RESEARCH ARTICLE

The Increase in E-commerce Purchases and the Impact on the Newest European City Logistics Development

Tiziana Campisi1, Antonio Russo1, *, Efstathios Bouhouras2, Giovanni Tesoriere1, Socrates Basbas2

Article Information

Identifiers and Pagination:

Year: 2023Volume: 17

E-location ID: e26671212279047

Publisher ID: e26671212279047

DOI: 10.2174/0126671212279047231128105715

Article History:

Received Date: 24/08/2023Revision Received Date: 23/10/2023

Acceptance Date: 01/11/2023

Electronic publication date: 05/12/2023

Collection year: 2023

open-access license: This is an open access article distributed under the terms of the Creative Commons Attribution 4.0 International Public License (CC-BY 4.0), a copy of which is available at: https://creativecommons.org/licenses/by/4.0/legalcode. This license permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Abstract

Background:

In recent times, the advancement of urban logistics has encountered a series of pivotal challenges pertaining to the efficient distribution of goods and associated concerns such as congestion and pollution. In response, efforts have been directed towards identifying enhanced solutions. Notably, the growing development of electronic commerce of electronic commerce has underscored the necessity of devising viable approaches, both functionally and economically, to bolster the evolution of city logistics. The document focuses on a comparative analysis of e-commerce purchase demand data in Europe, focusing on two product macro-categories, namely clothing and e-grocery. It points out that the pandemic, but the health crisis has accelerated this practice.

Objective:

The acquired findings unequivocally validate the necessity for a fundamental reassessment of delivery transport methods, taking into account the perishability of materials, sustainable urban accessibility, and the incorporation of cutting-edge technologies.

Methods:

The comparison in the different European contexts and the different trends recorded with the variation of the macro product categories was defined by QGIS maps and they underline how some of the states have restored their context of demand for mobility while others have preferred online commerce by reducing physical movements.

Results:

Analysis of the available data revealed that between 2020 and 2022 e-commerce concerning clothing, online food purchase and home delivery these are the findings; for the clothing category,, the distribution remained very similar; for the online food purchase category, the situation is quite similar and for home delivery category of ready-to-eat restaurant and fast-food food, many countries exceeded percentages of 20%.

Conclusion:

This could lead to an improvement in urban mobility planning, prompting an integration of these issues within the Sustainable Urban Mobility Plans (SUMPs) and at the same time it would allow logistics service managers to be able to introduce more sustainable and efficient modal forms.

1. INTRODUCTION

In 2020, the health emergency disrupted every economic and social equilibrium, compelling the whole world to face a completely redesigned scenario. Subsequently, 2021 was the year in which the effects of the pandemic had a more eloquent response, influencing not only the daily lives of individuals but also the business activities of companies and, above all, the mobility sector [1-3].

The shortage of raw materials, the consequent semiconductor crisis, the increase in inflation and costs related to electricity, natural gas and fuel, the Russian-Ukrainian conflict, the most recent lockdown in Shanghai and the consequent block of activities production and the port have seriously tested every economic sector that in these extraordinary conditions must be able to manage their activities in the best possible way [4, 5].

The mobility sector had to face a constantly evolving context, and it was not easy to predict future developments due to a series of economic but also psychosocial factors [6, 7].

Since the end of 2022, there has been a radical change in habits, starting from the way of working, through the affirmation of smart working and a hybrid working model that has reduced the need for travel and this process is definitely changing the way of conceiving the use of the private car but also the management of company fleets [8-10].

At the same time, new consumer purchasing habits have developed by encouraging e-commerce, with impacts on the work of couriers and suppliers of large-scale distribution and pharma. Among the various results obtained by [11], there is the need for companies to pursue the needs of customers; having an Internet site for e-commerce is considered a good practice.

In addition, the electrification process underway has focused the spotlight on issues related to sustainability by inducing world governments and administrations to intervene with strategic actions useful for safeguarding the environment and reducing emissions, starting right from the transport sector [12].

Logistics companies have found themselves managing sudden peaks in work by upgrading their fleets in order to respond effectively to such a growing demand [13, 14].

Given these foundations, an emerging paradigm of intelligent mobility is progressively gaining prominence within the automotive domain, which can keep pace with new needs, new technologies and new lifestyles linked to the urbanization process. The new requests for mobility and the trend towards more sustainable models find a meeting point in the Mobility as a Service (MaaS) paradigm, or rather mobility understood as a service [15-17].

This concept, therefore arises from the need to make mobility increasingly shared and sustainable, also involving the areas of electric mobility and micro-mobility, which will influence companies in the choice to develop wider transport solutions (from vehicles to electric scooters, for example) [18, 19].

To comprehend potential measures for enhancing logistical services and mitigating urban mobility-related effects, an initial step involves the analysis and comparison of purchasing patterns across various product categories, some more perishable than others. This analysis informs the identification of optimal strategies to adopt while also guiding local administrators in shaping urban planning initiatives that seamlessly integrate this evolving mobility landscape into Sustainable Urban Mobility Plans (SUMPs) [20, 21].

The changes described, which will be explored in more detail below, have been accelerated by the COVID-19 pandemic. In this sense, it is essential to study the evolution of e-commerce demand, particularly in Europe, where COVID-19 has spread exponentially since March 2020. In addition to differentiations between countries, it is useful to study differentiations between product categories. In particular, the implications linked to some best-selling or most critical products will be discussed below.”

