All published articles of this journal are available on ScienceDirect.

Uzbekistan’s Development under the Leadership of Various Political Reforms: The Case of Air Transport Industry

Abstract

The First President of Uzbekistan, Islam Karimov, continued to isolate the country for many years even after the collapse of the Soviet Union in 1991, which in turn worsened all the strategic sectors in the country, especially the aviation market and tourism industries. However, in the period 2017-2018, the skyrocket in the number of tourists, from 2.69 million to 5.34 million, became possible due to the coming of Shavkat Mirziyoyev to power as the new President. But the lack of air connectivity kept reducing aspiration of traveling from non-CIS countries. To solve the issue, the new President Mirziyoyev’s large-scale policy reforms concerned the air transport sector, too. The main objective of the study is to compare the development of the country under the leadership of various political reforms using the aviation industry of Uzbekistan as an example. To achieve the purposes, the authors examine reciprocal action/influence between airlines, airports and government. In addition, a significant amount of data was collected from Russian-language sources to enrich the content. Even though the paper was written before the COVID-19 pandemic, the authors' research is still important to nudge readers into a new perspective.

1. INTRODUCTION

Uzbekistan, the country in the heart of Central Asia with the richest human capital in the region and the diverse tourist resources such as Silk Road sites, kept being an isolated country for many years even after the collapse of the Soviet Union in 1991. The country was under a democratic autocracy of the First President of the Republic of Uzbekistan Islam Karimov; however, in the first years of his rule, he tried to modernize the country’s economic and political systems. During his presidency, the country was far from any international financial integration, global economic and political network. At the same time Nursultan Nazarbaev ruled the neighboring country Kazakhstan for over 30 years and the situation there is very different [1-3].

The coming of Shavkat Mirziyoyev to power as the new President of the Republic of Uzbekistan in September 2016 and the “open door” policy proposed by him initiated effective economic and political reforms in the country. Under the decree signed by him in December 2016, the tourism industry received the status of a strategic sector of the country's economy [4] and became one of the pillars for economic development and liberalization processes.

Thanks to the policy reforms, the list of countries exempted from the Uzbek visa also increased from 8 to 65 over the period 2018-2019 (Table 1). In addition, the number of tourists arriving in Uzbekistan has faced a meteoric rise from 2.69 million to 5.34 million in the period 2017-2018 (Table 2). However, the Commonwealth of Independent States (CIS) continued to remain the leading market for tourists with a volume of 93.8%. The reason of reduced aspiration for traveling from non-CIS countries is the lack of air connectivity. The aggravated development of the Uzbek aviation market is caused by the monopolistic position of the state-owned national carrier ‘Uzbekistan Airways (UzA)’. Since January 1992, UzA like its predecessor the Soviet Aeroflot continued to operate as a large-size state administration body on civil aviation that dominated everywhere: air navigation, airport service, personnel certification for airports and airlines [5]. To solve this problem, large-scale policy reforms of President Mirziyoyev touched upon the air transport sector, especially passenger transportation.

| Date | Countries | Duration |

|---|---|---|

| Visa exemption | ||

| 1991/08/31 | Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan (cancelled in 2000), Moldova, Poland (cancelled in 1993), Russia, Tajikistan (cancelled in 2000), Ukraine, | Up to 90 days |

| 2007/02/12 | Kyrgyzstan (resumed) | Up to 60 days |

| 2018/02/10 | Israel, Indonesia, Japan, South Korea, Malaysia, Singapore, Turkey | Up to 30 days |

| 2018/03/16 | Tajikistan (resumed) | |

| 2018/10/05 | France | |

| 2019/01/15 | Germany | |

| 2019/02/01 | Other European Union countries, Andorra, Argentina, Australia, Bosnia and Herzegovina, Brazil, Brunei, Canada, Chile, Iceland, Liechtenstein, Monaco, Mongolia, Montenegro, New Zealand, Norway, San Marino, Serbia, Switzerland, Vatican | |

| 2019/03/20 | United Arab Emirates | |

| 2018/07/01 | Visa-free transit (53 countries) | Up to 5 days |

| - | E-visa (75 countries) | Up to 30 days |

| Year | Tourist numbers | Change Rate |

|---|---|---|

| 2015 | 2.034.253 | 4.96% |

| 2016 | 2.027.000 | -0.35% |

| 2017 | 2.690.000 | 32.70% |

| 2018 | 5.346.000 | 98.73% |

| 2022 (expected) | 7.282.800 | 36.22% |

| 2025 (expected) | 9.089.300 | 24.80% |

Apart from some technical reports, research on Uzbekistan airlines and tourism remain very scant. Though these policy reforms had already generated some positive effects regarding the Uzbek air transport sector, extensive and more analytical research works are highly needed.

