style organization. ASEAN is currently suffering from a serious dilemma, whether shall sacrifice its economic goals for the sake of sovereignty or amend its agreement and acquiesce to a central Secretariat that can effect real change in the region.

4.1. Financial Policy

The quantitative analysis showed overburdened, inadequate, and declining logistical networks throughout the region. Transportation conditions persist despite FDI flows, which have increased since the global financial crisis. In 2014, ASEAN was the largest FDI recipient in the developing world, but more than half of those investments went to Singapore [71, 72]. Furthermore, while construction and transportation are needed to improve poor and declining infrastructure, the bulk of FDI inflows are in finance, manufacturing, wholesale and retail, real estate, and extractive industries; less than three percent came in construction and transportation industries. One apparent reason is ASEAN’s restrictiveness in those services. In preparation for the launch of AEC, member states adopted investment policies designed to provide greater transparency and opportunity for potential investors, but those policies have yet to produce results [21]. More substantial policy changes are required to lift ASEAN out of the middle and low income traps it has found itself in. The region cannot rely on the export-driven economics that worked prior to the financial crisis [73].

| Infrastructure Needs | |

|---|---|

| KH | US$12-16bn by 2022 |

| ID | US$235bn by 2020 |

| MY | US$100bn by 2020 |

| MR | US$320bn by 2030 |

| PH | US$110bn by 2020 |

| TH | US$105bn by 2020 |

| Note: Data from KPMG, [74] |

Table 3 shows a remarkable investment need in the seven lesser-developed ASEAN members through the year 2030. DiBiasio estimated as much as US$2.5 trillion in infrastructure investment will be needed in ASEAN through 2025, one-third of which is expected to go toward transportation [75]. In order to attract the more the trillion dollars or more investment needed within ten years, member states will most likely need to relax investment restrictions, including foreign ownership limits.

World Bank found “FDI remains artificially hampered by significant policy restrictions in foreign investment, especially in the services sector” [76]. Citing regional examples, it concluded that relaxing those restrictions would increase FDI. Despite the apparent negative relationship between FDI and foreign ownership restrictions, the World Bank found ASEAN countries impose stricter de jure restrictions than any other region. Philippines and Indonesia were the most restrictive of 73 countries surveyed, and Thailand and Malaysia ranked in the top ten most restrictive economies. To make matters worse, overall restrictiveness in recent years has increased in Brunei, Indonesia, Laos, and Malaysia [18].

Government spending will also play a critical role in developing ASEAN’s infrastructure, so tax compliance and fiscal policies should attract special attention. Private firms can capitalize on opportunities provided by government investment in infrastructure, but it is important that firms are confident risks are adequately managed so they do not face problems like was happened in the Donmuang Tollway case in Thailand. Walter Bau, a German firm, faced delays and complications with the majority-Thai board of directors, which led to sizeable losses for Bau. Although a 2010 arbitral tribunal awarded Bau 29 million Euros for Thailand’s breach of contract, the company was in liquidation by that point [77]. Private investors and partner companies will be seeking to profit within a specific timeframe, and governments need to accommodate their interests in order to benefit the overall economy through infrastructure development.

There are various means by which ASEAN members could fund their infrastructure projects, and so long as finances are made available, development objectives can be achieved. The bottom line is that infrastructure is desperately needed to accomplish short, medium, and long term growth. Given that the power of the ASEAN Secretariat is limited, each member and the group will have to rely upon the free market to attract investors and further progress toward total connectivity. Lifting the entire region out of low and middle income traps is a momentous challenge, but it certainly can occur with the proper amount of support, planning, cooperation, and advice.

RECOMMENDATIONS AND CONCLUSION

The Association of Southeast Asian Nations has set some lofty goals for economic development in the first ten years of AEC. By 2025, the group intends to be a globally-competitive single market, where goods, services, people, capital, and investments flow freely across national boundaries. Such economic growth and development could lift the region out of the low and middle income traps. However, AEC’s ambitions cannot come to fruition without significant improvements in multiple areas of political, legal, and financial activities both within sovereign nations and among the nations as a group. There are a multitude of changes that must occur for AEC to meet its targets. Our research yielded three main points of concern: lack of power in the Secretariat, inefficient customs procedures, and adversarial foreign investment laws.