Therefore, the General Background section introduces the importance of studying the evolution of e-commerce connected to the concept of digitization and mobility. The E-commerce Product Categories section serves to focus on the types of purchases considered. The Methodology section highlights the definition of the analysis steps conducted to compare the different purchasing propensities across Europe. In addition, the discussion section, as well as conclusion highlight some solutions or strategies that can be recommended to local administrations and first and last service managers mile for the development of more sustainable city logistics in accordance with the objectives of Agenda 2030 of the United Nations and the European Green Deal [22, 23].

2. BACKGROUND

In accordance with [24], e-commerce is defined as the act of buying and selling goods on an online platform. Three types of e-commerce have been identified:

• Business to business or B2B, between two companies;

• Business to consumer or B2C, where the seller is a company, and the purchaser is a final consumer;

• consumer to consumer or C2C, where both seller and purchase are user;

These trends highlight the centrality of last-mile logistics and city logistics, emphasizing the need to strengthen the local distribution networks [25]. From this, a stronger relationship between e-commerce and urban logistics derives. Among the changes that arise from this relationship, we note the structuring of logistics hubs to respond to customer needs: not only large logistics platforms but also small centers closer to consumption areas. Solutions of this type also consider various positive externalities, including the reduction of accidents and emissions.

Furthermore, among the effects deriving from the growth of online commerce, the fragmentation of delivery points is considered: in fact, the volumes previously limited by the storage capacity of warehouses and store shelves are now determined by the flow of purchases made by the consumers. Traditional logistics processes, such as inventory management and store replenishment, are now dependent on the end consumer.

But in the context of e-commerce, new practices and new terms are spreading. For example, the term M-commerce is used to define the practice of carrying out activities of various types (purchasing, financial) on a mobile device. The “M” is an abbreviation of “Mobile” and underlines the possibility of carrying out transactions from smartphones and other portable devices such as tablets [26-29].

But e-commerce, like all high-tech sectors, needs Europe's attention. In fact, if its advantages have been underlined and therefore it is important to support its development. On the other hand, it is important that the institutions carefully evaluate and study the negative implications for companies, the environment and users.

The European Parliament has proposed actions that go in three directions [30]:

• Identification of KPIs to monitor e-commerce

• Educate SMEs on access to e-commerce

• Support the use of e-commerce in supply chains

Due to its diffusion, it is important to consider e-commerce not as an anomaly but as an integrated element to be considered on a par with others.

Since 2020, studies relating to the repercussions of e-commerce in the social sector have increased. In the research conducted by [31] the adoption of e-commerce by enterprises in the EU context has been analyzed. A forecast was obtained for 2025 starting from analytical evaluations on the trend of the percentage of companies operating in the e-commerce sector. Among the results, it is highlighted how the share of e-commerce companies and their turnover vary with the size of the 'agency. Furthermore, e-commerce will increase in most EU countries by 2025.

Among the various fields of study of e-commerce research, we want to highlight the influence of the various forms of digital business on the performance of environmental innovation in the EU context. In particular, in a study conducted by [32], the period from 2011 to 2019 was analyzed, considering 4 KPIs related to e-commerce. In addition to the parameters usually considered, such as online sales, measures related to Customer Relationship Management and the use of the cloud were considered, both highly innovative elements. The results of this research demonstrate the great importance of the development of digital enterprises (not only for e-commerce sales) but also the growth of turnover and the increase of e-business in improving investments and activities. The research conducted by [33] underlined how the evolution of digital companies improves the acceptability and development capacity of energy security, while the increase in public services can incentivize the achievement of energy sustainability objectives. The use of modern digital technologies such as big data and cloud computing is extremely important to ensure a more efficient development of the e-commerce system from both the demand and supply sides, as described by [34].

In particular, the study focused on one element: the effect that digitization has on environmental sustainability. Considering the period 2006-2020 as a time interval and considering the EU countries, through the application of the technique of standard errors corrected by the panel, it was possible to underline that digitization favors environmental sustainability. However, there is a non-linear and statistically significant impact between key enablers and digital public services for citizens on carbon dioxide (CO2) emissions. The results could represent a starting point to improve support public policies with incentives to reduce carbon dioxide emissions starting from mobility choices. Some studies have, therefore, proposed a series of sustainable solutions for urban logistics.

The literature review was conducted by [35]; this study also considered several experiences from research projects in the electric mobility sector, emphasizing the importance of the use of electric vehicles for efficient transport services. The paper also focused on several other aspects related to what was previously said: economic benefits for companies, reduction of CO2 emissions, and increase in the level of service for customers. In another study, different challenges are highlighted; the sector faces them to improve the sustainability, economical and environmental, of the operations. A list of measures and initiatives whose impact on the different elements involved in last mile operations has been analyzed [36].

For e-commerce being considered a replacement for retail purchase, retail travel has been severe influenced by e-commerce. One important element is related to the lower costs of e-commerce in comparison to retail [37]. The use of smartphone as a device to search and finalize online purchasing, including payment, is rising quickly, and it was estimated to be used in more than 50% of purchases by the end of 2022 [38]. The goods purchased, the parcels delivered, and the operations carried out by the companies are parameters that can differ. The fragmentation of deliveries has led to an increase in delivery operations for each order; a package can be returned or must be delivered due to the absence of the customer at home, resulting in an increase in the number of operations for the same parcel. In contrast, several parcels can be delivered together, resulting in a reduction in operations.