Therefore, this paper constitutes the first attempt to reveal the causes of the country's isolation policy under the First President and its impact on the air transport industry; seeks to compare the situation of Uzbekistan’s aviation industry under the leadership of various political leaders and political reforms. In addition, the authors provide a conceptual framework of the Uzbekistan air transport system from the government, airlines and airports points of view (Fig. 1).

The rest of the paper is structured in the following manner. Section 2 describes the research methodology and the data collection methods. Sections 3 and 4 discuss the situation of Uzbek air transport under the governance of the first president and the current president, respectively. Section 5 gives appropriate recommendations accordingly. The last section gives the concluding marks as well as the future research work.

The paper was written before the COVID-19 pandemic and so the authors acknowledge that some of the analyses will have changed due to the substantially of different economic climate we are now in.

2. METHODOLOGY

Like in the article of Mostafa and Mahmood [6], the authors of this work pay more attention to government acts, presidential decrees and articles of professional magazines from Russian-language sources to enrich the content of the article. In addition, the authors decided to conduct a qualitative exploratory approach to policy reforms from the standpoint of examining three institutions: airports, airlines, and the government (Fig. 1).Quantitative wide-ranging research cannot be done, as Cline et al. [7] outlined that master planning studies need “to have a significant database of traffic from which to draw”. In the case of Uzbekistan, many government bodies and state enterprises still accomplish record-keeping as in Soviet time under the planned economy.

3. CONCEPTUAL INSIGHT INTO UZBEKISTAN AIRWAYS, 1992-2016.

3.1. Government

Reading this subsection, we may see that for the first eight years, the administration of President Karimov also tried to promote an air transport-oriented tourism strategy. The reason why the Uzbek Government eventually decided to conduct the main transformation in tourism for diversifying the local economy and creating post-Soviet identity was the possession of well-established 7500 historic attractions in 10 major towns [8]. The most important part of that decision became the creation of the state tourism organization called “Uzbektourism”, which was in charge of: i) firstly and mainly, performing the duties of the former Soviet tourism organization “Intourist”, ii) development of tourism policy, iii) licensing and control of private tourism enterprises, iv) privatization and commercialization of large state-owned tourism companies, v) tourism promotion [9].

Later, as an indication of good motives, President Karimov [10] signed the Degree in 1995 where it is outlined that Uzbektourism should tightly cooperate with UzAfor the betterment of air transport tourism. And thus, both state companies were sharing offices in foreign cities where UzA could carry out direct flights and started representing the travel industry of Uzbekistan. Airey & Shackley [8] were the first ones, who recorded the intensified cooperation between Uzbektourism and UzA, and the successful start of the heritage-based tourism industry on the Silk Road cities of Samarkand, Bukhara and Khiva. However, the transition from a planned to a market economy air transport tourism industry, as well as in all strategic sectors, went smoothly only until 1999.

The 1999 Tashkent bombings on 16 February was an assassination attempt on the First President Islam Karimov. According to the theory of authors, in the face of the ever-growing threat from Afghanistan in connection with the U.S.-Afghan war started in 2001, President Karimov used the Soviet conservative approach, isolating the country and restricting access to it from abroad to preserve peace in the country and protect its borders. Later, even so, his internal affairs were not sympathized by Western countries, ‘foreign affairs must be judged as one of his successes’ [11].

3.2. National Airline and Foreign Airline Services

The government needs to appoint the sovereign borders of the country both on earth and space, and the role of transport in this process has great significance [12]. As the new president in 1991, Islam Karimov had to fulfill this task and thereby strengthen the independence of the country after the collapse of the Soviet Union. The Uzbek national carrier, operating 75% of all flights from/to Uzbekistan, was not created for commercial purposes; it was responsible for meeting the needs of the Uzbek people in air transport within the republic, ensuring air safety and creating the country's aviation code. Even though it was hard for the company to survive in a market economy with the Soviet conservative approach in air transportation, it was the correct initial decision taken by the government, as it was necessary to solve domestic needs first. To protect the uncompetitive UzA in those days, the Uzbek government banned any type of foreign ownership in the aviation industry [13]. The restriction of foreign ownership is needed because of concerns that the system may be subordinate to the interests of other countries rather than of its own one. The US government, for instance, gives foreign investors the right to own only 49% of airline companies, but with a control of 25% [12].