Strengthen Central ASEAN Authority

The Secretariat was never intended to be a supranational governing body like the European Union, and while the spirit of consensus and voluntary submission to international objectives permeates the group at a base level, some have opined that the lack of coercive power vested in the Secretariat may ultimately leave AEC a fruitless enterprise. ASEAN members have committed to multilateral agreements aimed at harmonizing trade policies and improving regional economics through open borders, however, members may have insufficient incentive to comply if there is no potential for penalties. Although it is an unlikely amendment, ASEAN members should continually attempt to provide the Secretariat with greater authority to levy punitive measures against noncompliant states.

Increasing ASEAN supranational powers would likely result in greater cooperation in matters of military and security, which is essential in solving the piracy crisis in the Straits of Malacca. One-third of the world’s shipping traffic travels through the Indonesia and Malaysia. The ASEAN group could more effectively combat piracy in their waters if the Secretariat had authority to issue orders and back them up with penalties.

Improve Customs Procedures & Land Transport

Customs policies need to be harmonized with the aim of increasing efficiency. Small and medium enterprises need to be able to cut time and costs at borders to maintain profitability in a market dominated by multinational corporations. Documentary requirements need to be reduced and single electronic window should be created for importers and exporters. Even with expedited border clearance, trade cannot proliferate without roads, railways, and ports. Logistical networks in the region are the channels through which trade materializes and they desperately need repairs, upgrades, and expansions. Those trade routes also need to be safe and secure. ASEAN members need to ensure enforcement of road safety laws, freight and passenger carrier standards. Armed naval forces, particularly those in Singapore, Malaysia, Indonesia, and Thailand need to secure waterways.

Investment and Financing Policies and Procedures

ASEAN governments, in conjunction with the private sector, must cooperate with a common purpose in order to achieve their desired results of profitable, sustainable growth and development. Joint private/public investment is integral to AEC’s aspirations. In order to attract the investment it needs, ASEAN members will have to relax some foreign ownership regulations and ensure the monetary interests of private shareholders shall not be denied for political gain of domestic partners. ASEAN-wide consumer credit rating and reporting bureaus and judicial support for regional debt enforcement is likely to increase access to capital, and thus investment.

Banks will need to have access to income, asset, and debt profiles of applicants to facilitate development. An ASEAN-wide consumer credit bureau would be a wise addition as commerce and investment continue to grow across national boundaries. If lending institutions can gain access to a single credit reporting system which all ASEAN members contribute to, they can make better analyses, minimize their risks, and maximize credit opportunities. A regional credit bureau would require legislative recognition. Further legislation is also needed to provide for debt enforcement in any ASEAN state by legal persons incorporated into another ASEAN state. Although such a major advancement is unlikely to emerge prior to 2020, it could be one of the most significant steps toward reaching development goals.

Further Study

Research is present and ongoing at public and private organizations, but there is relatively little available regarding core weaknesses within ASEAN that prevent the group and its members from achieving economic objectives. The political environment undoubtedly makes critical analysis risky for government and some private sector researchers, but moreover, there appears to be a shortage of quality academic research originating from within ASEAN. In our research, we found that more than 90 percent of data came from intergovernmental organizations, foreign-sponsored NGOs, regional and global financial institutions, foreign governments, and foreign academic researchers. ASEAN member states and their respective domestic experts are simply not publishing qualitative or quantitative reports in sufficient supply to gain a more intimate understanding of the situation in the region. Research, especially non-partisan academic research, is essential in all aspects of economic development. Toward 2025, nationals of ASEAN members – university professors in particular – should take it upon themselves to inform stakeholders about facets of their growth that foreigners cannot.

CONSENT FOR PUBLICATION

Not applicable.

CONFLICT OF INTEREST

The authors declare no conflict of interest, financial or otherwise.

ACKNOWLEDGEMENTS

Declared none.