3. E-COMMERCE PRODUCT CATEGORIES

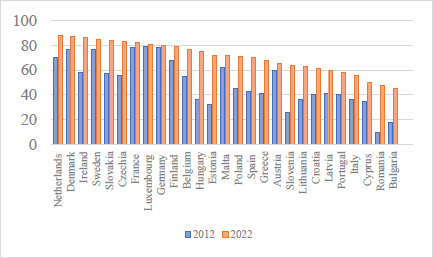

During the last decade 2012-2022, Eurostat compared the e-commerce sales trends obtaining, as presented in Fig. (1).

Considering the first year with covid restrictions eased across Europe, 2022, the best-selling product category is clothing, with 42% of online shoppers. The other top-selling categories online, however, don't have high values like clothes. The second most purchased online category, deliveries from restaurants, settles at 19%, however reporting a good diffusion, in the media in the EU, of e-grocery. Other popular categories (home accessories, books) have lower values. Fig. (2) presents the trend variation in the last 10 years and the main product categories sold from clothing (category with around 42% of choice) to films (category with around 3% value).

It has been seen the radical diffusion of e-commerce also considers categories usually anchored to traditional retail. The improvement in service levels has resulted in extremely fast deliveries, even for online purchases. By now, in urban centers, purchases are often multi-channel. A user can often combine an online purchase with a retail purchase, can make the purchase online and choose to pick it up at a pick-up point or have it delivered to work, greatly increasing the possibilities offered by the system. The E-grocery developed only later due to the difficulty of keeping the organoleptic properties of the foods intact, maintaining high levels of service and an effective system for the user and efficient for the companies.

|

Fig. (1). Distribution of e-commerce purchasing trends in the main European countries. Period of analysis 2012-2022 [39]. |

|

Fig. (2). Distribution of product categories mainly purchased via e-commerce in 2022 in Europe [39]. |

Among the possibilities offered by digitization to the food sector, online is particularly widespread in urban areas. Home delivery of ready-to-eat food ordered online makes it possible to overcome a time problem for the user and a problem of stagnant orders for companies. Furthermore, for companies, this is a business to be combined with the traditional in-store purchase and the more particular click-and-collect, in which the user orders online and collects in the store. This solution, in particular, allows the user to save time and the company by not having to equip itself with its fleet of vehicles for deliveries or having to rely on a third party to carry out the deliveries.

Another factor that affects the changes in urban logistics is, as already mentioned, the decrease in delivery times, of which technology is an enabling factor, allowing for a more efficient supply chain and the experimental use of alternative delivery methods such as drones [40-42].

In the context of B2C e-commerce, the term last mile delivery refers to the last step in the supply chain, where a good is delivered to the consumer's home or to an alternative location, such as a pick-up point. In several respects, it is considered one of the most complicated segments of the supply chain, above all for its relationship with the urban environment. Usually, in fact, the last mile of e-commerce takes place entirely in urban areas, the main place of housing agglomerations, and the problems that arise from it add up to those that urban logistics and citizens' mobility usually have to face. This growth, which has increased in recent years, has resulted in a further load on the urban network, causing critical issues that should be recalled below:

• Environmental problems. The problems related to emissions, both CO2 and pollutants. Fragmented deliveries often cause more pollution than retail sales; therefore, companies must equip themselves with sustainable fleets. In addition to emissions, the problems of accidents and increased urban congestion should be underlined.

• Failed delivery. The problem arises when deliveries, which are usually made to the customer's home, are not accepted due to the customer's absence. This determines the need to guarantee a second trip. One tool often used to approach this problem is assisted deliveries at home and in the office. The reception desks of offices and condominiums are often used for deliveries in the event of the customer's absence from home. This partially solves the problem of failed deliveries, but at the same time can lead to an overload of work in the concierges. It is appropriate that condominiums and offices adapt by equipping themselves with appropriate tools to address this criticality.

• Returns. Returns are levers used by many companies operating in the e-commerce sector as a crucial element of their strategy (e.g., Amazon). However, the returns spent policy requires high investments and an infrastructure in terms of reverse supply chain that is not within the reach of all companies.

• Economies of scale. Large quantities of deliveries are necessary to ensure the economy of the entire delivery system of a certain company.

Furthermore, although couriers make the majority of deliveries, different tools are spreading to guarantee deliveries: among these, pick-up points deserve mention. They are points, generally located in commercial activities or close to them, where the parcel is deposited by the operator and can be collected by the customer. Particular cases in which the pick-up point is an autonomous cabinet that does not require the support of an operator are also common and are known as lockers.

Therefore, considering urban logistics as a complete system, it emerges that the deliveries of goods are becoming more and more complex while the efficiency of the logistics network is actually declining. Both established operators and new entrants are increasingly delivering direct, and as a result, average vehicle loads and shipment sizes are decreasing. In three out of ten cases, direct delivery to consumers fails on the first attempt, and the number of complex and expensive return shipments is steadily increasing. With the growth of e-commerce, the “logistic intensity” of transactions is therefore destined to increase and to change the structure of cities.