When it comes to modernization, the UzA began to include the Airbus A-310s in order to replace the aging Soviet fleet and besides the flights to former Soviet Union states, domestic airports, and to new 20 destinations in Europe, North America and Asia in 1997 [8].The number of companies providing air transport services reached 23 by 2006, but the foreign carriers showed the minimum frequency of scheduled flights due to visa restrictions on Uzbek nationals and visa requirements from the Uzbek government for foreign visitors (Appendix A, Appendix B). UzA continued to be protected by the government and thus became dominant in the air transportation market, including ground infrastructure, which in turn caused many complaints and became the reason for lagging behind world practice. The national air company was never able to reach a level of three million passengers during Karimov’s presidency. The average passenger turnover of UzA from the pre-crisis year 2008 to the end of 2014 was 2.2 million.

The last problem is the lack of interlining arrangements of UzA and not being part of internationally recognized airline alliances, which always caused to “divert traffic to foreign carriers”, especially Russian and Turkish ones. Membership in any of the three alliances gives great privileges, such as transporting passengers to any destination in the world. With the help of Korean Air, UzA has been discussing the issue of joining SkyTeam since 2008 [14] and has not yet entered due to trivial reasons, such as standardizing the frequent flyer program in accordance with alliance standards.

The monopolistic status of the UzA couldn’t remain unshakable, so ADB [15] in cooperation with the Japanese Special Fund accomplished the first thorough analysis of the whole transport sector of Uzbekistan in 2007, where experts noted the list of critical barriers to transport development and then a set of action plans to prevent future inefficient investments and take reasonable measures in the transport sector of Uzbekistan in the 2006-2020 time frames. Unfortunately, the recommendations in the report were mainly implemented in the railway and road sectors. Only at the end of 2016, the listed critical barriers and action plans regarding air transport development (Appendix B, Appendix C) attracted the attention of the new presidential administration.

3.3. Local Airports

In 1997, Broeze [16] emphasized that seaports are the pillars for the stable development of the economy, culture and social life in the city and country. In the 20th century, airports became a rescue for landlocked countries. Plus, if one pays attention to the leading cities in tourism, they all have another similar feature - developed airports.

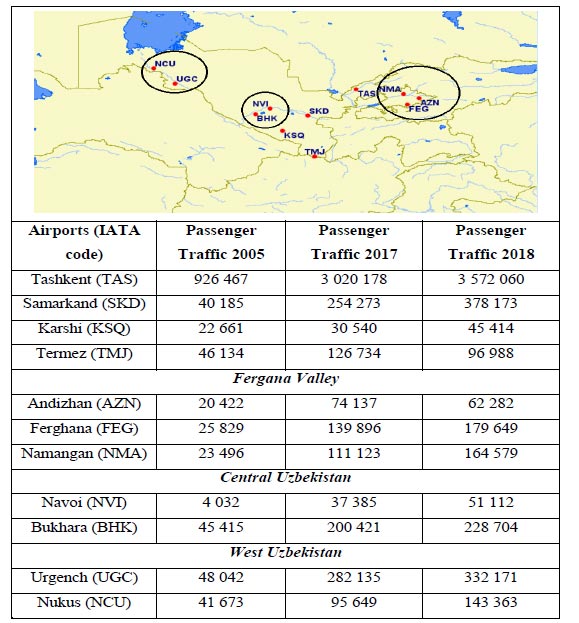

The most developed airport in Uzbekistan is Capital Airport, which is called Tashkent International Airport (IATA code: TAS). TAS is the most interconnected in Uzbekistan and Central Asia due to the number of connections to other airports in the world, but not the most accessible due to the small number of flights compared to the airports of Almaty, Astana and Bishkek. Capital Airport is divided into three terminals: Terminal 1 is for state visits; Terminal 3, with a capacity of 400 passengers per hour, is intended for local flights; and Terminal 2 is the main one for handling international departures and arrivals. TAS takes over two-thirds of the total passenger traffic in the country and has a connection with 10 local airports and other 50 airports in the world – it serves as the main air-gateway to Uzbekistan. While other Central Asian countries have two air-gateways, Uzbekistan has only Capital Airport TAS. In a country where almost half of the population of Central Asia lives, it is necessary to have one more node on the map. A well-designed air transport network with the second air-gateway may give a tremendous impetus and make the Uzbek city of that gateway a more attractive destination, thus it would contribute to regional development and play an important role in the revitalization.

The fact that other local airports only a few air routes means the air network controlled by UzA is insufficient for overseas and domestic travel purposes. The first issue towards air network development is that the ten local airports are connected through TAS. This hub-and-spoke route system is efficient if passengers want to continue their journey “to a wide geographic area” [17]. Even if in many cases socially important domestic flights from Uzbekistan’s spoke airports may be disadvantageous and unprofitable but they take passengers to hub airport TAS, from where people fly to other hub airports such as Moscow, Beijing, or Frankfurt-am-Main and that international flight may be profitable. However, traveling in a narrow geographic area, for example, within Uzbekistan, the hub-and-spoke route system is not rational because of unacceptable total travel time between any city-pairs. In order to find an answer to the present situation, ADB [15] proposed to rationalize the air network by restructuring or dispensing with unnecessary airports, especially in Fergana valley (see Fig. 2). The Kokand airport (ICAO code: UTKK), for instance, might be a good example. UTKK and the other three airports in Fergana valley were used during Soviet times as points of departure for cotton. After independence in 1991, the need for the airport is almost gone, so UTKK officially ceased to be available for civil aircraft in the early 2000s. Even finding three airports in a small valley is not a practical decision nowadays since UzA always keeps surviving on state subsidies.

Besides the issue mentioned above, UzA implements excessive safety control checks at the Uzbek airports reducing the free time of passengers, which they could spend at duty-free shops or eateries. In turn, it reduces the overall productivity and net profit of the airport. In 2015, Ülkü [18] mentioned that public authorities tend to control airport services based on social and demographic considerations, but in comparison with Uzbekistan, the control in other countries is minimal.

4. LARGE-SCALE POLICY REFORMS OF PRESIDENT MIRZIYOYEV

4.1. Government

Shavkat Mirziyoyev, the current President, served as Prime Minister under Islam Karimov for 13 years. But, like all local politicians, he was in the shadow of the first person of the state. 13 years of administrative experience at the Cabinet of Ministers gave Shavkat Mirziyoyev a colossal and thorough knowledge of internal political and internal economic processes. As soon as he succeeded Karimov after his death in September 2016, there have been several positive changes, such as decreased export duties, the improving situation in agriculture and weakening the influence of the state on small business. The sector that received the most attention was tourism. President Mirziyoyev established a State Committee for Tourism Development, which should be in charge of “implementation to increase the contribution of tourism in GDP, local budget revenues, employment, and the quality and standard of living of the population”. The next step in the industry step turned the liberalization process of the country's visaregime.

In the past, the citizens of 8 countries had only visa-free access to Uzbekistan. And as of February 10, 2018, impressive changes in visa policy started for citizens of Israel, Indonesia, Japan, South Korea, Malaysia, Singapore and Turkey. The government granted access to them to enter Uzbekistan without any visa up to 30 days. Table 1 shows that the process of visa liberalization did not stop at adding only 7 countries. Just in the period 2016-2017, the increased amount of tourists by almost 32% showed the nation that the actions taken by the current presidential administration are justified (Table 2). However, the statistic of 2018 proves more the effectiveness of the decree.

Linking section 3 and section 4, the authors explored that the idea of making tourism a strategic sector of the economy was borrowed from the experience of the first years of Karimov’s presidency. However, in the case of the Shavkat Mirziyoyev, the reforms are large-scale - the improvement of the investment climate in the country, the strengthening of friendly relations with neighboring countries, and not drifting among great powers [19-21].

4.2. National Airline and Foreign Airline Services

The location of Uzbekistan might make UzA a profitable airline, as numerous potential customers on the route South-East Asia – Europe might generate high travel demand. Low labor costs in combination with its renewed fleet, currently consisting of B787-8 and A320neo, might contribute to the national carrier’s success. However, the rush to reorganize the airline is unacceptable, since other two Central Asian state-owned carriers, Air Kazakhstan and Kyrgyzstan Airlines, went bankrupt in 2004 and 2005 [22]. Moreover, Air Kyrgyzstan and Tajik Air have also experienced financial losses for several years and stopped carrying passengers in 2018 and 2019. Therefore, the transformation of UzA has been discussed for years should be done gradually and carefully. The air transport reforms started by President Mirziyoyev may be divided in two stages.