4. METHODOLOGY

Mobility is radically changing, especially in urban contexts, which will be subject, in the coming years, to an increasingly substantial increase in population density and, consequently, to the significant decrease in spaces useful for circulation and parking of one's means of transport. In parallel, for some sectors, such as food and pharma, it is often required that the vehicles used are equipped with a refrigerated system, which also includes constant and real-time monitoring of the temperature of the vehicles, in addition to a need for a reduced lead order-to-delivery time, especially for orders from restaurants. This research work investigates and compares e-commerce purchasing trends in Europe by defining a percentage distribution of users who have purchased online considering the following three product categories, recalling the aggregation made by Eurostat:

• The first is represented by “clothes (including sports clothing), shoes or accessories.” It is a category mainly related to clothes;

• The second one is “food or beverages from stores or from meal-kits providers.” It is the first e-grocery-related category;

• The third one is “deliveries from restaurants, fast-food chains, catering services” It is the second e-grocery-related category.

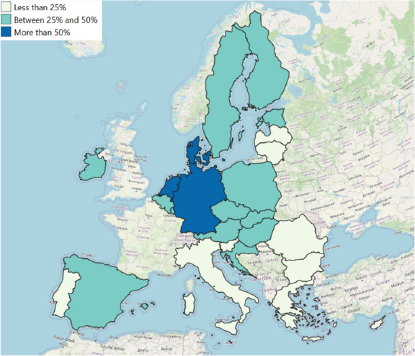

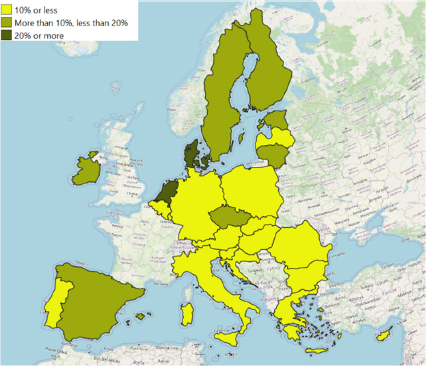

The three categories were previously analysed by [20] and refer to the two macro-classes: clothing (the first class) and e-grocery (the other two). The importance of the clothing category is linked to its wide diffusion, as described in the previous section. The logistical implications previously indicated call instead for a greater focus on the e-grocery category. The data analysed are those provided by Eurostat [43]. It must be mentioned once again how the categorization of goods from 2019 to 2020 was changed by Eurostat. This work did not consider the data for 2021 to better highlight any variations over a longer period long, 2021 being a year of transition with characteristics of both 2020 and 2022 in terms of restrictions. These two years are chosen to show the change in COVID-19 era. 2020 is the year of restrictions, while 2022 is the year in which, in the countries analysed, restrictions were eased completely. The clusters identified are shown in the legend in Fig. (3). The geographical distributions of purchases are therefore identified for three categories of online goods for the years 2020 and 2022. Some criticalities were found in the retrieval of data. In particular, for France they are not indicated, as data for 2020 is not available. Furthermore, the United Kingdom has not been considered due to the unavailability of data for 2022. Complete dataset is reported in Appendix. Figs. (3 and 4) show the trend in purchases of clothing, shoes and accessories in the main European countries in the periods 2020 (Fig. 3) and 2022 (Fig. 4).

Based on Fig. (3 and 4), it is obvious that there is an increase in the Scandinavian countries and partially in the Iberian Peninsula and a slight decrease in Germany.

If, before 2020 consumers were slowly switching from the online purchase of products to cook or to take directly to the table, the isolation caused by COVID-19 has accelerated this process giving a huge boost to the success of e-commerce. There are various reasons for the increase in online purchases, i.e. social aspects connected in part to a greater ease of use of apps, confinement and the possibility of comparing multiple sites to buy the product at the best price but also psychological aspects as highlighted by a study conducted by [44] which proposes two reasons why we buy: two reasons which in hindsight have less to do with reason than, precisely, with our most instinctive and emotional part, i.e. to decrease pain (or sadness) and/or to increase pleasure (or happiness).

|

Fig. (3). Percentage of people who purchased clothes (including sports clothing), shoes or accessories (2020). |

|

Fig. (4). Percentage of people who purchased clothes (including sports clothing), shoes or accessories (2022). |

These are in fact among the most basic emotions that living beings experience, and for this reason, they are the ones that most influence any human action.

The present research shows and compares six different maps (due for each analysed product category) obtained with the help of open source GIS tools [45-47]

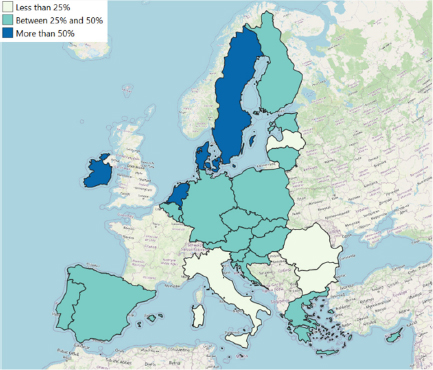

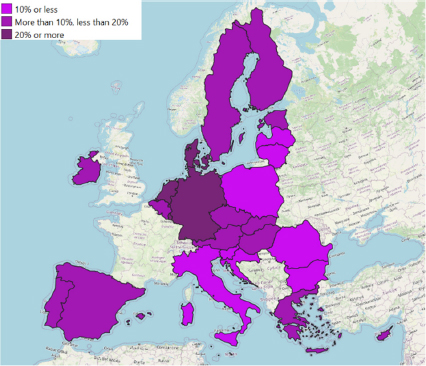

Likewise, as regards the product category of perishable goods, Figs. (5 and 6) also show the comparison of data for the period 2020 (Fig. 5 and 2022 (Fig. 6).