The company continued to exist as a state body for civil aviation at the first stage. The aviation market of Uzbekistan started actively opening after the current presidential administration set the tasks of attracting more foreign investment and a radical improvement in transport services for the population in the framework of state program ‘Development Strategy for 2017-2021’, so the national carrier increased the number of flights for Uzbek citizens to the following well-known destinations such as Almaty, Nur-Sultan, Istanbul, Seoul and the whole Russian Federation. Therewith the Russian carriers – Nordstar, Red Wings Airlines and Nordwind Airlines– began to fly into the country. Furthermore, on October 18, 2016, UzA initiated the online booking and payment of airfare services through “UzCard” bank cards, one year later through “Visa” cards and starting from November 9, 2018, to the existing online payment methods “MasterCard” was added [23,24]. The first stage – the period 2017–2018 – demonstrated that UzA increased efficiency and passenger traffic through reforms without company restructuring or its privatization (Table 3).

4.3. Airports

The first phase of policy reforms made also a difference to the Uzbek airports. For instance, as of June 15, 2018, Terminal 2 of TAS has been noticeably improved by merging are constructed old building for local flights to increase its capacity to 1,200 arriving passengers per hour. It became the last upgrade for Capital Airport, as later it was determined TAS has no growth opportunities due to its location in the city center like in the cases of the former Singaporean International Airport Paya Labar (QPG) and the former Turkish Istanbul Ataturk Airport (ISL) [25,26]. Because of well-done timely decisions by the governments of Turkey and Singapore, they could maintain and enlarge traffic flow to their capitals. The Uzbek authorities relying on the experiences of foreign colleagues concluded to establish a new additional airport uptownon the basis of the “Tashkent-Vostochny” airfield until the year 2020. The new airport should serve for civil and business aviation to ensure the organization of meetings and send-offs of foreign delegations at the highest level.

What about other airports? The international airports of Samarkand, Bukhara and Urgench started having simplified procedures of border control, baggage claim and customs clearance due to the presidential decree. S7 Airlines and Turkish Airlines launched new regular flights to Samarkand, thereby creating an additional air-gateway. Fig. (2) shows that the approach of dispensing with five airports, Andizhan, Navoi, Karshi, Termez and Nukus, should be applied. It would reduce costs since UzA keeps surviving on state subsidies and the aforementioned airports showed the smallest result in the absolute ratio in their regions but the second phase of President Mirziyoyev’s policy reforms was aimed at solving the issue.

4.4. The Second Phase of President Mirziyoyev’s Policy Reforms

In order to de-monopolize air transportation in Uzbekistan and thereby make UzA commercial and independent from government subsidies, President Mirziyoyev signed the Decree “On Measures for the radical Improvement of Civil Aviation of the Republic of Uzbekistan” [27], which started integrating the recommendations of JSF and ADB in aviation into the legislative practice, as the government came to realize the outdated and non-transparent management system combining the functions of state regulation and commercial activity would not allow introducing the modern management system at the enterprises of the industry, ensuring their financial stability and profitability.

According to the degree above,on the basis of the national air carrier UzA, one aims to establish two new Joint-Stock Companies (JSC), “Uzbekistan Airways” and “Uzbekistan Airports”, and several Limited Liability Companies (LLC), “Uzbekistan Helicopters”, “Uzbekistan Air Technics”, “Catering” and “Training Centre”. The centre of “Uzair navigation” and “Civil Aviation Agency” started providing their services under the supervision of the Ministry of Transport of Uzbekistan. Separation of powers on air surveillance, air navigation, certification and airport services into separate independent structures gave the concept that an airport is no longer a strategic object.

The airports became commercial enterprises and the state can use them only when necessary for state purposes or in emergencies. Uzbekistan Airports JSC is granted the right to determine and set rates and fees for services provided by the airport, with the exception of services provided to resident airlines. In addition, the air harbors gained the right to expand and modernize the infrastructure necessary for storing aviation fuel and oil and lubricants of the airport, as well as enter into contracts with local or foreign legal entities for the supply of aviation fuel and oil and lubricants for their implementation domestic or foreign airlines operating flights to international airports of the country, including transit. The document also states that from October 1, 2019, in accordance with international legal standards, the Open Skies mode is introduced at Karshi, Nukus and Termez international airports using the “fifth air freedom”, as well as Bukhara using “fifth air freedom” when transporting foreign nationals. Perhaps this decision of the government will help solve the financial problem of the first three airports mentioned above [28].