|

Fig. (5). Percentage of people who purchased food or beverages from stores or from meal-kits providers (2020). |

|

Fig. (6). Percentage of people who purchased food or beverages from stores or from meal-kits providers (2022). |

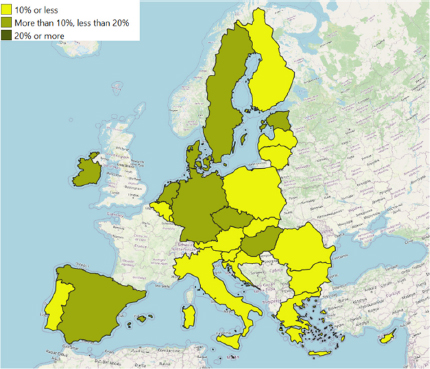

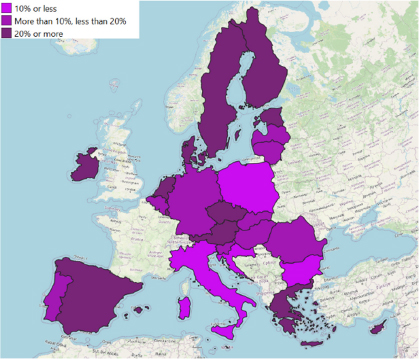

In this case, there was an increase in some countries of the northern part of the European Union, like Denmark and a slight decrease in Eastern countries. Finally, as regards the purchase of food from restaurants, fast food or catering services, it is possible to view the trends with values for 2020 in the Fig. (7) and 2022 in the Fig. (8).

|

Fig. (7). Percentage of people who purchased “deliveries from restaurants, fast-food chains, catering services” (2020). |

|

Fig. (8). Percentage of people who purchased “deliveries from restaurants, fast-food chains, catering services” (2022). |

In this case, it is possible to underline a strong increase in Spain, Greece and the Scandinavian countries and a decrease in central Europe. The reason for this rapid evolution is certainly digitalization, which is increasingly penetrating people's daily lives. The use of e-commerce is steadily increasing and is influencing the behavior of companies that market food and beverages. A decrease in this period may instead indicate a market adjustment to pre-pandemic levels. After the emergency phase, there is the possibility that different users have returned to using the classic retail purchase.

This suggests the wide margins for growth of food marketing and the online competition that will inevitably increase. In the near future, most likely, we will also witness the birth of marketplaces dedicated to the purchase of food and drink, a trend that has already materialized in France and Great Britain, i.e. virtual supermarkets where the user can find many products and different brands. This should not scare those who are planning or already have food e-commerce because the marketplace could be one more opportunity to sell. Another factor to take into consideration is the use of smartphones both for surfing and for shopping.

5. RESULT AND DISCUSSION

The comparison of the trends defined in the previous paragraph brings out the following considerations:

• For the clothing category, the distribution remained very similar. An increase in the value for some southern countries (such as Portugal and Greece) was offset by a slight decline in some major countries (Germany and Sweden). Italy always remains in the cluster with the lowest percentage;

• For the online food purchase category, the situation is quite similar, even if different countries have “slipped” to a lower range (Germany, Hungary) while others have “risen” (Denmark, Holland). It would seem that this is the category of goods most affected by post-Covid normalization, and therefore, the decline in different realities is largely justifiable. Italy is stable in the third cluster;

• For the home delivery category of ready-to-eat restaurants and fast-food food, many countries exceeded percentages of 20%, while only Germany was “relegated.” Even countries that have a lower propensity to purchase online, such as Greece, have very high values, such as Greece. For both years, Italy is in the third tier.

Three recurring elements:

• Italy is in “band three” in all three cases and in both years. Italy is particularly refractory to online, confirming the trend already highlighted in Campisi et al., 2021;

• Clothes remain stable as a category of goods, showing values greater than 25% in 2022 in almost all of Europe (except for Latvia, Romania, Bulgaria and Italy)

• The two e-grocery categories would seem to show different behavior: the purchase of food and drinks from supermarkets would seem to see a generalized decline, while the purchase from restaurants and fast-food restaurants would seem to increase very often from 2020 to 2022.

These data, therefore, underline the need to rethink urban mobility planning, paying greater attention to the aspect of last-mile delivery. In fact, in the coming years, city logistics will continue to expand, and if a series of strategies to make mobility more sustainable are not implemented, there will be an increase in the number of vans and light pick-ups for the urban delivery of goods by 2030 (Table 1).

| - | Clothes (including Sport Clothing), Shoes or Accessories | Deliveries from Restaurants, Fast-food Chains, Catering Services | Food or Beverages from Stores or from Meal-kits Providers | |||