| Years | Output | Input | Economic Efficiency | |||

|---|---|---|---|---|---|---|

| Passenger traffic | Workers | Fleet | Routes | |||

| 2014 | 2 624 859 | 14 400 | 28 | 52 | 79,46% | |

| 2015 | 2 572 289 | 14 500 | 26 | 51 | 79,39% | |

| 2016 | 2 471 387 | 14 462 | 26 | 50 | 77,80% | |

| 2017 | 2 703 412 | 14 440 | 26 | 56 | 79,36% | |

| 2018 | 3 175 320 | 14 500 | 27 | 59 | 89,76% | |

| - | London-Sydney | London-Perth | Amsterdam-Jakarta | Frankfurt-KualaLumpur |

|---|---|---|---|---|

| Nonstop | 17,016 | 14,499 | 11,353 | 10,001 |

| Via Dubai | 17,589 | 14,577 | 11,718 | 10,398 |

| Via Singapore | 17,176 | 14,783 | 11,395 | 10,577 |

| Via Hong Kong | 17,019 | 15,654 | 12,533 | 11,704 |

| Via Tashkent (UZB) | 17,077 | 14,690 | 11,385 | 10,056 |

| Via Bukhara (UZB) | 17,124 | 14,603 | 11,355 | 10,008 |

| Via Samarkand (UZB) | 17,108 | 14,631 | 11,361 | 10,019 |

The airports of Samarkand, Namangan and Urgench may be modernized and developed by the Russian holding company “Novaport” but neither the Uzbek government nor Novaport disclose the volume of investments and the scale of the transformation. The first airport to undergo reconstruction is Samarkand. In 2022, the city will host the summit of the Shanghai Cooperation Organization, which will be the first major international event in the city for the entire post-Soviet period [29,30].

5. RESULTS AND DISCUSSION

Even though everything is fine with the Uzbekistan Airport JSC, not everything is so smooth with Uzbekistan Airways JSC.UzA JSC should have stopped being a monopolist de jure. Not operating as a civil aviation authority did not mean that the state would stop supporting UzA JSC. As mentioned earlier Uzbekistan Airport JSC is granted the right to determine all the airport service fees, with the exception of services provided to resident airlines, namely UzA JSC. In 2018, President Mirziyoyev [27] gave a clear order to the Information and Analytical Center under the Cabinet of Ministers to coordinate the development of policies for local and foreign carriers in the national air transportation market; even so, the Uzbek lawyer Alisher Annazarov outlines that the state did not ensure equal conditions for all would-be resident airlines in local airports [31]. He also draws our attention to the high cost of fuel and airport charges, the absence of an adequate policy for implementation of a low-cost carrier business model and zero competition in the field of ground support services for aircraft and passenger services [32]. And these reasons prevent local and foreign entrepreneurs from creating a local airline.

For the development of the economy, the priority for the government should be to regulate the already existing monopolies, since, unfortunately, now the activities of many monopolies are detrimental to the development of small businesses.

If the first reason for the reconstruction of the Samarkand airport is the coming summit of the Shanghai Cooperation Organization, then the second reason is to optimize the workload of the Tashkent International Airport. However, in the authors’ view, this decision was irrational:

Since the distance by air from the main airport of the country to the supposed second transport hub of the country is only 260 km. There is already a connection between the two largest cities, which can be reached by high-speed rail in 2 hours and 15 minutes;

− The airport of this region is located in a densely populated area of the capital of the region, which is also called Samarkand. The airport has only one runway with a length of only 3,105 meters. The west of Samarkand, quite flat and less populated, could have become a new gateway to the city of Samarkand, but the government decided to simply reconstruct the current one [33].

Bukhara airport was supposed to be a rational solution (439 km by air, 570 km by land far from Tashkent), since, being in the center of the country, it is ideal for connecting local flights. In addition, if you pay attention to Table 4. Uzbek airports have a unique geographical position capable of connecting East with West and Bukhara airport among others is in a way that could not be better.

CONCLUSION

As stated in the introduction, the authors' first goal was to investigate the factors that influenced President Karimov’s decision to isolate the country and the role of such a policy in the air transport industry. According to the authors’ hypothesis, the First President Karimov made Uzbekistan more isolationist as a preventive measure due to the US-Afghan war and the 1999 terrorist attacks in Tashkent. Later, because of being isolated, Uzbekistan became one of the slowest transition economies among CIS to carry out reforms [1,34]. However, the aviation market of Uzbekistan always used to be under the conservative approach and should have remained under the planned economy: in the period 1992-1999 to satisfy public needs in domestic flights; in the period 2000-2016 to protect the noncompetitive UzA. The development of air transport, even under the conditions of President Karimov’s isolated political regime, is considered a small success, since the national carrier UzA has not gone bankrupt since its inception, while neighboring countries, Tajikistan, Kyrgyzstan and Kazakhstan, have faced this experience.

The second purpose of the paper was to compare the air transport development of Uzbekistan in the framework of policy reforms of two presidents. The key events in the history of Uzbek air transportation, of course, are President Karimov’s Decree dated January 28, 1992 “On the establishment of the National Carrier of Uzbekistan” and President Mirziyoyev’s Decree dated November 27, 2018 “On measures for the radical improvement of civil aviation of the Republic of Uzbekistan”. If the former was aimed at strengthening the borders of the new sovereign state on air space and protecting from the fate of bankruptcy occurred with other regional carriers, the latter meant de-monopolization of civilian air services in Uzbekistan and thereby the commercialization of UzA and all state unitary objects (Uzbekistan Airways JSC, Uzbekistan Airports JSC, Uzbekistan Helicopters LLC, Uzbekistan Air Technics LLC, Catering LLC and Training Centre LLC) under its control. However, the main goal of the current presidential decrees and government acts is to develop the air transport-oriented tourism strategy.A recent review of the literature on this matter found that “the most complicated task of tourism policy is implementation” [35], which can be clearly seen in the example of UzA JSC that is not a monopolist in name only. But the last task is open to question because other reforms carried out by President Mirziyoyev are completed.

CONSENT FOR PUBLICATION

Not applicable

AVAILABILITY OF DATA AND MATERIALS

The data supporting the findings of the article is available on the web site of the Ministry of Tourism and Sports of the Republic of Uzbekistan at https://uzbektourism.uz/en/research/ statistics.

FUNDING

This work was supported by the China Scholarship Council (Grant No: 2017DFJ014586).

CONFLICT OF INTEREST

The authors declare no conflict of interest, financial or otherwise.

ACKNOWLEDGEMENTS

We thank Shanghai Maritime University for their support. The authors also thank Patrick Powers (Oberlin College, the USA) and Iroda Saydazimova for language editing.

Appendices

| Carrier | Route | Weekly Frequency |

|---|---|---|

| Aeroflot | Tashkent – Moscow | 5 |

| Aeroflot Don | Tashkent – Rostov | 1 |

| Asiana | Tashkent – Seoul | 2 |

| British Airways | Tashkent – London | 3 |

| China Southern | Tashkent – Urumqi | 2 |

| Dalavia Airlines | Tashkent – Khabarovsk | 1 |

| Domodedova Airlines | Tashkent – Moscow | 6 |

| Samarkand - Moscow | 2 | |

| Ferghana – Moscow | 2 | |

| Bukhara – Moscow | 1 | |

| Gazprom Air | Nukus – Moscow | 1 |

| Grumov Air | Namangan – Moscow | 1 |

| Andijan – Moscow | 1 | |

| Bukhara – Moscow | 1 | |

| IMAir | Tashkent – Baku | 2 |

| Iran Air | Tashkent – Tehran | 1 |

| Krasnayarsk | Tashkent – Krasnoyarsk | 1 |

| Kyrgyz Airlines | Tashkent – Bishkek | 1 |

| Lufhansa | Tashkent – Frankfurt | Freight only |

| Perm Airlines | Tashkent – Perm | 1 |

| Pulkova | Tashkent – St Petersburg | 2 |

| Bukhara – St Petersburg | 1 | |

| Namangan – St Petersburg | 1 | |

| Samarkand – St Petersburg | 1 | |

| Samara Airlines | Tashkent – Samara | 1 |

| Bukhara – Samara | 1 | |

| Siberia Airlines | Tashkent – Novosibirsk | 1 |

| Tbilisi Air Shili | Tashkent- Tbilisi | 1 |

| TransAero | Tashkent – Moscow | 3 |

| Bukhara – Moscow | 1 | |

| Turkish Airlines | Tashkent – Istanbul | 4 |

| UMAir | Tashkent – Kiev | 1 |

| Uralsk Airlines | Tashkent – Ekaterinaburg | 1 |

| Uzbekistan Airways | |||

|---|---|---|---|

| Sr.No. | Critical Barriers | Sr.No. | Action Plans |

| 1 | Impact of Government interventions | 1 | Increase management autonomy |

| 2 | Poor financial position, worsened by current high cost of fuel and slow ability to rationalize | 2 | Focus on commercial operation |