|---|---|---|---|---|---|---|

| Country | 2020 | 2022 | 2020 | 2022 | 2020 | 2022 |

| Belgium | 39,6 | 41,81 | 16,54 | 18,61 | 9,88 | 9,58 |

| Bulgaria | 11,75 | 19,45 | 2,49 | 6,34 | 1,25 | 2,58 |

| Czechia | 33,13 | 42,43 | 14,07 | 24,41 | 13,93 | 16,38 |

| Denmark | 51,27 | 53,66 | 40,06 | 39,97 | 17,13 | 20,27 |

| Germany | 51,52 | 47,45 | 22,39 | 16,11 | 14,68 | 9,05 |

| Estonia | 27,29 | 32,63 | 16,96 | 22,96 | 12,73 | 15,66 |

| Ireland | 36,66 | 55,16 | 19,14 | 45,34 | 10,18 | 13,15 |

| Greece | 24,88 | 32,49 | 10,23 | 20,54 | 4,15 | 7,17 |

| Spain | 30,25 | 37,99 | 16,08 | 22,5 | 13,65 | 11,65 |

| Croatia | 26,71 | 31,33 | 7,99 | 8,41 | 3,86 | 2,07 |

| Italy | 16,69 | 22,53 | 4,62 | 7,12 | 4,51 | 4,33 |

| Cyprus | 19,96 | 25,54 | 15,66 | 24,17 | 4,35 | 7,47 |

| Latvia | 17,39 | 23,74 | 6,85 | 10,62 | 4,69 | 8,04 |

| Lithuania | 22,82 | 29,2 | 6,9 | 13,44 | 8,39 | 11,94 |

| Luxembourg | 41,42 | 41,26 | 22,51 | 28,65 | 9,62 | 9,94 |

| Hungary | 28,89 | 35,1 | 16,47 | 19,36 | 16,89 | 9,05 |

| Malta | 33,56 | 36,61 | 33,04 | 40,44 | 21,04 | 23,55 |

| Netherlands | 53,22 | 58,67 | 39,83 | 48,21 | 19,73 | 26,84 |

| Austria | 30,04 | 35,57 | 16,19 | 21,2 | 4,48 | 9,02 |

| Poland | 31,98 | 36,94 | 6,19 | 9,02 | 5,49 | 5,17 |

| Portugal | 21,28 | 28,11 | 13,46 | 17,85 | 6,7 | 8,41 |

| Romania | 15,75 | 20,9 | 6,19 | 10,23 | 2,93 | 3,59 |

| Slovenia | 24,51 | 32,95 | 6,4 | 11,29 | 3,4 | 4,1 |

| Slovakia | 32,28 | 45,46 | 12,41 | 18,61 | 4,62 | 4,21 |

| Finland | 31,65 | 37,86 | 18,92 | 26,98 | 8,44 | 15,72 |

| Sweden | 47,04 | 52,78 | 17,21 | 22,39 | 15,59 | 19,05 |

CONCLUSION

The evolution of “city logistics” does not only concern the delivery of goods in the last mile (e-commerce or supply of commercial activities) but concerns all the logistics chains that impact the city, such as management of solid urban waste, transport of materials construction, and some essential services for the life of citizens.

It is, therefore, essential to “decarbonize” all logistics chains through the use of vehicles powered by renewable energy sources. This is possible, for example, through the reduction to zero emissions with the use of biomethane and hydrogen vehicles and, in particular, cargo bikes, a concrete alternative to classic vehicles for operators in the sector.

There are three main considerations that can be defined in the light of the trends and strategies included:

• The first is that urban logistics is understood in the SUMPs analysed mainly as e-commerce and delivery of goods. It would be interesting if in the SUMPs being developed, more importance was given to the use of sustainable modes of transport such as cargo bikes and also for other logistics chains, for example, in the management of municipal solid waste.

• The second consideration concerns the poor definition of targets. In most of the SUMPs, not only in these analyzed, quantitative objectives are missing: what I want to achieve and in how much time.

• Finally, a third reflection is that the use of electric cargo bikes is obviously linked to the availability of recharging points.

Therefore, in the municipal “decarbonization” plan, the investment aimed at creating stations suitable for recharging vehicles at night shelter platforms is crucial, equipping not only the surface but also creating substations, where necessary.

By changing their consumption habits, consumers become a central element in the redesign of the urban delivery sector. Therefore, with regard to the challenge of the last mile and a more sustainable e-commerce model, consumers will be key players, resorting to forms of collection rather than home delivery by accepting longer delivery times, which often have a lower environmental impact.

The growth of online purchases profoundly changes the characteristics of urban goods transport, generating service innovations that reduce delivery times, making slots more precise and giving the consumer greater power over the organization of delivery times and places. All this also affects the new professional figures that are taking shape in the courier sector and the means of transport to be used to access the urban area.

A limitation of the research is that it is focused on three product categories, two of which are similar to each other. The product categories, however, as explained in the paper, are explanatory of the general trend of e-commerce in recent years. Future developments include the possibility of verifying for other categories how this evolution has taken place in recent years and how it is distributed in various countries. Furthermore, there is the possibility of evaluating any correlations within the various countries between aggregate socio-economic variables and the percentages of purchases.

The current paper is of interest to three categories of stakeholders: logistics companies, planners and administrators. The increase in purchases from restaurants, in particular, requires specific interventions both on the part of the public administration and planners and on the part of companies. Distribution companies operating in the e-grocery must rethink the size and categorization of fleets; planners and public administrators, acting in concert with the companies, must determine routes, stopping places and loading/unloading areas that can guarantee reductions in externalities, guaranteeing the sustainability of the service.

CONSENT FOR PUBLICATION

Not applicable.

AVAILABILITY OF DATA AND MATERIALS

The data and supportive information are available within the article.

FUNDING

None.

CONFLICT OF INTEREST

Tiziana Campisi is the Co editor in chief of The Open Transportation Journal.

ACKNOWLEDGEMENTS

Declared none.

REFERENCES

| [1] | M. Coccia, "COVID-19 pandemic over 2020 (with lockdowns) and 2021 (with vaccinations): Similar effects for seasonality and environmental factors", Environ. Res., vol. 208, p. 112711, 2022. |

| [2] | G. You, "The disturbance of urban mobility in the context of COVID-19 pandemic", Cities, vol. 128, p. 103821, 2022. |

| [3] | L. Lei, and X. Liu, "The COVID‐19 pandemic and residential mobility intentions in the United States: Evidence from Google Trends data", Popul. Space Place, vol. 28, no. 6, p. e2581, 2022. |

| [4] | I. von Homeyer, S. Oberthür, and C. Dupont, "Implementing the European Green Deal during the evolving energy crisis", J. Common Mark. Stud., vol. 60, no. S1, pp. 125-136, 2022. |

| [5] | I. Charradi, T. Campisi, G. Tesoriere, and K.B. Abdallah, "A Holistic Approach to SUMP Strategies and Actions in the Post-pandemic and Energy Crisis Era", In: Computational Science and Its Applications. Springer International Publishing: Cham, 2022, pp. 345-359. |

| [6] | L. Na, and L. Yang, "Psychological and behavioral responses during the COVID-19 pandemic among individuals with mobility and/or self-care disabilities", Disabil. Health J., vol. 15, no. 1, p. 101216, 2022. |

| [7] | T. Campisi, S. Basbas, M. Trouva, T. Papas, N. Akgün-Tanbay, N. Stamatiadis, and G. Tesoriere, "Anxiety, fear and stress feelings of road users during daily walking in COVID-19 pandemic: Sicilian cities", Transp. Res. Procedia, vol. 62, pp. 107-114, 2022. |

| [8] | T. Campisi, G. Tesoriere, M. Trouva, T. Papas, and S. Basbas, "Impact of teleworking on travel behaviour during the COVID-19 era: the case of Sicily, Italy", Transp. Res. Procedia, vol. 60, pp. 251-258, 2022. |

| [9] | G. Marzano, and A. Zając, "Emergency remote education and smart working at three European higher education institutions", Int. J. Web-Based Learn. Teach. Technol., vol. 17, no. 6, pp. 1-22, 2021. |

| [10] | T. Campisi, S. Basbas, N.A. Tanbay, and G. Georgiadis, "Some considerations on the key factors determining the reduction of public transport demand in Sicily during COVID-19 pandemic", Int. J. Transp. Dev. Integration, vol. 6, no. 1, pp. 81-94, 2021. |

| [11] | T. Campisi, A. Russo, S. Basbas, E. Bouhouras, and G. Tesoriere, "A literature review of the main factors influencing the e-commerce and last-mile delivery projects during COVID-19 pandemic", Transp. Res. Procedia, vol. 69, pp. 552-559, 2023. |

| [12] | G. Bösehans, K. Kavta, M.C. Bell, and D. Dissanayake, "Exploring the potential of shared electric vehicles from e‐mobility hubs as an alternative for commute and food shopping trips", IET Intell. Transp. Syst., 2023. |

| [13] | A. Pahwa, and M. Jaller, "Assessing last-mile distribution resilience under demand disruptions", Transp. Res., Part E Logist. Trans. Rev., vol. 172, p. 103066, 2023. |

| [14] | G. Garola, C. Siragusa, A. Seghezzi, and R. Mangiaracina, "Managing COVID-19 disruption: The response of express couriers and lessons learned to improve resilience", Int. J. Logist. Manag., vol. 34, no. 7, pp. 121-141, 2023. |

| [15] | Y. Zhang, and M. Kamargianni, "A review on the factors influencing the adoption of new mobility technologies and services: Autonomous vehicle, drone, micromobility and mobility as a service", Transp. Rev., vol. 43, no. 3, pp. 407-429, 2023. |

| [16] | F. Russo, "Sustainable Mobility as a Service: Dynamic models for agenda 2030 policies", Information, vol. 13, no. 8, p. 355, 2022. |

| [17] | T. Campisi, C. Garau, G. Acampa, F. Maltinti, A. Canale, and M. Coni, "Developing flexible mobility on-demand in the era of mobility as a service: An overview of the italian context before and after pandemic", In: Computational Science and Its Applications. Springer International Publishing: Cham, 2021, pp. 323-338. |

| [18] | T. Campisi, C. Garau, M. Ignaccolo, M. Coni, A. Canale, G. Inturri, and V. Torrisi, "A new vision on smart and resilient urban mobility in the aftermath of the pandemic: Key factors on european transport policies", In: Computational science and its applications. Springer International Publishing: Cham, 2021, pp. 603-618. |

| [19] | E. Vitkauskaitė, and E. Vaičiukynaitė, "Comparative study of business models of European micro-mobility online services", Proceedings of The 20th International Conference on Electronic Business, pp. 55-62 |

| [20] | T. Campisi, A. Russo, S. Basbas, I. Politis, E. Bouhouras, and G. Tesoriere, "Assessing the evolution of urban planning and last mile delivery in the era of E-commerce", Conference on Sustainable Urban Mobility, 2022pp. 1253-1265 Cham |

| [21] | M. Kiba-Janiak, K. Cheba, J. Witkowski, A. Jagoda, A. Skowrońska, T. Kołakowski, and M. Mucowska, "Sustainable city logistics of last-mile delivery and returns on the e-commerce market”, Various Groups of Stakeholders’ Perspectives–Aims and Scope of the Project", ACC Journal, 2022. |

| [22] | F. Russo, and A. Comi, "The role of city logistics in pursuing the goals of agenda 2030", International Conference on Computational Science and Its Applications, 2023pp. 335-348 Cham |