| 3 | Lack of fleet standardization | 3 | Complete fleet rationalization, agree programme of supporting measures |

| 4 | Retention of aircraft for spares, creates negative image | 4 | Introduce e-ticketing and yield management, improve interlining |

| 5 | Outdated aircraft with high fuel burn used on domestic routes | 5 | Improve quality of service/marketing of UzA brand |

| 6 | Domestic tariffs subject to approval by Ministry of Finance | 6 | Rationalize Tashkent-Ferghana Valley air services. Introduce direct services between regional cities where demand warrants. |

| 7 | 7. Need to service all domestic airports | 7 | - |

| 8 | Outdated ticketing and reservation systems. | 8 | - |

| 9 | Dependence on Uzbek customers | 9 | - |

| 10 | Visa restrictions on Uzbek nationals and visa requirements for foreign visitors limit market opportunities | 10 | - |

| 11 | Increasing competition in the transit sector | 11 | - |

| 12 | Quality of service issues | 12 | - |

| 13 | Increasing competition from other carriers, especially for the transit market | 13 | - |

| 14 | Small size compared to competitors | 14 | - |

| 15 | Possible increase in losses could result in reductions in service. | 15 | - |

| Other Airlines | |||

| Sr.No. | Critical Barriers | Sr.No. | Action Plans |

| 1 | Low growth in domestic demand. | 1 | In short term, seek to retain service by major carriers |

| 2 | Reduction in volumes of foreign nationals | 2 | Encourage more carriers to provide services |

| 3 | Dependence on low frequency services by small carriers | 3 | Monitor small CIS regional carriers for safety and financial stability. |

| 4 | Need for hubbing to have international connectivity | 4 | - |

| 5 | Poor connectivity because of lack of major carriers | 5 | - |

| 6 | Lack of cargo capacity and services. | 6 | - |

| 7 | Uzbekistan Airways quasi-monopoly may stifle competition | 7 | - |

| 8 | Even greater reliance on foreign hubs. | 8 | - |

| Airport Services | |||

| Sr.No. | Critical Barriers | Sr.No. | Action Plans |

| 1 | Lack of competition in the airport services sector, particularly in passenger and cargo handling limits improvement in service standards. | 1 | Improve service, particularly in passenger handling and customer-orientation, to international standards to meet regional competition. |

| 2 | Poor catering and retail facilities constrain ‘passenger spend’ and creates negative image of both airport and national carrier. | 2 | Improve arrangements for transit passengers. |

| 3 | Poor passenger facilitation services. | 3 | Improve catering, especially in international/transit areas. |

| 4 | Overall service standards have not improved in parallel with trends at other airports | 4 | Exploit retailing opportunities and grow terminal passenger spend. |

| 5 | Improved service standards at competing airports in the region may result in diversion of passenger traffic, especially transit and tourist. | 5 | Remove legal/regulatory constraints restricting competition, provide supplier choice, particularly for passenger, cargo and ramp handling. |

| 6 | Monopoly may dissuade new carriers from opening up services as service levels not compatible with their brand image. | 6 | - |

| Aviation Infrastructure | |||

| Sr.No. | Critical Barriers | Sr.No. | Action Plans |

| 1 | Ownership and management by largest customer- UzA. | 1 | Divest airport operation from UzA. |

| 2 | Cost of maintaining comprehensive airport network. | 2 | Rationalize airport network, especially for Ferghana Valley. |

| 3 | Expenditure at minor airports limits funding at core airports. | 3 | Improve connectivity between Tashkent domestic/ international terminals. |

| 4 | Airports considered as a social amenity. | 4 | Review security in line with international best practice. |

| 5 | Security dictating rather than supporting operations. | 5 | Modernise approach to design of structures. |

| 6 | Poor operational design of most terminals. | 6 | Increase mechanization of cargo terminals. |

| 7 | Poor scheduling resulting in traffic peaking problems. | 7 | Review function of Tashkent transit terminal. |

| 8 | Cargo volume insufficient to support increased mechanization. | 8 | Establish separate financial records for airports/Tashkent IA. |

| 9 | Sub-standard transit facilities. | 9 | Develop Tashkent as regional freight gateway. |

| 10 | Deteriorating standard of regional airports. | 10 | - |

| 11 | High reliance on UzA to generate demand. | 11 | - |

| 12 | Pressure to relocate Tashkent Airport on environmental grounds. | 12 | - |