| [23] | R. Rosales, and H. Haarstad, "Governance challenges for urban logistics: Lessons from three N orwegian cities", Environ. Policy Gov., vol. 33, no. 3, pp. 221-231, 2023. |

| [24] | M. Niranjanamurthy, N. Kavyashree, S. Jagannath, and D. Chahar, "Analysis of e-commerce and m-commerce: Advantages, limitations and security issues", Int. J. Adv. Res. Comput. Commun. Eng., vol. 2, no. 6, pp. 2360-2370, 2013. |

| [25] | D. Correia, C. Vagos, J. L. Marques, and L. Teixeira, "Fulfilment of last-mile urban logistics for sustainable and inclusive smart cities: A case study conducted in Portugal", Int. J. Logist. Res., pp. 1-28, 2023. |

| [26] | S. Vinerean, C. Budac, L.A. Baltador, and D.C. Dabija, "Assessing the effects of the COVID-19 pandemic on M-commerce adoption: An adapted UTAUT2 approach", Electronics, vol. 11, no. 8, p. 1269, 2022. |

| [27] | P. Kourouthanasassis, and G. Giaglis, "Introduction to the special issue mobile commerce; The past, present, and future of mobile commerce research", Int. J. Electron. Commer., vol. 16, no. 4, pp. 5-18, 2012. |

| [28] | S. Du, and H. Li, "The knowledge mapping of mobile commerce research: A visual analysis based on I-Model", Sustainability, vol. 11, no. 6, p. 1580, 2019. |

| [29] | A.R. Ashraf, N.T. Thongpapanl, B. Menguc, and G. Northey, "The role of M-commerce readiness in emerging and developed markets", J. Int. Mark., vol. 25, no. 2, pp. 25-51, 2017. |

| [30] | European Parliament, "The impact of e-coomerce on trasnport in Europe and possible actions to be taken to meet increased demand", Available from: https://www.europarl.europa.eu/RegData/etudes/etudes/join/2002/315043/DG-4-TRAN_ET(2002)315043_EN.pdf |

| [31] | G. Soava, A. Mehedintu, and M. Sterpu, "Analysis and forecast of the use of E-commerce in enterprises of the European Union States", Sustainability, vol. 14, no. 14, p. 8943, 2022. |

| [32] | B.Q. Hung, N.T.H. Nham, and L.T. Ha, "The importance of digitalization in powering environmental innovation performance of European countries", Journal of Innovation & Knowledge, vol. 8, no. 1, p. 100284, 2023. |

| [33] | L.T. Ha, "Are digital business and digital public services a driver for better energy security? Evidence from a European sample", Environ. Sci. Pollut. Res. Int., vol. 29, no. 18, pp. 27232-27256, 2022. |

| [34] | A. Kwilinski, O. Lyulyov, and T. Pimonenko, "Environmental sustainability within attaining sustainable development goals: The role of digitalization and the transport sector", Sustainability, vol. 15, no. 14, p. 11282, 2023. |

| [35] | D. Schöder, F. Ding, and J.K. Campos, "The impact of e-commerce development on urban logistics sustainability", Open Journal of Social Sciences, vol. 4, no. 3, pp. 1-6, 2016. |

| [36] | M. Bachofner, C. Lemardelé, M. Estrada, and L. Pagès, "City logistics: Challenges and opportunities for technology providers", Journal of Urban Mobility, vol. 2, p. 100020, 2022. |

| [37] | J.M. Argilés-Bosch, J. Garcia-Blandón, and D. Ravenda, "Cost behavior in e-commerce firms", Electron. Commerce Res., pp. 1-34, 2022. |

| [38] | S. Lone, and J.W.J. Weltevreden, 2022 European E-commerce Report.. Amsterdam University of Applied Sciences & Ecommerce Europe: Amsterdam, Brussels, 2022. |

| [39] | "E-commerce continues to grow in the EU", Available from: https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20230228-2 |

| [40] | H. Eskandaripour, and E. Boldsaikhan, "Last-mile drone delivery: Past, present, and future", Drones, vol. 7, no. 2, p. 77, 2023. |

| [41] | N. Yanpirat, D.F. Silva, and A.E. Smith, "Sustainable last mile parcel delivery and return service using drones", Eng. Appl. Artif. Intell., vol. 124, p. 106631, 2023. |

| [42] | M. Nikolić, F. Netjasov, D. Crnogorac, M. Milenković, and D. Glavić, "Urban air mobility: Multi-objective mixed integer programming model for solving the drone scheduling problem", International Conference on Computational Science and Its Applications, 2023pp. 349-362 Cham |

| [43] | EUROSTAT, "EUROSTAT, Internet purchases – goods of services", Available from:https://ec.europa.eu/eurostat/databrowser/view/ISOC_EC_IBGS$DV_901/default/table?lang=en |

| [44] | J. Keszka, "The Only 2 Reasons Why People Buy", Available from: https://bettermarketing.pub/the-only-2-reasons-why-people-buy-65a0e55fe499 |

| [45] | QGIS Development Team, QGIS Geographic Information System.. Open Source Geospatial Foundation, 2023. |

| [46] | EUROSTAT, Available from: https://ec.europa.eu/eurostat/web/gisco/geodata/reference-data/administrative-units-statistical-units |

| [47] | "Layer openstreet map (OpenStreetMap contributors", Available from: https://planet.openstreetmap.org Available from: https://www.openstreetmap.org/#map=7/40.125/20.654 |